Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

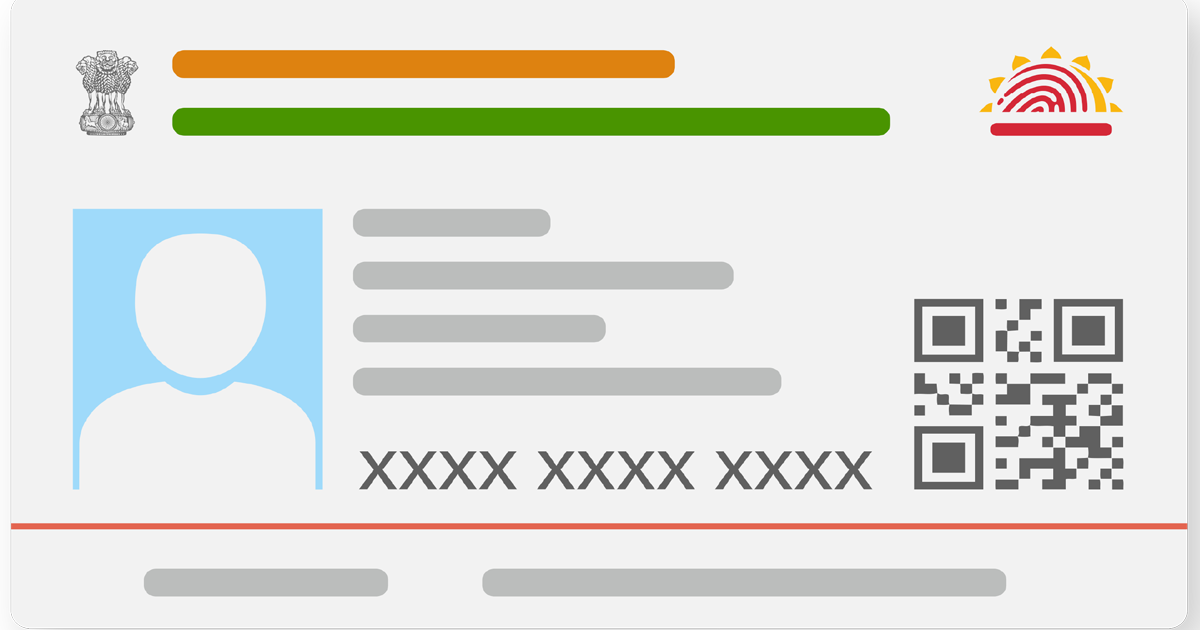

Before applying for a personal loan on Aadhar card you should know something about Aadhar card. The Indian government established the Aadhar Card on 29 Sep 2010 to provide citizens with access to a limited number of services from both the corporate and public sectors. After collecting fingerprints and retinal scans, the Indian government provides each individual with a unique 12-digit number known as an Aadhar.

An Aadhar card has become one of the most required forms of identification for Indians citizen. It can be used as identification to submit tax returns, create bank accounts, purchase SIM cards, obtain passports, and make loan applications.

Every adult's life eventually includes a period when they must spend a sizable sum of money on personal items. These can range from a wedding reception to a medical emergency. You need a lot of money, which is a regular aspect of personal expenditures. Others may not have the privilege, even though some people have the resources to cover their personal expenses. In light of this, many people opt for an instant personal loan on Aadhar card from reputable financial institutions.

The Role of Aadhaar Card in Getting Your Loan Approved

Financial troubles hit when you least expect them. It leaves you scrambling for speedy solutions during tough times. Be it family medical emergencies or wedding expenses, it can drain your savings faster than you planned. The stress may build up as bills pile on your shoulders and deadlines approach without relief in sight. Your credit card limits might not stretch far enough for these unexpected costs.

Quick Identity Verification

Getting your loan quickly starts with proving who you are, and your Aadhar card makes this process surprisingly easy for everyone involved. Your fingerprints stored in the Aadhar database let lenders check your identity right away without asking for stacks of papers. This saves precious hours when you need money for urgent family matters or medical bills that cannot wait. Lenders feel more comfortable approving loans faster when they can verify your details through the secure government database.

