Did You Know?

We serve loans, the best way you can borrow

At lendingplate, we offer personal loans for women with speedy approval processes. You receive funds directly in your bank account within 30 minutes of approval. We process applications swiftly through our mobile app or website.

Our personal loans for women range from ₹5,000 to ₹2.5 lakhs to support various needs like weddings, medical expenses, or festival celebrations. You receive loan offers based on your specific profile with terms that match your repayment capacity. The loan amounts suit different requirements and income levels making financial support accessible for women across India. Our dedicated support team guides you through questions.

Our financial solutions address your unique needs with quick processing and minimal documentation requirements. We value your time and make borrowing simple.

Quick Application Process: You can complete the entire loan application through our mobile app or website within minutes. We verify your details instantly using secure technology.

Minimal Documentation: Upload your basic KYC documents and income proof through our app. Our digital verification system speeds up the approval process.

Flexible Repayment Options: Choose repayment terms that match your financial planning. We offer various tenure options to keep your EMIs manageable.

No Collateral Required: Get personal loans for women without pledging any assets. Your income documents and credit score are sufficient for loan approval.

Same Day Disbursement: Receive funds in your account within 30 minutes after final approval. We process applications quickly to meet urgent requirements.

Complete Digital Process: Skip branch visits and paperwork. Complete everything from application to document submission through our secure digital platform.

We offer competitive interest rates starting from 12% per annum with these benefits –

We start our interest rates from 12% per annum making borrowing affordable for you. Our risk-based pricing model considers your credit score and income profile to offer personalised rates. You receive detailed breakdowns of interest calculations before accepting the loan. We review rates regularly to ensure you receive the best possible offers.

Your credit score and monthly income form the foundation of our approval process. We look beyond traditional parameters and consider your overall financial profile while evaluating applications. Our advanced credit assessment systems analyse multiple data points to determine the maximum eligible amounts. You receive pre-approved offers based on your profile making the process quicker.

Skip the tedious branch visits and endless paperwork with our fully digital process. Our mobile app guides you through each step – from application to document upload. You receive instant updates about your application status through SMS and app notifications. Most applications receive decisions within minutes of submission.

Choose loan tenures between 3-36 months based on your comfort with payments. We offer multiple repayment dates – letting you align EMIs with your salary credits. We ensure you borrow responsibly without straining your finances.

Experience complete transparency with our upfront fee structure and clear communication. We display all applicable charges (including processing fees before you accept the loan). You receive detailed loan agreements explaining every charge associated with your loan. Our customer support team helps you understand any charges you have questions about.

Make extra payments toward your loan after completing 6 months without paying any penalties. You save on interest costs by making additional payments when you have surplus funds. The prepayment amount gets directly adjusted against your principal. Our app lets you track the impact of prepayments on your loan closure date.

We make borrowing simple with our fully digital application process. Get started in minutes through our website or mobile app. So, are you ready to get started? Apply now through our app and receive funds within 30 minutes of approval. We can offer the amount you need for your personal requirements – whether it is a medical emergency or travelling solo (or something else).

