Did You Know?

We serve loans, the best way you can borrow

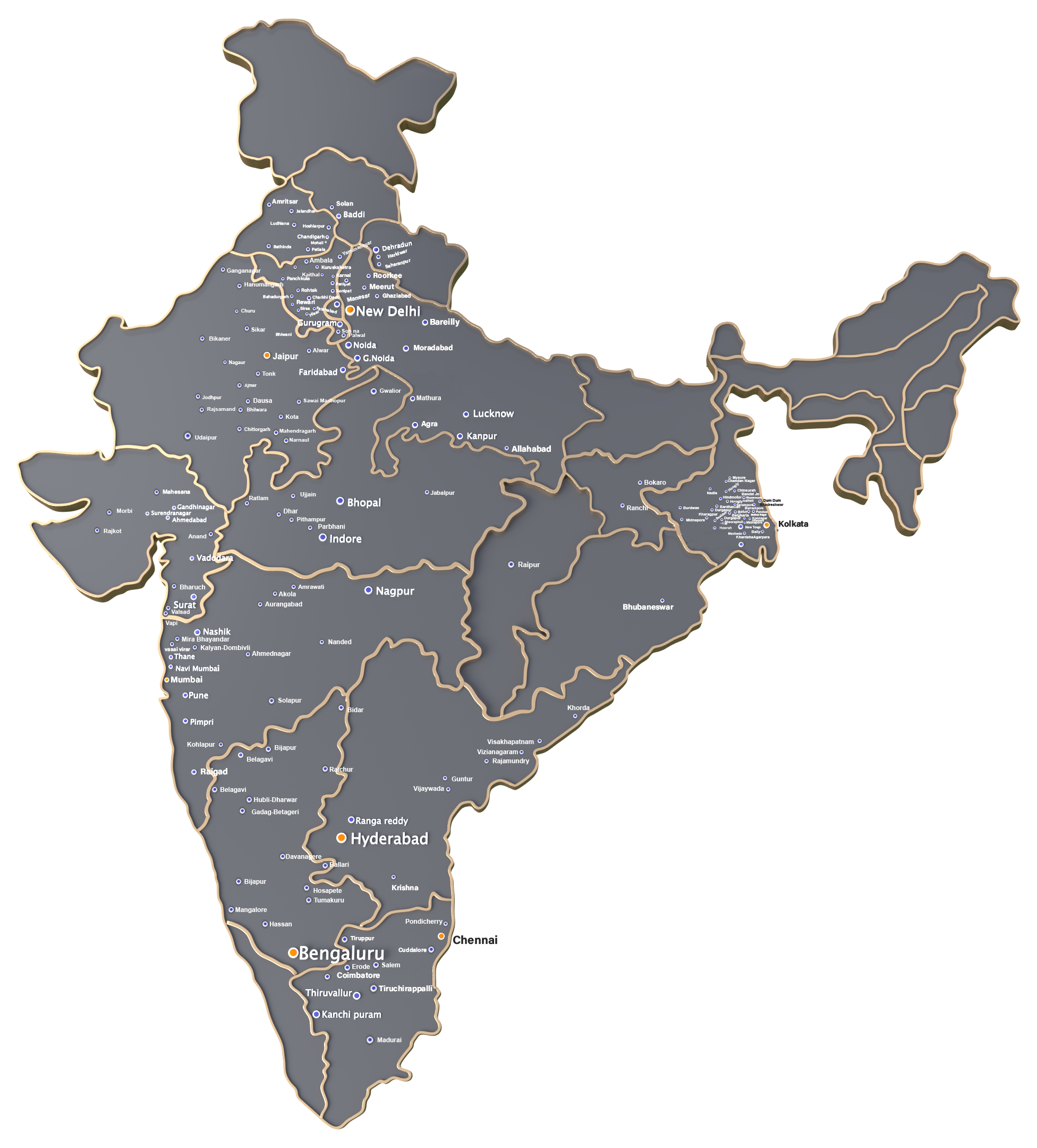

A personal loan for self employed gives you fast money access with no property required. Your money goes straight to your bank once we check your work and money papers. Our lendingplate team looks at your papers in 30 minutes and sends money today.

Our instant personal loan for self employed options gives you the flexibility to use the funds for various purposes. Buy new tools for your equipment, make your business bigger, or get extra cash when sales are slow. We offer loans from ₹5,000 to ₹ 2,50,000 with minimal documentation requirements.

The instant loan for self employed in India through lendingplate requires only basic KYC documents and bank details. We use advanced technology to assess your loan application based on your business performance and repayment capacity.

At lendingplate, we understand your needs and offer personal loan for self employed options with several advantages.

Quick Approval with Minimal Documentation Required:

You need to submit only essential documents like KYC and bank statements.

Flexible Repayment Options that Suit You:

Pick payment plans that fit how your business makes money.

Nothing Needed As Security for Your Loan:

Get funds without pledging any business or personal assets.

Same Day Fund Transfer to Account:

Once approved, we transfer the loan amount directly to your bank account within hours.

