Did You Know?

We serve loans, the best way you can borrow

A personal loan for travel makes your dream trip memorable. We at lendingplate offer quick as well as hassle-free travel loans to cover everything—from flights to tour packages. Just provide identity proof, salary slips, address proof, income proof, and an employment certificate, and you’re set to apply. Focus on creating unforgettable memories while the loan handles the rest. A travel loan will help you plan your trip properly.

We ensure your holiday plans are funded fast. Get an instant quote and receive the funds in your account within days.

You do not need to worry about endless paperwork. We make the process simple to simplify your trip.

There is no need for extra security. Our travel loans require zero collateral—apply and pack your bags.

You can select a repayment plan based on your budget. Enjoy complete control over your EMIs.

Fill out the application form and share your banking details for faster application processing.

Provide your KYC details and upload income details to get verified.

You will receive the funds within 30 minutes after successful verification.

The eligibility criteria for a personal loan for travel are as follows.

Age: You must be 21 years

Salary : Your monthly income should be above ₹20000

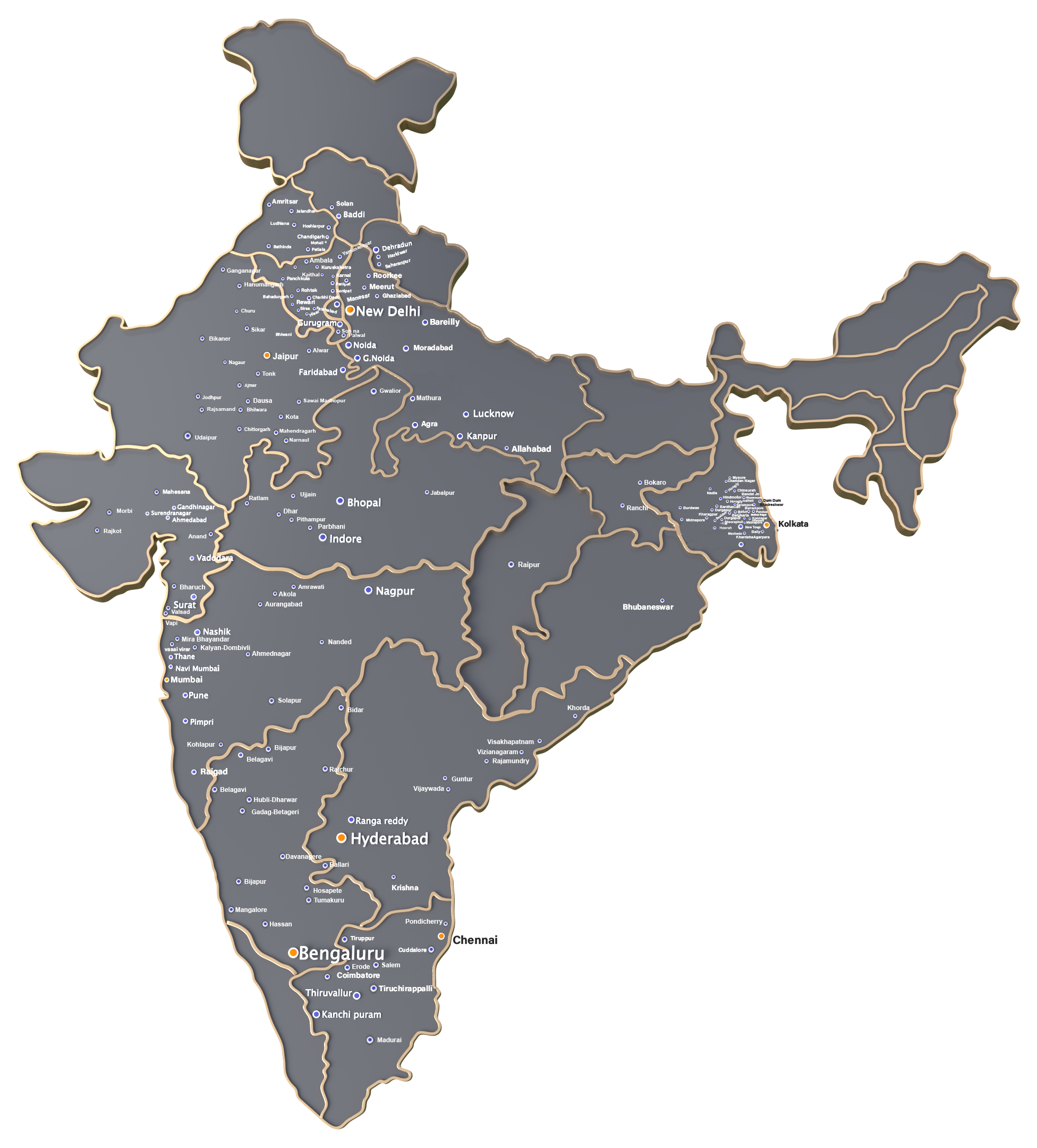

Citizenship : You must be an Indian citizen

We at lendingplate strive to make the loan application process convenient for you. That is why, we only need the following documents to process your travel loan.

