Did You Know?

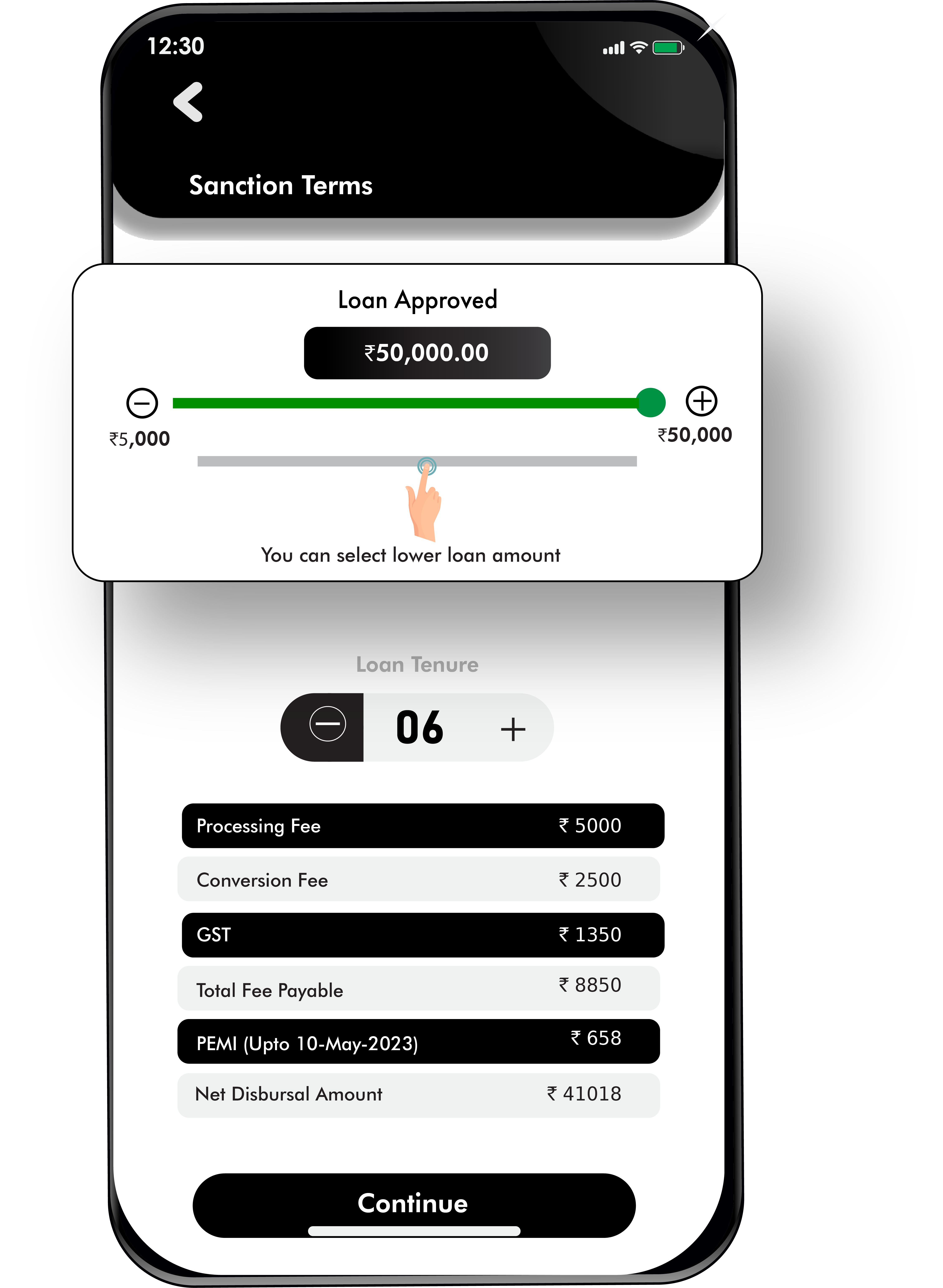

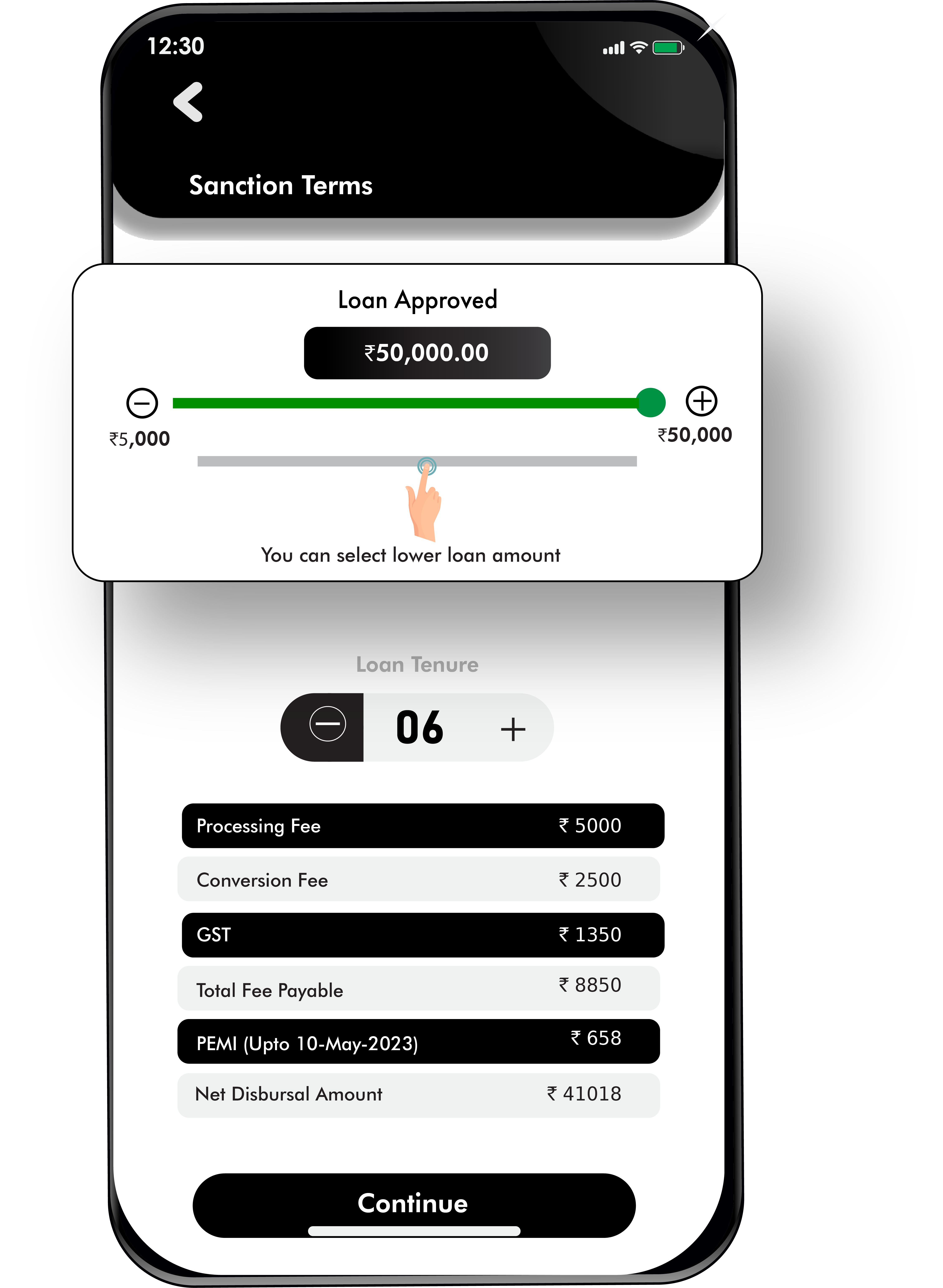

We serve loans, the best way you can borrow

No Impact on Credit Score, analyse your score

Monitor your finances and better your score

Know what lenders see when you apply for loan

Get Instant Offers based on your Score

Your CIBIL score is a three-digit number between 300 and 900 that shows how good you are with money. A higher CIBIL score means banks trust you more and might offer better loan terms. When you apply for credit, the lender checks your credit score first to understand your payment habits.

Many people don't know they can check their scores themselves before applying for loans. Understanding your CIBIL score helps you make better financial decisions and plan your money matters wisely. The Reserve Bank of India recognises CIBIL as an official credit bureau that collects your data from banks. Your CIBIL score stays with you throughout your financial life – so take care of it like you would your health.

