Did You Know?

We serve loans, the best way you can borrow

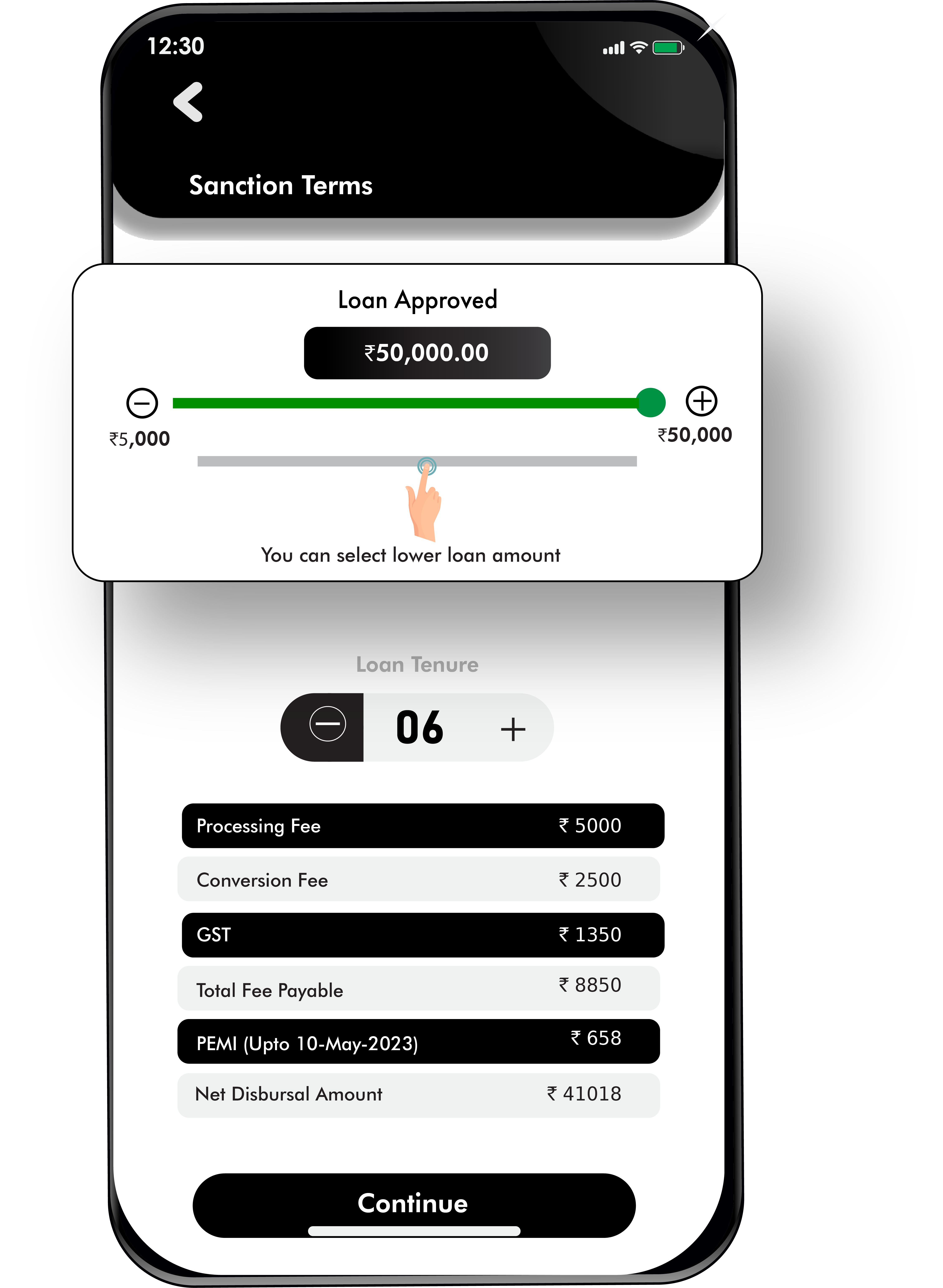

Getting extra money should not create stress in your life. Our personal loan for salaried employees gives you quick access to funds between ₹5,000 and ₹2.50 lakhs. You may use this money for multiple needs like weddings and medical expenses.

We make borrowing simple by offering online applications and same-day approvals. Our team reviews your application quickly – so you receive funds within 30 minutes. Your regular monthly salary helps us approve your loan faster. We value transparency in all dealings and never add hidden charges to your loan agreement.

We at lendingplate understand your need for quick financial support. Our personal loan for salaried employees offers convenience that suits your lifestyle.

Quick Money Access:

You receive loan money directly in your bank account within 30 minutes after approval. No long waiting periods or complex procedures slow down your access to funds.

Minimal Documentation Required:

We ask for basic KYC documents and income proof. Your salary slips and bank statements help us process your application faster without extra paperwork.

