Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

A good credit score is essential for achieving financial success because it affects the interest rates you get on loans. Your credit score will determine the interest amount you get charged on the loan you take. In the past few years, interest rates on personal loans, mortgage loans, etc., have increased significantly since the Reserve Bank of India raised the benchmark interest rates to curb slow inflation.

Therefore, if you have a low score, you will likely get a very high-interest loan. On the contrary, a good credit score that's in an acceptable range is accompanied by a lower interest rate. In that case, you must work towards improving the score. Are you planning to take out a loan to purchase a car or home or just want to pay your other bills? If so, it is very important to improve your credit score, but it isn't an easy peasy job. Without proper strategies, it may take you forever to increase your credit score.

When you closely monitor your credit score, you will observe that it changes frequently. Even though it's normal for a credit score to change by a few points from one month to the next, noticeable improvements need time. It is unrealistic to expect a 300-point increase in credit score within a month, despite claims that make such promises. Any guarantees regarding certain increments within a fixed timeframe are suspicious.

You can improve your credit score by certain points by identifying the issues that negatively impact the score and adopting new healthy financial habits to gradually increase it.

Believe it or not, credit scores affect our lives in some way or another. Sometimes we forget about some things and only remember them when in desperate need. This is the case with credit scores; we overlook it until it's time to apply for a loan.

A low credit score can affect you negatively. For instance, it will be challenging to get a loan or even a credit card loan. This is because lenders see you as someone who isn't responsible for paying their bills on time. So, they may not be willing to grant you a loan. Besides, you may pay higher rates on a loan you secure. Actually, this might cost you a lot because you are literally paying almost double the loan amount you requested.

A credit score shows how well of a manager you are to your bills. Lenders will therefore decide if you are the best person to get a loan or not after assessing your score. This score is based on your borrowing practices and payment history, so lenders use it to help decide if you are a good candidate for a loan or credit. Though it may seem harsh to the borrower, the lender should make a quick decision, and the score makes ruling out unqualified individuals easier.

So, we can confidently say that your credit score plays a crucial role in your life, mostly pertaining to finances. Therefore, it is important to understand how to keep your score in a good range to reap the financial benefits of a good credit score.

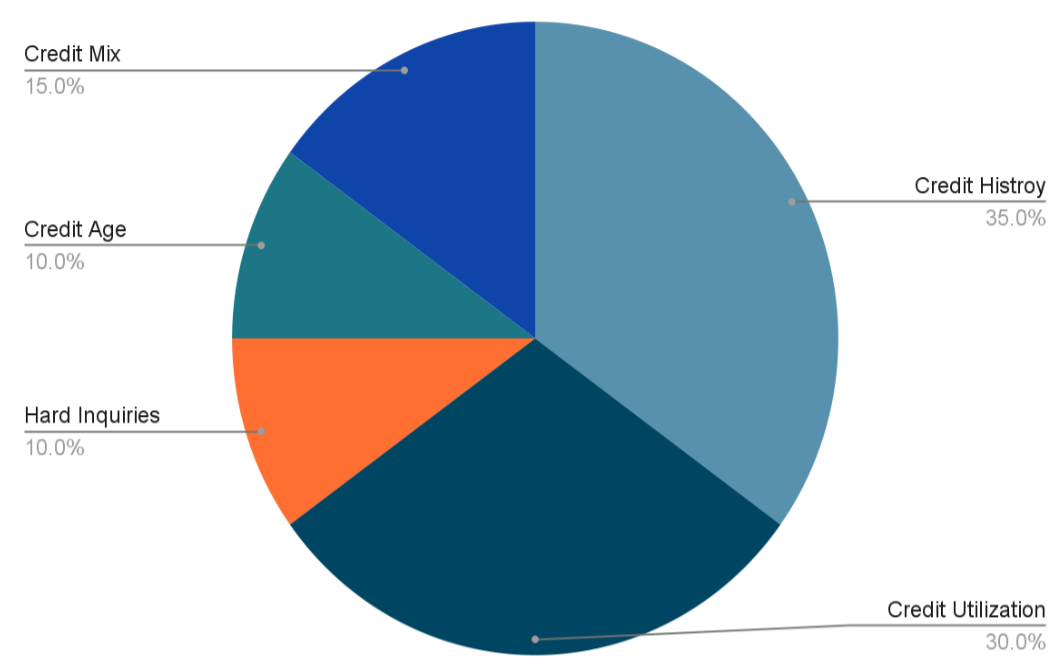

Credit scores are determined by the information in your reports. Lenders use different credit score models to find your total score, with most scoring models taking into account these factors:

It is not easy to improve your credit score, even for a few points, but we are here to show how easy it is in just a few months. Here is what to do if you want your score to increase:

Make your payments on time and in full. Your payment history contributes 30–35% of your overall score. Thus, if you miss or make late payments, it can significantly decrease your score. Conversely, having a positive payment history may lead to an improved credit score.

