Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

Money troubles hit when you least expect them. It leaves you scrambling for speedy financial help without much time to spare.

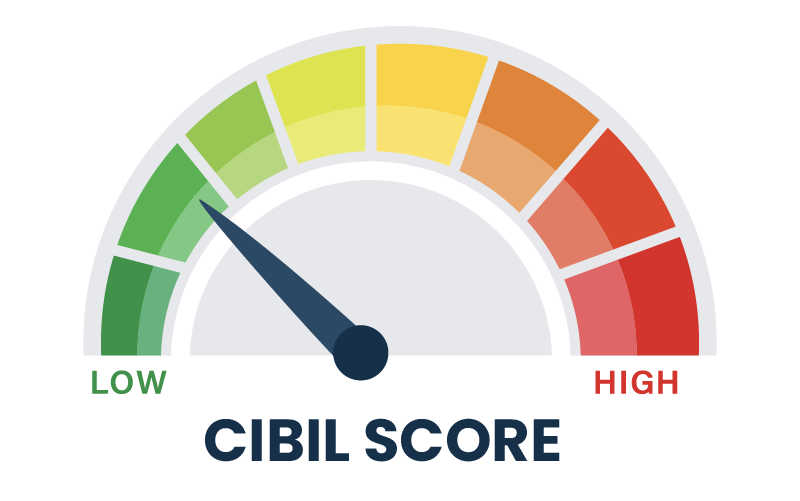

Your credit score speaks volumes about your financial behaviour. It tells lenders how responsibly you handle money or whether you can pay bills on time. The three-digit number ranges between 300 & 900. A higher score suggests you're trustworthy with repayments, while lower scores raise red flags about potential risks for lenders.

Think of your credit score as a financial reputation that follows you everywhere, impacting not just loan approvals but also interest rates offered. Each financial move—from credit card payments to loan applications – leaves a mark on this score, building your financial identity over time. Your spending habits, payment history, and credit utilisation shape this number – which becomes crucial when sudden expenses arise and you need cash quickly.

Lenders view different score ranges through distinct lenses when considering loan applications, with each range carrying specific implications for approval chances and terms offered.

| Credit Score Range | What It Indicates | Loan Approval Chances |

|---|---|---|

| 750-900 | Excellent credit history | Very high approval odds with the best rates |

| 700-749 | Good credit standing | Strong approval chances with competitive rates |

| 650-699 | Fair credit rating | Moderate approval with slightly higher rates |

| 600-649 | Below average credit | Limited options with higher interest rates |

| 300-599 | Poor credit standing | Very difficult to get approved; it may need collateral |

Personal loans and your credit score share a two-way relationship where each influences the other in meaningful ways throughout your financial journey.

1. Establishes Credit History Length –

Your loan history duration matters significantly to lenders, showing how long you've managed credit responsibilities and built financial trust over time.

2. Demonstrates Payment Reliability –

Regular on-time payments toward your personal loan create a positive payment pattern that boosts your score and proves your commitment to financial obligations.

3. Impacts Available Credit Ratio –

The loan amount compared to your income affects your credit utilisation ratio, which lenders analyse to determine if you're stretching your finances too thin.

4. Shows Debt Management Skills –

Successfully managing multiple loans demonstrates your ability to juggle financial commitments without falling behind on payments or defaulting.

5. Creates Financial Reputation –

Every loan interaction builds your financial character in credit reports, creating a lasting impression that follows you through future borrowing needs and opportunities.

Most reputable lenders look for a minimum CIBIL score for personal loan of 700 or above. It places you in the "good credit" category. Some lenders might consider applications with scores between 650-699. Approval becomes significantly more challenging when your score dips below 650. It may often require additional security or a co-applicant with stronger credit.

The minimum CIBIL score required for personal loan varies depending on lenders. Traditional banks generally maintain strict rules around 700-750. The new digital lenders or NBFCs may allow scores below 630, too. You should remember that lower scores almost always translate to costlier loans through elevated interest rates.

Your credit score not only determines approval but also significantly impacts the interest rate you'll pay throughout the loan tenure. Even a small rate difference can mean thousands in additional interest over time.

Your credit score offers lenders valuable insights into your money management habits and helps them make informed lending decisions aligned with their risk policies.

1. Payment History Analysis

Lenders carefully examine your past payment patterns, placing special importance on recent history and consistent on-time payments across all accounts.

2. Credit Utilisation Review

Your balance-to-limit ratio reveals spending habits and potential financial strain, with lenders preferring ratios below 30% for healthier financial indicators.

3. Income-to-Debt Assessment

Lenders calculate your monthly obligations against income to ensure you can comfortably afford new loan payments without straining your budget.

4. Credit History Duration

A longer credit history provides more data points for lenders to evaluate your financial behaviour patterns and stability over extended periods.

5. Recent Credit Applications

Multiple applications in a short timeframe may signal financial distress. It may result in lenders scrutinising your application more carefully before approval.

Boosting your credit score takes consistent effort. However, even small improvements can significantly impact your loan approval chances.

1. Pay Bills On Time

Never miss payment deadlines on any loans or credit cards, as payment history carries the heaviest weight in calculating your overall score.

2. Reduce Existing Debt First

Lower your outstanding balances on credit cards and existing loans before applying for new credit to improve your debt-to-income ratio.

3. Fix Credit Report Errors

You must check the credit report regularly for outdated information that may lower your score unfairly or dispute any errors.

4. Limit New Credit Applications

Space out loan applications at least six months apart to avoid multiple hard inquiries that temporarily lower your score.

5. Maintain Old Credit Accounts

Keep accounts active even with minimal use. A longer credit history positively impacts your overall score calculation.

Raising your credit score requires patience. However, implementing these practical tips can help you reach lending thresholds speedier.

1. Become An Authorised User

Join a family member's well-maintained credit card account as an authorised user to benefit from their positive payment history.

2. Use Credit Builder Loans

Specific loans are designed to build a positive credit report payment history while you save money in a secured account simultaneously.

3. Monitor Credit Regularly

Track your score monthly through free monitoring services to catch negative changes early and understand the factors affecting your score.

4. Maintain Credit Utilisation Below 30%

Keep credit card balances well below their limits even if you pay in full monthly, as high utilisation impacts scores negatively.

5. Request Credit Limit Increases

Higher limits improve your utilisation ratio instantly if spending remains constant, but avoid the temptation to increase spending proportionally.

With a 650 score, loan approval becomes possible but challenging through certain lenders like NBFCs who cater to this segment. Traditional banks might hesitate, but lendingplate considers applications in this range with slightly higher interest rates and possibly additional documentation. Your income stability and employment history become particularly crucial when applying with this minimum CIBIL score required for personal loan.

Paying down credit card balances can boost your score within 30-45 days by improving utilisation ratios. Removing errors through disputes shows results within one billing cycle while becoming an authorised user on someone's well-maintained account transfers their positive history to your report almost immediately. Consistency matters more than quick fixes for sustainable improvements in your CIBIL score.

A 700 score typically meets the minimum CIBIL score for personal loan requirements at most financial institutions, including lendingplate. This score places you in a favourable position to receive competitive interest rates and reasonable repayment terms without excessive documentation or verification processes. Your approval odds increase substantially, though income proof and employment stability remain important factors in the final lending decision.

Dramatic score improvements rarely happen within just 10 days, but paying down credit card balances below 30% utilisation can show quick positive movement. Requesting the removal of settled accounts or disputing inaccuracies might help if errors exist. For urgent loan needs with borderline scores, consider lendingplate – which evaluates applications more holistically beyond just personal loan eligibility score requirements.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019