Your CIBIL score calculation takes into account your past financial behaviour and current credit situation. Understanding these factors helps you maintain a good score. Key factors that influence your CIBIL score:

Payment History

Payment history shows if you pay your loans and credit cards on time. Late payments hurt your CIBIL score quite badly. Even one missed payment can drop your score by 50-100 points. Your payment record from the past 36 months affects your current score calculation.

Credit Utilisation Ratio

This ratio compares how much credit you use against your total available credit. Using more than 30% of your credit limit lowers your CIBIL score. If you max out your cards, your score might drop by 70-100 points. Paying down balances helps improve this ratio.

Length of Credit History

Longer credit histories help build better CIBIL scores by showing consistent behaviour. New credit users typically have lower scores than those with years of history.

Credit Mix

Having different types of loans shows you can handle various credit responsibilities well. Secured loans like home loans and unsecured credit cards together can improve your CIBIL score. Too many loans of the same type might signal financial stress.

| CIBIL Score Range | Impact on Loan Eligibility | Impact on Interest Rates |

| 300-549 | Your loan application might get rejected due to high risk perception by lenders. | If approved, you'll face the highest interest rates in the market. |

| 550-649 | You may get loans but with stricter terms and higher documentation requirements. | Interest rates will be higher than average with limited negotiation room. |

| 650-749 | Most loan applications get approved with standard verification process. | You get standard market rates with some room for negotiation. |

| 750-799 | Your applications get fast-tracked with minimal documentation needs. | Banks offer preferential rates that are lower than standard offers. |

| 800-900 | You receive pre-approved offers and the fastest approval times. | You qualify for the lowest interest rates with maximum discount benefits. |

You can easily proceed with CIBIL score check online through several official methods mentioned below.

Step 1

Go to CIBIL's official website and locate their score checking section.

Step 2

Enter your name, contact details PAN and provide identity verification documents.

Step 3

Select whether you want a free basic report or a paid comprehensive analysis.

Step 4

Get your report instantly online or receive it by email within minutes.

Your CIBIL score affects nearly every aspect of your financial life in ways you might not realise.

Higher loan approval chances with scores above 750

Higher loan approval chances with scores above 750 Better interest rates save thousands on long-term loans

Better interest rates save thousands on long-term loans Quicker loan processing with minimal documentation needs

Quicker loan processing with minimal documentation needs Higher credit limits on cards as your score improves

Higher credit limits on cards as your score improves Negotiating power for better loan terms with lenders

Negotiating power for better loan terms with lenders Protection from identity theft through regular monitoring

Protection from identity theft through regular monitoringWant to improve your financial health? Check your CIBIL score today!

Having a strong CIBIL score unlocks multiple advantages that make your financial journey smoother and more affordable.

Lenders readily approve applications from high-score customers without extensive verification processes.

Your high score qualifies you for the best interest rates – saving considerable money on loans.

Applications with excellent scores get priority treatment and faster approvals from lenders.

Banks offer larger loan amounts and higher card limits to customers with proven creditworthiness.

A strong score gives you leverage to negotiate better terms, fees and repayment conditions.

You can boost your CIBIL score with consistent effort and smart financial practices that build trust with lenders.

Pay Bills Timely

Make all payments before due dates (as late payments severely impact your score).

Maintain Low Utilisation

Keep your credit card usage below 30% of your total available limit.

Limit Credit Applications

Apply for new credit only when necessary (as multiple inquiries lower scores).

Monitor Your Report

Check your credit report regularly to catch and fix errors quickly.

Diversify Credit Mix

Balance your credit portfolio with different types of loans and cards.

Avoid these common pitfalls that can damage your credit score and limit your financial opportunities.

Your CIBIL score directly influences every aspect of your borrowing experience – from approval odds to final costs.

Loan Approvals

Your CIBIL score serves as the first screening filter for loan applications. Most banks have minimum score thresholds – typically around 700 for personal loans.

Interest Rates

The interest rate difference between high and low CIBIL scores can be substantial. For personal loans, scores above 750 might get rates 4-6% lower than those with scores around 650.

Credit Card Applications

Credit card issuers use CIBIL scores to determine eligibility and card limits. Premium credit cards typically require scores above 750 for approval. Your initial credit limit correlates directly with your score with higher limits for better scores.

