Did You Know?

We serve loans, the best way you can borrow

We at lendingplate are here to offer instant cash loan solutions to put money in your account during emergencies. You can complete the procedure within 30 minutes. Our digital lending platform can transform your financial needs into a reality that too with minimal documentation.

So, receive instant loans from ₹5,000 to ₹2,50,000 directly to your bank account in a hassle-free manner. Our quick cash loans are available through our portal. So, complete the whole process online without visiting any branch.

Our dedicated team works round the clock to process your application swiftly while maintaining the highest security standards for your data protection. Apply for fast cash loans today and experience hassle-free borrowing with transparent terms.

Visit the lendingplate portal on your smartphone or desktop to begin your loan application journey today.

Complete our simple digital form with your personal and employment details for quick processing.

Submit your identity proof and income documents through our secure mobile application platform.

Connect your bank account digitally for instant verification of your financial details.

Get your approved loan amount credited directly to your bank account within minutes.

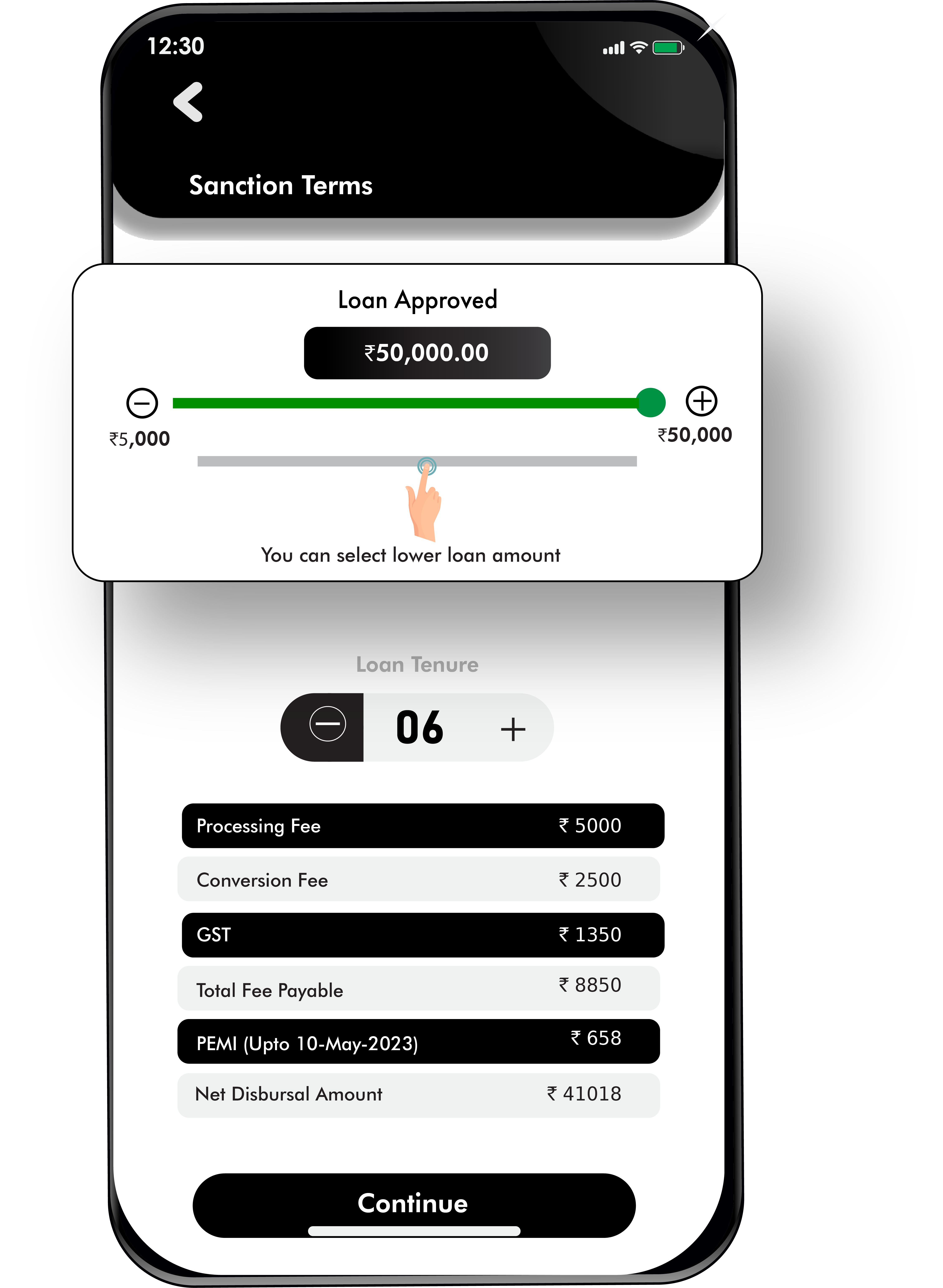

Plan your borrowing wisely with our advanced EMI calculator that shows detailed breakdowns of your monthly payments. Enter your desired loan amount, tenure, and interest rate to view comprehensive repayment schedules instantly. Our calculator helps you make informed decisions by displaying exact EMI amounts with principal and interest components.

Experience seamless loan applications through our advanced mobile platform that processes your request within minutes without requiring branch visits.

Choose from multiple repayment tenures ranging between 3 to 15 months that perfectly match your monthly budget requirements.

Submit only essential documents through our secure digital platform that protects your sensitive information with advanced encryption technology.