Identity proof

Address verification

Income statements

The amount of loan you can borrow depends on these factors.

Monthly Income:

Your income shapes what’s possible. It is not numbers on paper; it is about the freedom you can afford. A steady paycheque opens doors to larger loans, making it easier to fund the dreams you have been saving for.

Credit Score:

You must think of your credit score as your financial reputation. A good score—750 or higher—signals responsibility and trust. It’s your ticket to bigger opportunities, showing lenders they can count on you. Small efforts now can unlock life-changing possibilities later.

Existing Loans:

Every financial commitment you have tells a story. Existing loans matter because lenders want to ensure you’re not stretched too thin. Clearing space in your budget means borrowing more when it counts, without stress weighing you down.

Here is what you should know about the travel loan interest rate at lendingplate.

| Type of Fee | Description |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

You may need an instant travel loan to fund the expenses of your next trip, here are the reasons to opt for one-

Wondering how to get a loan to travel abroadfor various reasons? You may use it for different purposes. The following are a few ways to use your personal loan for travel-

Flight Tickets- Cover your airfare costs, whether domestic or international, making travel booking hassle-free without upfront savings.

Accommodation - Book hotels or holiday stays comfortably. Spread the payments instead of paying lump sums early.

Sightseeing & Activities - Pay for tours & leisure activities without draining your budget at the destination.

Travel Insurance - Secure your trip by covering insurance costs. This adds financial protection for unexpected events.

Shopping & Miscellaneous - Manage expenses for shopping, dining as well as local transport while travelling without financial stress.

You apply by submitting eligibility details and documents to the lender. After assessment of your creditworthiness and income, the loan amount is sanctioned. You receive funds directly into your account to spend on travel needs. You then repay the loan in fixed EMIs over an agreed period.

Once your application meets eligibility, and all documents are verified, the lender issues a sanction letter. You review and sign the loan agreement confirming terms and repayment. The approved amount is transferred electronically to your bank account, usually within a few business days. Disbursal timing may vary depending on lender policies and your profile. This prompt fund transfer enables you to book travel arrangements without delay.

Comprehending the repayment terms will help you pay the monthly instalments. The repayment terms of a travel loan are as follows.

Be Honest About Your Finances

Taking a loan is a big step, so make sure it fits into your life. Look at your income and expenses. Can you comfortably handle another EMI? Borrow what you can repay without sacrificing your peace of mind.

Dream Big, Budget Smart

Holidays are magical, but they need a plan. List every expense—from flights to little indulgences like souvenirs. Borrowing just enough keeps your adventure exciting without the weight of unnecessary debt. Leave room for surprises because, let’s face it, they happen.

Read the Fine Print

Loan terms can feel like a maze, but they matter. Check those interest rates and fees closely. Choose terms that work for your travel dreams and your wallet.

The Credit Score is Your Ally

A strong credit score is like having a good reputation. It helps you get better deals and lower interest rates. If yours isn’t ideal, take a moment to improve it before applying. A little effort now pays off later.

A personal loan can make your trip a reality. But before you dive in, think about these important points:

Can You Truly Afford It?

Picture coming back from paradise only to face monthly repayments that pinch. Make sure your budget can handle it without stealing joy from your everyday life.

Do not Settle for the First Offer

You wouldn’t book the first hotel without checking reviews, right? Compare loan rates and terms. A better deal could save you a chunk of change.

Travel Smart

A dream trip does not have to mean luxury hotels and first-class flights. Borrow only what you need to explore and create memories—not debt regret.

Know the True Price of the Loan

That interest rate is the tip of the iceberg. Look out for hidden fees and charges. You deserve clarity while applying for a travel loan.

Wondering how to get a travel loan?

Getting your travel loan approved smoothly requires preparation and strategy. Here are a few tips to get personal loan for travel-

Maintain a Good Credit Score- Ensure your credit history is clean & current to enhance approval chances and secure better interest rates.

Prepare the Documents- Submit the required documents. This way, you can avoid processing delays or rejection because of the missing papers.

Borrow Wisely- Apply for a loan amount that fits your travel needs but remains affordable within your monthly budget for repayments.

Apply Early- Start the loan process well ahead of your travel dates to secure funds on time and avoid last-minute stress.

Keep Your Income Proof Ready- You need to maintain the updated income proofs consistently. This includes salary slips as well as bank statements that support your application.

So a reliable loan supports your trip while keeping finances stable. Now you have understood how to use travel loans in India effectively for your travel plans without financial hurdles.

You can use a personal loan for expenses during your trip. A personal loan can help make your dream trip happen.

It is about your income and credit score. Lenders want to know whether you can repay by assessing your eligibility.

You can get approval for a travel loan on lendingplate in minutes.

We at lendingplate have no hidden charges for a travel loan.

Lenders prefer borrowers with a credit score of more than 700. A steady income can balance a low credit score.

Early repayment can save you interest. But you may have to pay foreclosure charges.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.