Flexible Repayment Options:

Choose loan tenures that suit your monthly budget. We offer various repayment schedules so you can select EMIs that match your salary dates.

No Collateral Needed:

Your regular salary serves as sufficient security. We trust your repayment capacity based on your employment status and income without asking for any assets.

Digital Application Process:

Apply through our website or mobile app anytime. The entire process stays online from application to approval without visiting any office.

Our advanced technology reviews applications instantly. You know your loan status within minutes through our automated verification system. You track every step through your mobile app or website account. No more waiting for manual reviews or branch visits. Your employer verification happens digitally through our partner network.

We maintain complete transparency about processing fees and other charges. Every cost related to your loan appears clearly in your agreement. We explain all charges in simple language. We send regular updates about payment schedules.

We offer reasonable interest rates starting from 12% per annum. Your credit score and employment stability help determine your final interest rate. We consider your income level when setting final rates. Longer employment tenure often qualifies for better rates.

Pick any amount from ₹5,000 up to ₹2.50 lakhs. We adjust loan amounts based on your salary level. Higher incomes qualify for bigger loan amounts. Your existing EMIs affect available loan limits. We consider your age when deciding loan amounts. Longer employment history may increase available amounts.

Upload documents directly through your phone camera. Our app automatically checks document quality and clarity. We accept digital signatures on loan agreements. Digital KYC makes identity proof simple. You track document status through your online account.

Select comfortable EMI plans ranging from 3 to 24 months. Create payment schedules matching your salary dates. We help you choose payment schedules that match your salary credit dates. Our EMI calculator shows exact payment amounts.

Start your loan application in simple steps.

You need to understand the charges once you borrow the amount from us. Once you know the charges, it becomes easier to apply for the loan –

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Your comfort matters most when planning loan repayment. We structure EMIs that match your salary dates so you never miss payments.

Flexible Repayment Schedule:

Pick repayment tenures between 3 to 24 months. We adjust your EMI amount based on your chosen tenure and loan amount. Monthly payments automatically align with your salary credit dates for convenience.

Easy EMI Calculation:

Use our EMI calculator to plan your monthly payments. Enter your desired loan amount and tenure to see exact EMI figures. This helps you choose a payment plan that matches your monthly budget.

Prepayment Options Available:

Pay extra amounts toward your loan whenever you want. We charge no penalties for prepayment after six months. This option helps reduce your interest burden significantly.

Make informed decisions about your personal loan for salaried employees by evaluating these important factors.

Check Your Monthly Income Balance:

Calculate your take-home salary minus existing commitments. Your new EMI should not strain your monthly expenses. Keep emergency funds separate from loan repayment amounts.

Review Current Credit Score Level:

Higher credit scores qualify for better interest rates. Check your score before applying to understand your loan eligibility chances. Take steps to improve low scores.

Evaluate Total Interest Cost:

Consider the full cost (including interest) over your chosen tenure. Compare different tenure options to find balanced EMIs. Calculate prepayment benefits if you expect extra income.

Assess the Employment Stability Factor:

Stable employment increases approval chances. Long-term career prospects affect loan eligibility. Company reputation influences interest rate offerings.

You need a minimum monthly salary of ₹15,000 to apply for a personal loan for salaried employees. Your take-home salary matters more than gross income. We check your bank statements to verify regular salary credits. Higher salaries improve your chances of loan approval. Your employer's reputation also influences eligibility.

We calculate your eligible loan amount based on monthly income and existing obligations. Your credit score impacts the maximum amount available. We consider your age and remaining service years. Current employer stability affects loan amount decisions. Bank statement analysis shows your spending patterns.

Interest rates start at 12% per annum for eligible borrowers. Your final rate depends on multiple factors including credit score. We review your previous loan repayment records. Your current employer's reputation affects interest rates.

Most loans receive approval within 5 minutes of application submission. Document verification takes another 10 minutes through our digital process. Money reaches your account within 30 minutes after final approval. Digital KYC speeds up the verification timeline.

Choose repayment periods between 3 months and 24 months. Longer tenures give you smaller EMI amounts. Short tenures help reduce total interest costs. Select tenure based on your monthly surplus income. We allow tenure changes before loan disbursal.

Yes, complete your entire loan process through our website or mobile app. Online applications work 24/7 without any branch visits. Upload all documents digitally using your phone camera. Digital signatures make paperwork completely online. Online verification happens through secure banking channels.

Yes, we consider applications from people with credit scores above 650. Recent salary increases might balance lower credit scores. Good employment stability helps overcome credit issues. We look at your current repayment capacity carefully. Regular salary credits strengthen your application despite low scores. Your employer's reputation influences approval chances. Longer work experience might help with lower scores.

Multiple loans depend on your repayment capacity and current obligations. We check your income-to-EMI ratio carefully. Your credit score affects multiple loan eligibility. We consider existing loan repayment history.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.