Simple Online Application Process Available:

Apply through our website or mobile app from anywhere – No need to visit any branch.

Competitive Interest Rates for Businesses:

We offer reasonable interest rates based on your business profile.

Before applying for a personal loan for self employed, check if you meet our basic eligibility requirements. We keep our criteria simple and transparent.

| Parameter | Requirement |

|---|---|

| Age | 21-58 years |

| Business Vintage | Minimum 1 year |

| Credit Score | 650+ |

| Business Type | Self-employed professional or business owner |

| KYC Status | Valid identity and address proof |

| Document Type | Details Required |

|---|---|

| Identity Proof |

|

| Signature Proof |

|

| Address Proof |

|

| Business Proof |

|

| Income Proof |

|

| Financial Documents |

|

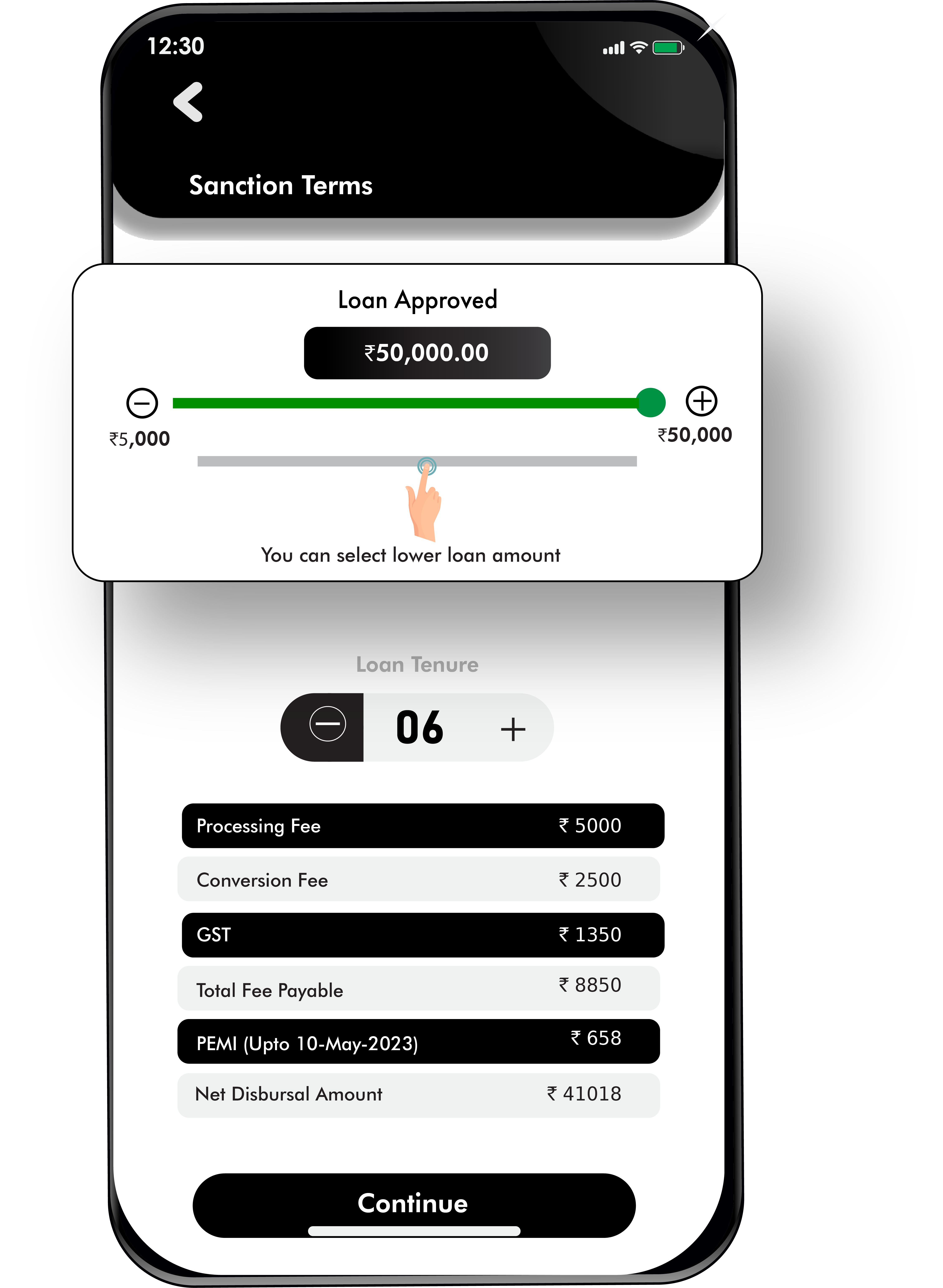

At lendingplate, we maintain complete transparency about our interest rates and other charges:

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Fill Basic Application Form Online:

Visit our website or download the app. Enter your personal details and basic business information in the simple application form.

Upload Required Documents Digitally:

Submit your KYC identity proof business documents and bank statements through our secure digital platform for quick verification.

Get Instant Loan Approval Status:

Our advanced system analyses your application immediately. You receive the approval status within 30 minutes of document submission.