Trust our transparent fee structure that clearly displays all applicable charges upfront without any surprises during repayment.

Rest assured with our bank-grade security measures that protect your personal and financial information throughout the process.

Receive your approved loan amount directly in your bank account within 30 minutes through our automated disbursement system.

Make your dreams possible with our simple eligibility requirements for instant cash loan applications. We design our criteria to help maximise customers’ access to quick financing solutions for their needs. Trust our decade-long experience in understanding your requirements and delivering suitable financial products.

Get access to lending solutions with our competitive interest rates and flexible repayment options. We maintain complete clarity in our charges structure. Here’s what you need to understand before getting a loan from us –

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Calculating your EMI for an instant cash loan is simple and practical. You work out your monthly payment using this proven formula-

EMI = [P x R x (1+R)^N] / [(1+R)^N - 1]

Here,

P is your loan amount

R is your monthly interest rate (annual rate divided by 12 and then by 100)

N is the total number of months for repayment

Checking the EMI helps you understand the actual cost of your loan before you apply. Then, you can compare offers from different lenders. Try using lendingplate’s EMI calculator. Enter the amount, tenure, and rate to get instant results.

Knowing your EMI upfront ensures your monthly budget stays comfortable. It helps you avoid surprises during repayment.

Repayment Capacity :

Calculate your monthly income and expenses carefully before finalising the loan amount.

Interest Charges :

Review all applicable fees and charges to understand your total repayment obligation.

Loan Purpose :

Ensure you borrow only for essential needs that match your repayment capability.

Experience smart financing solutions with our customer-first approach. Choose us for your financial needs because we prioritise speed and security in every transaction.

Our paperless process gets you from application to approval within minutes online.

We offer rates starting at 12% per annum with flexible terms suited to your budget.

Your approved loan amount reaches your bank account within 30 minutes during business hours.

We display all fees and charges upfront so you know what you will pay.

Our bank-grade encryption keeps your personal and financial information protected at all times.

Select a repayment schedule between 3 to 15 months that matches your income.

Join thousands of satisfied customers who trust us for their urgent financial requirements daily.

Our customer service specialists help you through every step of your loan application journey.

You can get an instant cash loan during emergency situations where you need urgent cash. These loans offer peace of mind-

Deal With Unexpected Bills

Keep up with Your Lifestyle

Ease Important Moments

You use an instant cash loan because it suits your need for speed. Noticed an offer on your dream phone but out of cash? Pick the device up now and pay later. That’s why people count on quick cash loans, and why you find real value in fast cash loans for these day-to-day hurdles.

Instant cash loan approval feels like a relief. Just focus on using these funds wisely. Borrowing More Than You Need - You might feel tempted to borrow a big chunk just because it’s offered. Don’t. Only take as much as needed for your emergency or goal. Bigger loans mean higher repayments. Stick to your actual needs.

Skipping Repayment Details - You must read every repayment rule on your loan. Understand your due dates & check whether there are any charges for late payments. It may impact your credit & bring penalties if you lose track of your EMI or ignore reminders.

Missing EMIs Or Forgetting The Total Cost - Don’t believe that missing an EMI is no big deal. Each missed payment affects your credit. Loan costs add up fast with fees or interest. Mark your calendar and make every payment on time, every month.

Not Checking The App Or Portal - Always follow up on your application as well as your repayment status in the app. Keep screenshots & download receipts. Never forget to save the records.

Applying for fast cash loans online or urgent cash loans makes things smoother. Pay close attention to terms, borrow just what matters, and avoid stress later. That way, you use your instant cash loan in India to truly help you. With these steps, you can always get instant cash loan support when you need it without regrets.

Make your monthly payments through our convenient digital channels. Set up auto-debit from your bank account for hassle-free repayments. Access your loan details anytime through our mobile app. Track your payments and upcoming EMIs easily. Get instant payment confirmations and statements online. We help you manage your loan repayments effortlessly through our digital payment channels that offer multiple options. You can set up auto-debit instructions from your bank account for timely EMI payments. Get access to your loan details anytime through our portal and track repayment schedules.

Receive instant payment confirmations and download statements online. Contact our support team for assistance with repayment queries or special requests.

You can apply for loans up to ₹2,50,000 depending on your monthly income and eligibility criteria. The final approved amount considers factors like salary and credit score. We also check your income stability – you need to earn at least ₹20,000 every month to get an instant loan from us.

Our digital platform processes applications within minutes through automated verification systems. After approval, we credit the loan amount to your bank account within 30 minutes during working hours.

Yes, we evaluate applications from customers without credit history based on alternative data points. We consider factors like income stability, employment profile and bank statement analysis for loan decisions.

Late payments attract additional charges and negatively impact your credit score. Contact our support team immediately if you face repayment difficulties. We work with customers to arrange flexible payment plans.

Yes, our platform uses advanced encryption and security protocols for all transactions. We follow strict RBI guidelines and maintain complete transparency in our lending processes and charges.

We offer loans to salaried professionals from approved organisations. However, self-employed individuals can also consult us for instant cash loans with great interest rates (ranging from 12% to 36% per annum). We plan to offer services to both self-employed and salaried individuals.

Choose flexible repayment tenures between 3 to 15 months based on your preference. You need to select an EMI amount that comfortably fits your monthly budget and income.

No, we maintain complete transparency in our fee structure. All applicable charges (including processing fees, interest rates and other costs) are clearly communicated upfront.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.