Address Confirmation Made Simple

Moving between rental homes often creates problems when applying for loans, as lenders worry about contacting you later. Your Aadhar card shows your current address, removing this concern completely from the application process. You save time by not gathering separate proofs or visiting offices multiple times for verification checks. This smooths your path toward faster approval when racing against time for important payments like school fees or booking wedding venues.

Reduced Documentation Burden

Gathering numerous documents from different offices used to take days before you could even apply for financial help. Now your Aadhar card replaces multiple papers, letting you apply for a personal loan only on aadhar card with minimal hassle. This particularly helps people working long hours who cannot take time off to collect papers from various offices. The streamlined process means your application moves faster through the approval stages when every hour counts during personal emergencies.

Enhanced Security for Both Parties

Worry about identity theft keeps many people from applying online, fearing their information might get stolen during the process. Aadhar's biometric verification protects both you and the lender from fraud attempts by confirming your physical presence. This security feature reduces rejection rates caused by identity concerns that previously delayed many genuinely needy applicants. Lenders process your request with greater confidence, knowing the application truly comes from you.

Digital KYC Processing

Standing in long bank queues wastes precious time when you urgently need funds for pressing family matters. E-KYC through Aadhar lets you complete verification from home on your phone in minutes rather than hours. This digital approach works perfectly for busy professionals who cannot take leave for banking tasks during working hours. Your application jumps ahead in processing time compared to traditional paper methods that require manual checking.

Unified Database Access

Explaining your financial background repeatedly to different officers creates confusion and increases rejection chances through human error. The Aadhar-linked system gives lenders standardised access to your verified details through authorised channels with your permission. This prevents miscommunication that might wrongly disqualify you from getting financial help when most needed. Your application receives fair consideration based on actual facts rather than paperwork mistakes.

Paperless Application Process

Printing, signing, and physically submitting loan documents create unnecessary delays when dealing with urgent money needs. Aadhar-based applications work completely online, eliminating paper waste and travel time for busy applicants with tight schedules. This environmentally friendly approach particularly benefits those living far from bank branches in smaller towns or rural areas. Your application reaches processing teams instantly rather than waiting days in transit.

Broader Accessibility

Traditional loan processes often exclude people without extensive documentation or banking history despite their genuine needs. Aadhar-based verification opens doors for individuals who might struggle with gathering multiple identity proofs. First-time loan applicants especially benefit from this simplified approach when building their credit profiles. Your basic identity rights through Aadhar help overcome barriers that previously blocked financial assistance.

As per RBI report on dec 2022 there were approx. 9471 NBFCs registered with Reserve Bank of India. Eligibility criteria to avail a personal loan of different lending institutions may be slightly different or similar. For lendingplate you should have the following eligibility to avail an Aadhar card loan:

| Eligibility | Requirements |

|---|---|

| Citizenship | Indian |

| Age | 21 Years or older |

| Minimum Income | ₹20,000/Month |

| Employment | Self-employed with regular salary credit in bank |

| Credit Check | Yes |

Do not wait since you can apply for an Aadhar card loan without providing your pay stubs. Submit these documents as soon as you meet the eligibility requirements. You will receive a personal loan approval decision more quickly the sooner you give your lender these supporting documents.

| Documents Required | Examples |

|---|---|

| ID Proof | Aadhar, PAN |

| Address Proof | Aadhar, Utility Bill, Bank/ Credit Card/ Home Loan Statement, Rent Agreement |

| Income Proof | Bank Statement, Employer ID, Payslip, Work Email |

lendingplate is registered NBFCs w which provides a personal loan up to 2 lacs depending on customer’s eligibility and needs.

There are following benefits of an Aadhar card from lendingplate.

| Loan Features | Details |

|---|---|

| Affordable Interest Rates | Start from 2.5% - 3% per month with EMI |

| Collateral Free Loan | You don’t need any collateral to avail this loan |

| Flexible Loan Amount | Avail a personal loan up to ₹2 lacs |

| Freelook Offer | Return your loan amount in the first 3 days. You don’t pay any fees. |

| Instant Approval | Eligible candidates can get instant loan approval within 1 hour |

| Build Credit Score | A personal loan on Aadhar Card helps you to build a good credit score |

It is recommended to apply for Aadhar card loan when you need a specific amount of money to finance a home remodeling project, a medical emergency, or wedding festivities.

