Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

Financial decisions often involve complex terms and calculations, leaving consumers confused about the actual cost of loans and credit cards. One crucial term to understand is the annual percentage rate (APR). It represents the true cost of borrowing, encompassing both the interest rate and additional fees. This comprehensive guide explains APR, explaining its significance and providing clear steps to calculate it accurately.

Annual percentage rate (APR) is a standardized way to calculate the total cost of borrowing in a year. The APR not only includes the interest rate charged by the lender but also includes additional fees and costs associated with the loan, such as processing fees, the foreclosure amount, and other charges by the lender or bank. Lenders are required by law to disclose the APR to consumers, ensuring transparency and enabling borrowers to make informed financial decisions.

1. Interest Rate: The percentage of the loan amount charged by the lender for borrowing the money.

2. Fees and Additional Costs: Any upfront fees, closing costs, or other charges associated with obtaining the loan.

You may also read this: Personal loan with loan interest rate

To calculate APR accurately, follow these steps:

Step 1: Identify the Loan Amount and Interest Rate

Begin by determining the principal loan amount (the initial amount borrowed) and the nominal interest rate (the annual interest rate specified in the loan agreement). For example, consider a ₹10,000 loan with an annual interest rate of 5%.

Step 2: Determine the Loan Term

Know the duration of the loan in years. The loan term influences the total interest paid over the loan period. For instance, a 5-year loan has a term of 5 years.

Step 3: Add Any Additional Fees and Costs

Include all fees associated with the loan, such as processing fees or closing costs. For illustration purposes, let’s assume there are no additional fees in this example.

Step 4: Use the APR Formula

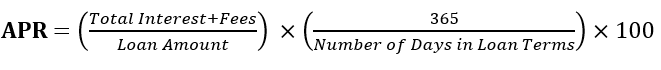

APR can be calculated using the following formula:

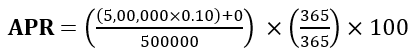

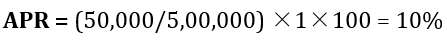

Using the example:

In this example, the APR is 10%, reflecting both the interest rate and any potential fees associated with the loan.

You may also read this: Personal loan with low CIBIL score

1. Comparison Tool: APR allows borrowers to compare loan offers from different lenders accurately. It provides a standardized metric, enabling borrowers to assess the total cost of various financial products.

2. True Cost of Borrowing: Unlike nominal interest rates, which only consider the interest charged, APR provides a comprehensive view of the actual cost of borrowing by incorporating all associated fees.

3. Informed Decision Making: Understanding APR empowers consumers to make well-informed financial decisions, ensuring they choose loans that align with their budgets and financial goals.

The annual percentage rate (APR) is a fundamental concept in personal finance, representing the true cost of borrowing money in a year. By encompassing both the interest rate and additional fees, APR offers consumers a clear understanding of their financial obligations. Armed with this knowledge and the ability to calculate APR accurately, individuals can confidently navigate the complex world of loans and credit, making decisions that enhance their financial well-being.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019