Understanding the key factors that influence your CIBIL score helps you focus your efforts where they matter most.

Payment History:

Your track record of paying bills makes up 35% of your CIBIL score calculation. Even a single payment delayed by 30 days can drop your score by 50-80 points. Recent late payments hurt more than older ones with effects diminishing after two years.

Credit Utilisation:

How much of your available credit you use affects 30% of your CIBIL score. The ideal utilisation ratio stays below 30% across all your credit cards combined. Maxing out even one card can drop your score despite having other cards with zero balances.

Credit History Length:

Your credit age accounts for 15% of your CIBIL score calculation. Keeping your oldest accounts active maintains a longer credit history. New credit users typically need 18-24 months to build a substantial history for better scores. Closing old cards can significantly reduce your average account age hurting your score.

Credit Mix:

Having diverse credit types influences 10% of your CIBIL score calculation. Having only one type of credit limits your score potential regardless of perfect payment history.

Hard Inquiries:

Each new credit application creates a hard inquiry that affects 10% of your CIBIL score. Multiple inquiries within 14-45 days for the same loan type count as one inquiry. More than six inquiries in six months signal high credit-seeking behaviour to lenders.

Let us clear up some widespread misconceptions about CIBIL scores that might be affecting your financial decisions.

Checking Lowers Score:

You can proceed with the CIBIL score check free. It is a soft inquiry that never affects your score. Many people wrongly believe personal checks hurt their scores. You can check your score unlimited times through official channels without any negative impact.

Income Affects Score:

Your salary or income level has zero direct impact on your CIBIL score calculation. People often assume higher incomes automatically mean better scores (which is incorrect). Your payment behaviour matters more than how much you earn for score calculation. Income does affect your loan eligibility and amounts but not your actual score.

Closing Cards Helps:

Closing credit cards often hurts rather than helps your CIBIL score in multiple ways. Shutting accounts reduces your total available credit while increasing your utilisation ratio immediately. Keeping cards open with zero balances actually benefits your score long-term. This misunderstanding makes people think that they are improving their scores.

A credit score measures your creditworthiness based on your past financial behaviour and current situation. lendingplate uses these scores to evaluate loan applications and determine interest rates. Your score gets calculated using information from your credit report that includes your payment history, credit utilisation, credit age and types of credit accounts. Recent financial behaviour impacts your score more heavily than older history. Checking your own CIBIL score doesn't affect your score – unlike when lenders make inquiries. Regularly checking your credit score helps you understand where you stand and what you need to improve.

Regular monitoring helps spot unauthorised accounts opened in your name immediately.

See how your financial decisions positively impact your score over time.

Know your score before applying for loans to avoid surprises and rejections.

You can check Credit Score for free on our website. You only need to share few basic information about yourself.

Lenders check Credit Score to know about a) your past repayment track record and credit history, b) to review your credit balance and decide on your eligibility for further credit limit, c) to identify whether you meet the lenders credit norms and d) to arrive at the interest rate and loan amount suitable for you.

A low Credit Score can deny you further loan from any lender. On the brighter side, a high credit score speaks high about your repayment capacity and intent. You should check your Credit Score to know about your financial health and plan your borrowings.

If you have a poor Credit Score then you can do a lot to improve it. Avoid borrowing when you can do without it. Do debt consolidation to reduce your EMIs and make yourself comfortable on repalyment of your loans. Plan your repayments properly and ensure you pay your bills and dues on time.

A high credit score basically means that you have lesser probability of default and you are more likely to get higher credit lines at lower interest rates approved by the lending institutions. A low credit score, on the other side, reflects that you have a high probability of default and lenders will be cautious towards lending to you.

A lot of factors are taken into consideration while deciding the Credit Score of an individual like repayment history, credit utilization, credit duration, credit mix and even frequency of recent inquiries with the credit bureaus. As per the RBI guidelines, the credit bureaus receive credit performance reports on monthly basis from its member banks and lending institutions. These details are in turn processed to arrive at the Credit Score of the Individuals.

Yes. you can maintain a good repayment track while paying your instalment on time. Having a practice of returning borrowed funds on time enhances your credibility and improves the score. lendingplate is member of all the credit bureaus in India and loan repaid on time is regularly reported to them which in turn shall improve your Credit Score over a period of time.