Five advantages of obtaining a personal loan from a lendingplate are listed below:

One of the most important factors that a customer considers is the interest rate. lendingplate provides personal loan with minimal interest rates of 2.5% - 3% per month. This is the best option to apply for an instant loan for emergency needs.

The fact that a personal loan is an unsecured credit is another important feature that can work in your favour. This means that while applying for a personal loan using your Aadhar and PAN card, you are not required to offer any kind of collateral. People can easily obtain immediate personal loans using their Aadhar and PAN cards for this reason.

lendingplate is providing a personal loan from ₹ 10,000 - ₹ 20,00,00 depending on customer’s eligibility and needs. The loan amount depends on your monthly salary.

When you take out a personal loan and promptly pay back the principal and interest, your credit score will significantly rise. You will be able to easily obtain approval for loans in the future as a result. Your creditworthiness will rise as a result of on-time EMI payments.

You can obtain a fast loan without any paperwork for personal costs. Your Aadhar card, PAN card and salary slip are the things needed for a personal loan to be granted. As a result, the documentation process as a whole is quick and easy to complete.

We can comprehend why loans on Aadhar Card have become increasingly popular and in demand in recent years as we consider their many advantages. Several banks and other financial institutions have simplified and sped up the personal loan application and paperwork processes on their end. The typical lag between needs for the same has also become shorter. The qualifying standards for personal loans are quite straightforward, and you would be accepted for a sum that corresponds to your income based on your current pay or your income over the previous three years.

The necessity of an Aadhar card for a personal loan has grown recently. This is due to the fact that it is now accepted as a form of identification and evidence of address for a person. A PAN card functions similarly as a valid source of income documentation.

Follow the below instructions to avail a personal loan on Aadhar Card:

If you are Android user, you can directly apply through lendingplate personal loan app which is available of Google Play Store. Download the personal loan app and follow the instructions to apply for loan.

People must present their Know Your Customer (KYC) documents in order to use any financial services. The government has ordered that banks and other financial institutions collect client KYC information in order to combat money laundering. KYC used to involve a tonne of paperwork, but it can now be completed quite rapidly. Banks have also started using e-KYC, which totally digitises the KYC process. As a result of Aadhar's access to the individuals' biometric data, verification is a simple and rapid process.

Personal loans are subject to stringent validation and verification procedures at both private and public sector institutions. Obtaining a loan used to require the applicant to submit a lot of paperwork, and the approval process took a long time. However, following the introduction of Aadhar Card loan, fewer documents are required, and the time it takes for a loan to be authorised has dropped.

Personal loans are mostly used in crisis situations. As a result, they will require a quick verification process and an early deposit of loan cash into their bank accounts. The primary purpose of an Aadhar card is to expedite the process. Because of the digitization of KYC verification, obtaining a personal loan is now extremely simple. Because the Aadhar database has the individual's personal information, it takes less time to approve the loan.

Despite the fact that it's not essential, possessing an Aadhar card makes applying for a personal loan on Aadhar card much easier. The verification process is simplified for bank employees if the borrower supplies their Aadhar details. There is also a paperless alternative called e-KYC, where documents can be uploaded online. The person is not required to submit any physical documents using e-KYC. Several banks also provide rapid loans in exchange for a scanned copy of the borrower's Aadhar card.

Since the introduction of the Aadhar card, obtaining a personal loan has become quite simple. Because the Aadhar database contains information such as name, permanent residence, and date of birth, bank and NBFC verification is also performed quickly.

Aadhaar Loan Options -

| 20000 Loan on Aadhar Card | 50000 Loan on Aadhar Card | 1 Lakh Loan on Aadhar Card | 2 Lakh Loan on Aadhar Card |

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019