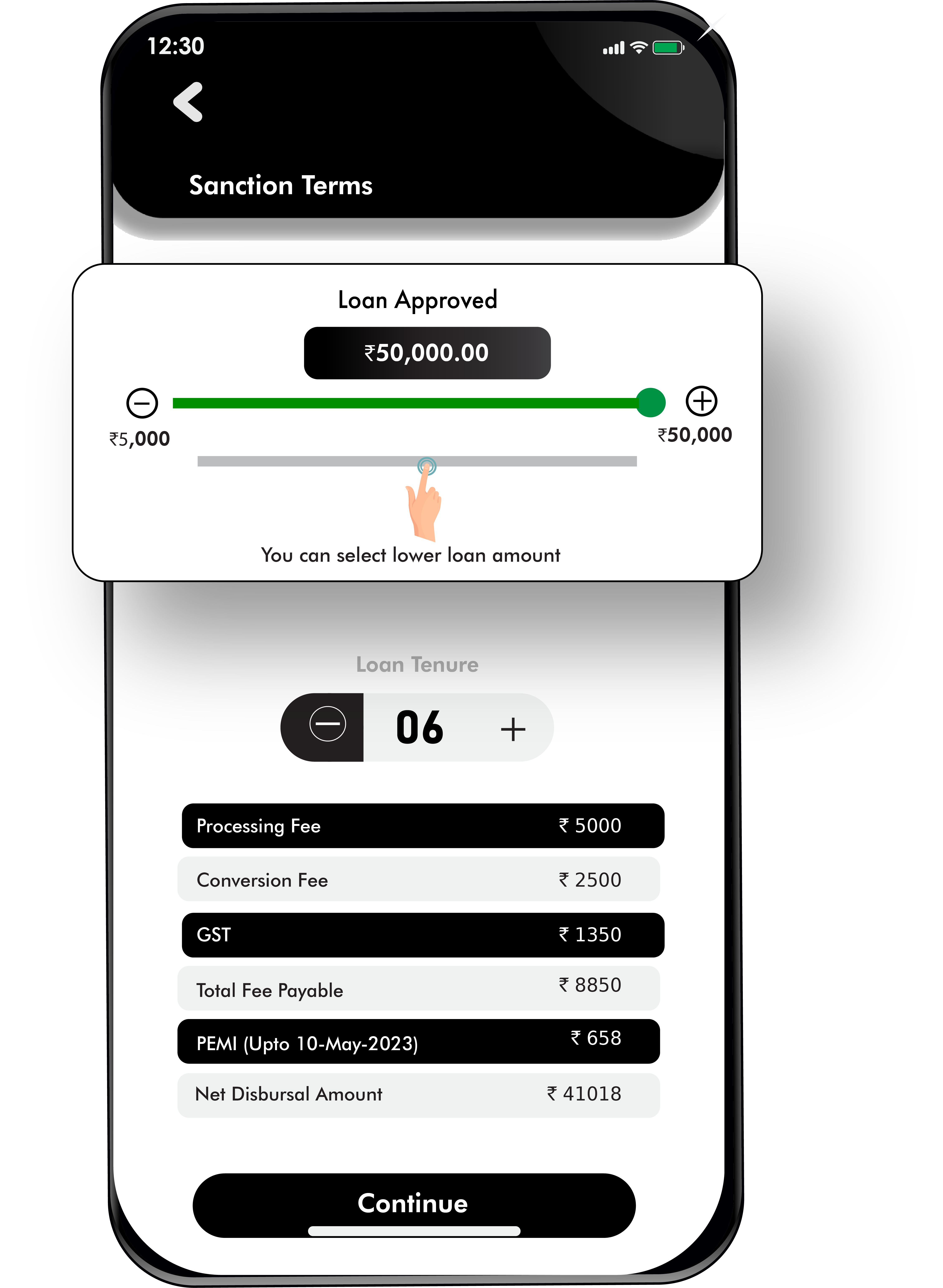

You need to understand the charges once you borrow the amount from us. Once you know the charges, it becomes easier to apply for the loan –

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Understanding our repayment options helps you plan your finances better. Choose terms that match your monthly budget with our personal loans for women.

Flexible EMI Payment Options:

Select from various repayment tenures between 3 to 36 months. Adjust your EMI amount based on your monthly income.

Auto-Debit Facility Available:

Set up automatic EMI payments from your bank account. Never miss a payment date with this convenient option.

Part Payment Flexibility:

Make additional payments toward your loan after six months. Reduce your overall interest cost with part payments.

Early Settlement Option:

Close your loan ahead of schedule without any prepayment penalties after six months of regular payments.

Digital Payment Methods:

Pay your EMIs through multiple digital payment options. Access your loan account 24/7 through our mobile app.

Here are the things you should consider before taking personal loans for women –

Check Your Current Financial Position:

Review your monthly income and expenses carefully. Ensure the new EMI fits comfortably within your budget.

Compare Total Interest Costs:

Calculate the total interest payment over your chosen tenure. Select a tenure that balances EMI affordability with total cost.

Understand All Applicable Charges:

Know about processing fees and other charges upfront. We maintain complete transparency in our fee structure.

Review Your Credit Score First:

Check your credit score before applying. A good score above 650 improves your chances of approval.

Evaluate Your Repayment Capacity:

Consider your existing financial commitments. Make sure you can manage the additional EMI comfortably.

Read All Terms Carefully:

Go through the loan agreement thoroughly. Understand all terms and conditions before accepting the offer.

We offer personal loans for women with quick processing and minimal documentation. Our loans range from ₹5,000 to ₹2.5 lakhs with flexible repayment options. You can apply through our mobile app or website and receive funds within 30 minutes of approval. We consider your income and credit profile for loan approval without requiring any collateral or security.

The maximum loan amount we offer is ₹2.5 lakhs. Your approved amount depends on factors like monthly income credit score and existing financial commitments. We evaluate each application individually to offer the highest possible amount. The loan processing happens digitally making it convenient for you to apply and receive funds quickly.

You do not need a co-applicant or guarantor for our personal loans for women. Your income & credit score are sufficient for loan approval. We focus on making the process simple with minimal documentation requirements.

Our interest rates start from 12% per annum based on your credit profile. The exact rate depends on factors like income, credit score and loan tenure. We maintain complete transparency in our pricing with no hidden charges.

We need basic KYC documents like government ID proof, address proof and income documents. For salaried applicants, we require recent salary slips and bank statements. Business owners can submit income tax returns and business proof. Upload all documents digitally through our app for quick verification.

We require proof of regular income, either from salary or business, for loan approval. This helps ensure comfortable loan repayment through EMIs. However, we consider multiple income sources while evaluating applications.

Our personal loans for women are unsecured. So, you do not have to need to pledge any assets. We approve loans based on your income and credit profile. The entire process – from application to disbursement, happens digitally.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.