Receive Funds in Your Account:

After approval, we transfer the loan amount directly to your registered bank account on the same day.

Your loan application success depends on several important factors. We have analysed a few parameters below. Understanding these helps improve your chances of approval.

Business Performance Assessment:

We evaluate your business stability through bank statements and financial records. It shows your income flow. Note that a steady income flow increases your approval chances.

Credit Score Impact on Approval:

Your credit score reflects your past repayment behaviour. We evaluate your credit score before accepting your loan application. A score above 650 improves your chances.

Income Stability Verification:

Regular business income shown in bank statements helps us assess your repayment capacity. We look for consistent cash flows. A stable income proof increases your likelihood of loan acceptance.

When you look for a personal loan for self employed, LendingPlate stands out with genuine advantages tailored for your needs. You get a smooth application process that respects your busy schedule and puts you in control. Our online personal loan for self employed option makes applying simple and quick, so you save time. Here are the reasons to choose us-

100% Online Personal Loan for Self Employed

Complete the entire application for a personal loan for self employed online. Stay at home, use your own device, and apply any hour you prefer. Skip any trips to a branch & get a process designed for your convenience.

Flexible Loan Amount Choices

Pick the loan sum that matches your business or personal needs. lendingPlate offers you a choice from lower amounts for quick expenses to larger sums for bigger goals. Everything fits your unique requirements. The flexibility supports your financial plans without stress.

Instant Loan for Self Employed in India – Available 24x7

Access the platform at any hour and secure an instant loan for self employed in India whenever the need arises. lendingPlate keeps the service running round the clock, so you never have to wait for traditional banking hours or delays.

Quick & Easy Documentation

Submitting documents is fast and straightforward. You upload what’s needed right from your phone or laptop. The process trims paperwork to a minimum, so you can get on with your work and not spend ages completing endless forms or physical files.

Get Your Funds in Minutes

When you qualify, you can see the loan amount in your account within minutes. There’s no prolonged waiting for approvals. This feature gives you immediate access and lets you handle expenses without disruption or anxiety about long processing.

Competitive Interest Rates

lendingPlate’s interest rates for loans for self employed are kept competitive to help you manage repayments. Rates remain clear and reasonable, supporting your ability to repay on time and plan finances confidently, whether your needs are small or large.

Flexible Repayment Options

You select the repayment period that suits your budget. You may opt for our loan for a shorter or longer plan. We let you maintain control over business or personal finances without any pressure.

Transparent Processing Fees

Processing charges are stated upfront. You do not encounter surprise deductions or hidden extras. Everything is clear from the start, so you always know exactly what you’re paying for your instant personal loan for self employed.

If you’re seeking loans for self employed with easy eligibility criteria, lendingPlate is built for you. Experience the convenience of an instant loan for self employed in India without compromising on trust or quality. Choose lendingPlate for a loan experience made for you.

Yes, self-employed professionals can get personal loans from lendingplate. We offer loans from ₹10000 to ₹250000 for business owners and professionals with a minimum of one year of business vintage. Our quick digital process makes loan approval simple. You need to provide basic KYC documents and financial statements. We approve loans for various business types (including manufacturers or retailers – even service providers and freelance professionals).

For a personal loan for self employed at lendingplate, you need a minimum annual income of ₹3 lakhs. We verify your income through bank statements and ITR documents. A higher income improves your eligibility for larger loan amounts. We look at your regular business cash flows and consider all income sources. Your business should show stable income patterns in bank statements for at least 6 months.

Interest rates start from 12% per annum based on your credit profile and business performance. Better credit scores and stable business income help you qualify for lower rates. We keep our interest calculation transparent. You receive a detailed breakup of interest charges before accepting the loan. Our relationship managers explain the complete cost structure (including processing fees and other charges).

We assess your loan eligibility based on your business's vintage credit score and monthly income. Your bank statements and ITR help us evaluate repayment capacity. We consider existing loan obligations. Our advanced assessment system looks at your business growth trends, profit margins and market reputation. We also factor in your business sector performance and future growth potential.

A credit score above 650 improves approval chances. However, we consider other factors like business performance and income stability. Strong business financials might help overcome a lower credit score. We look at recent credit behaviour improvements and your debt management history. Regular business income and good banking habits can support your application.

Yes, our personal loan for self employed options does not require any collateral. We offer loans based on your income documents and credit profile. No need to pledge business or personal assets. This makes the loan process faster and simpler. Your business stuff and personal items stay yours to use freely during your whole loan time.

You can apply for loans up to ₹ 250,000 based on your eligibility. The final amount depends on your income, business vintage and credit score. A higher income and better credit profile qualify for larger amounts. We increase loan limits for repeat customers with good repayment records. Your business growth and increased income can help you qualify for higher amounts in future.

Yes, you can use the loan amount for any legitimate purpose including business expansion inventory purchase or working capital needs. We do not restrict the end use of personal loans. Small business owners buy extra stock, get new tools, or open new shops with our loans. The money works for personal things, too – like school fees, doctor bills, or fixing your house.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.