Paying at least the minimum amount due on all your debts and financial commitments punctually every month could significantly enhance your credit score. Lenders want borrowers who can be trusted, and when you pay all your bills before they are due, you can earn the lender's trust.

One great way to avoid missing payments is to use an autopay. You have to arrange the plan with your lender such that the payments will always be made automatically from your account on a particular date every month. Having automatic payments means you don't have to remember to pay your bill each month through a check or by signing into the website; everything is done automatically through your bank account.

Also, check your report to make sure nothing is missing or there are no discrepancies. Check your report regularly so that you know where your score stands. You may check online for free or request a copy of your credit report from the credit bureaus. If you find incorrect data in your credit report, you should ensure it is corrected.

If you find that one of your debts is listed twice on your credit report, removing this error can decrease the debt amount on your report. This may increase your credit score, as credit utilization is usually 20–30% of your credit.

Carefully review your credit report for older debts, incorrect information, or fraudulent charges. In case you find mistakes, reach out to the relevant credit bureau to correct them. You can dispute with the Credit Bureaus (Transunion, CIBIL, Equifax, and Experian).

Debt consolidation involves obtaining a new loan or credit card to settle existing loans or cards. Combining multiple debts into one large debt will help you get more favourable repayment terms, like low interest rates and low EMIs.

So, if you find it a challenge to pay multiple credit cards with higher rates, why not apply for credit with balance transfers? This could be the only way to consolidate the many credit card bills, and it may improve your credit score since the credit amount is increased. The interest rate will also be much lower, saving you money in the long run. Consolidating payments can also make it easier to manage your finances.

There are some credit cards with a zero APR on balance transfers, which can be a good way of consolidating your debts and saving cash otherwise from high-interest rates. Remember that most introductory interest periods last between 12-21 months.

Keeping older accounts open can boost your credit score as it demonstrates your credit history and responsible use of credit over time.

One common mistake people make is closing their old accounts. While you can discard your physical cards, it's important not to close the account, as the length of your credit history adds up to 15% of your score. Shutting down old accounts could potentially lower your score, even if you never used the line of credit. Maintaining open accounts helps to increase the maturity of your credit over time.

Increasing credit limits also has an impact on your score. To increase the score, there are two steps you can take. First, try increasing your current credit limit; second, apply for a new card (or multiple cards). By doing this, you'll ultimately have access to more funds and consequently achieve a lower utilization rate, reflecting positively on your overall score.

Before you open a credit card, do some research first. Your credit score considers how frequently you apply for and open new accounts. Applying for a new credit card or loan will prompt the issuer or lender to conduct a hard inquiry on your credit report, which could potentially lower your score, which lowers the credit score by a few points.

Although there are negative effects from such hard inquiries, reducing your credit utilization ratio has a greater positive impact on your score. But, do not apply for many multiple credit cards within a short period of time as it could raise concerns with issuers.

Amid economic fallout, credit issuers may have tighter requirements and terms.

Even though credit cards can increase your score, improper usage can hurt it. If you have no current credit or a low rating, make sure you pay your bills each month and in full. This could be the first step towards achieving an outstanding score. One way to improve your credit score faster is by paying your credit card before the reporting date instead of the due date.

You may also read this: Advantages and Disadvantages of Credit Cards

It's possible to improve your score by 200 points in a few months. However, it depends on what caused it to reduce. If the score was lowered by mistakes in your report, you might easily raise it by correcting them.

Also, if you have missed one or two payments and your credit score has dropped, you can ask creditors to remove the negative items. Other card issuers may agree to remove them if you have a good history as a customer.

If you have little or no credit history, requesting that someone with good credit add you to their account as an authorized user may be wise.

Sometimes it may not be possible to take the necessary steps, especially within a short period. If you have a history of missed payments or using up your credit limit and cannot resolve these issues within a few months, it'll probably require more time and being a responsible borrower.

Improving your credit score is a gradual process that cannot be achieved overnight. It requires consistent effort and healthy financial habits. Therefore, focus on practicing financial habits to gradually boost your credit score. Some credit solution companies may make false promises about increasing your credit score significantly within a short time. Remember, building a good credit score is a gradual process that takes time.

Increasing your credit score requires patience and time. If you use the right strategies, you can increase your score by many points in just a few months. By reviewing your report, you can find any mistakes that could be hurting your score and correct them.

Also, paying your bills on time, consolidating debts, and increasing your credit limit can increase your score faster.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019