Did You Know?

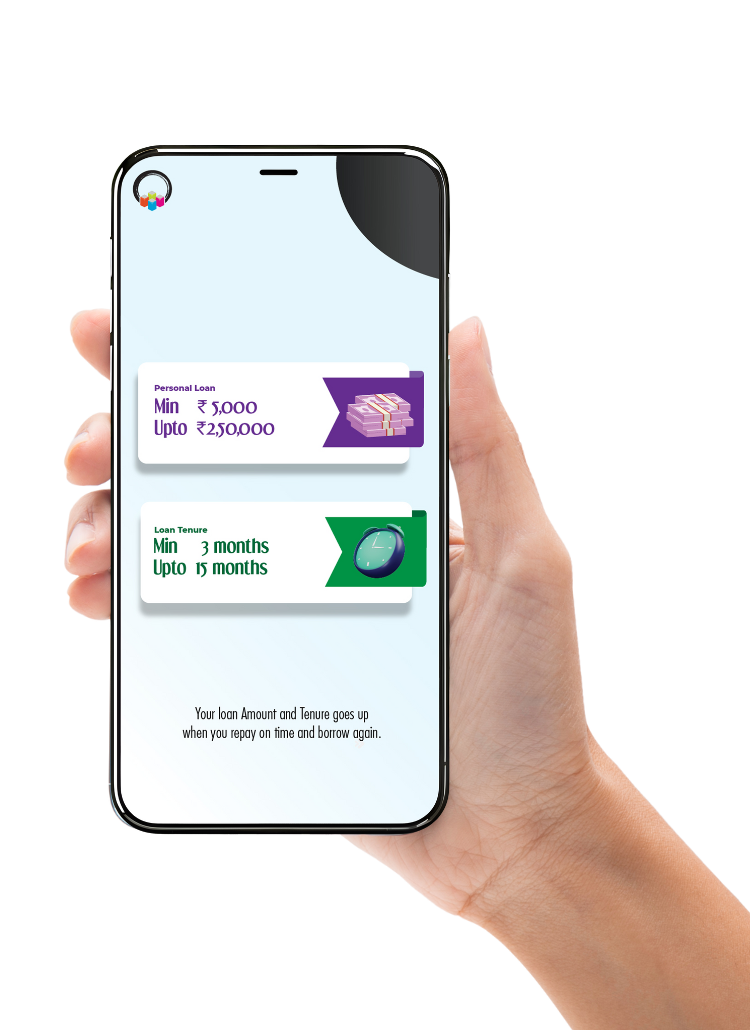

We serve loans, the best way you can borrow

Your financial dreams are closer than you think with our quick loan solutions.

No Collateral Needed

Minimal Documentation

Competitive Interest Rates

Quick Cash When You Need

Instant Digital Approval

Transparent Processing

Affordable Interest Rates

Flexible Repayment Options

We are your trusted financial partner for seamless lending experiences. Get in touch with us for 150k personal loan –

Understanding your loan costs helps make informed financial decisions. Here are the details about our personal loan interest rates alongside charges –

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Discover if you qualify for our seamless lending experience.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Enjoy affordable interest rates that make borrowing cost-effective and manageable. Lendingplate offers you the best opportunity to get a personal loan with good, bad, or no credit!

Check Eligibility Online

Upload Required Documents

Receive Instant Approval

Complete Fund Transfer

Equated Monthly Instalment (EMI) represents the fixed payment amount you'll make monthly for your 150000 personal loan. This calculation considers three critical components: principal amount, interest rate, and loan tenure.

The standard EMI calculation formula is: EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Where: P = Principal Amount (₹1,50,000) R = Monthly Interest Rate (Annual Rate ÷ 12) N = Total Number of Monthly Instalments

Example Scenario:

Monthly Interest Rate: 18% ÷ 12 = 1.5% Calculation: [150000 x 0.015 x (1+0.015)^24]/[(1+0.015)^24-1] Approximate Monthly EMI: ₹7,200 The EMI remains constant throughout the loan tenure, with initial instalments covering more interest and later instalments addressing more principal.

Getting a personal loan needs the right understanding of your financial landscape. Your financial journey demands smart decisions that keep up with your immediate needs.

assurance (if approved)

Online

Safe

Transparent

Gathering necessary documents streamlines your loan application process. Proper documentation ensures quick verification and faster approval for your 150000 personal loan.

Government-issued identification documents validate your personal information (Aadhaar card, passport, voter ID, or driving license) and serve as identity proof. Ensure documents are current, clear, and legible for smooth processing.

Salary slips, bank statements, and income tax returns demonstrate your financial stability. Provide consecutive three-month salary slips showing consistent income. Bank statements should reflect regular salary credits and healthy account maintenance.

Utility bills, rental agreements, or official address proofs confirm your residential details. Documents must display your current residential address matching other submitted paperwork. Recent utility bills like electricity or telephone bills work best.

Embarking on your loan application journey requires a systematic approach. Our streamlined process ensures hassle-free 150k personal loan applications. Let’s find out more about how to apply for the loan speedily –

It is quite easy to apply for a personal loan from lendingplate –

Attractive interest rates for borrowers.

Seamless online application process.

Dedicated assistance throughout your loan journey.

Speedy loan approvals within minutes.

Navigate through our user-friendly digital platform designed for seamless loan applications. Enter personal and financial details accurately. Upload necessary documents like identity and income proofs. Our advanced algorithm processes your application instantly, providing quick approvals and immediate fund transfers.

Our system allows multiple loan applications based on your creditworthiness. Each application undergoes individual assessment considering your current financial status, previous repayment history, and credit score. Responsible borrowing and timely repayments enhance your chances of subsequent approvals.

All charges are clearly communicated upfront during application. Processing fees, interest rates, and potential penalties are explicitly mentioned. No surprise costs or concealed expenses exist in our 150000 personal loan offerings.

Early loan prepayment demonstrates financial discipline. We offer minimal foreclosure charges as per our customer-friendly policy. Prepayment reduces the overall interest burden and improves your credit profile. Consult our representatives for specific prepayment terms and conditions.

Our digital infrastructure enables round-the-clock loan applications. Technological sophistication allows instant processing, verification, and approval. Regardless of time or location, you can submit loan requests and receive quick responses through our website.

You need minimum documents such as:

You need to upload the documents online. Our verification system ensures speedy processing without pesky paperwork.

Missing loan instalments incur late payment penalties and potential credit score impact. We recommend setting up automatic payment mechanisms. Consistent defaults might restrict future borrowing capabilities. Contact our customer support for personalised guidance during financial challenges.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.