Did You Know?

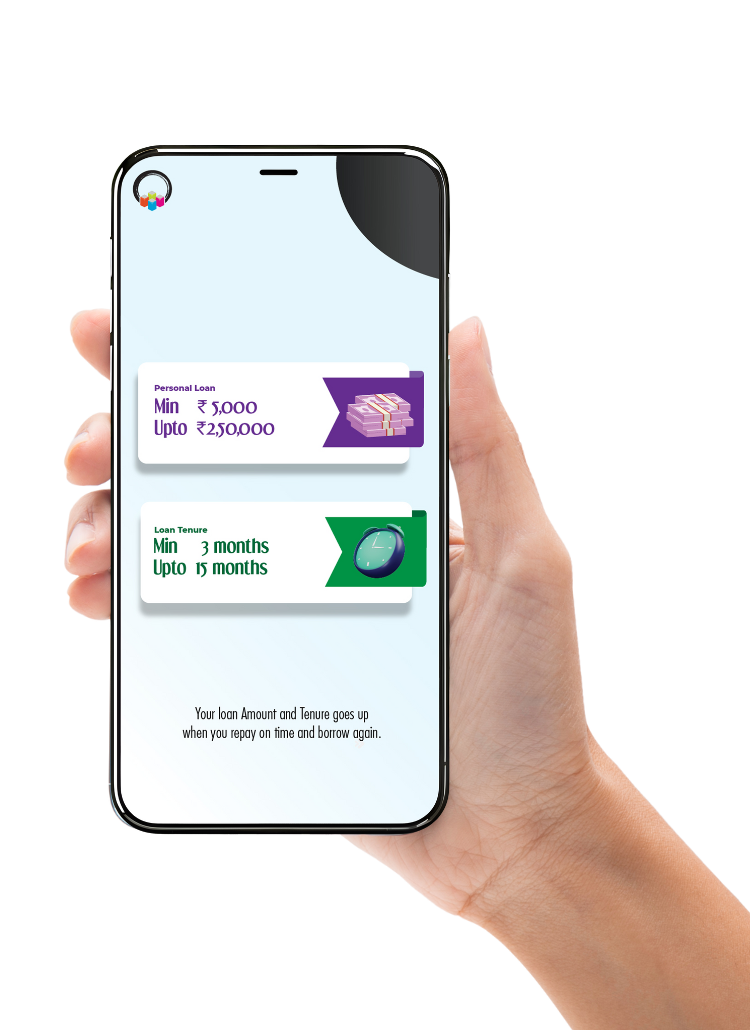

We serve loans, the best way you can borrow

A 30,000 personal loan gives you quick access to funds without lengthy paperwork or waiting periods.

Fast Approvals Every Time

No Collateral Security Needed

Minimal Documentation Required

Flexible Repayment Options

Quick Cash Disbursement

Simple Online Application

24/7 Customer Support

Improve Your Credit Score

We make borrowing simple with our quick application process that puts money in your account fast.

We offer competitive interest rates and a transparent fee structure for our personal loans. You know what you pay before you apply for your instant personal loan 20000.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Getting a loan with a lendingplate is simple if you meet these basic requirements to qualify.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Your financial past should not block your future needs for quick funds today.

Check Your Eligibility

Submit Your Application

Quick Approval Process

Get Money Fast

The EMI for your 30000 personal loan depends on two main factors: interest rate and loan tenure. You can calculate it using a simple formula: EMI = P × r × (1 + r)^n ÷ [(1 + r)^n - 1], where P is the principal amount, r is the monthly interest rate, and n is the loan tenure in months.

For example, if you take a 30000 personal loan at 18% annual interest for 12 months, your monthly EMI would be around ₹2,765. For the same loan amount at 24% for 6 months, the EMI increases to about ₹5,387.

Interest rates at lendingplate range from 12% to 36% based on your profile and credit score. A higher credit score typically gets you lower rates and better terms.

You can use our EMI calculator on the website to find the exact amount you need to pay each month. Simply input your loan amount, interest rate, and tenure to see your monthly payments.

Getting an instant loan 30000 from lendingplate means choosing speed and convenience. You apply today and get money today without long waits or branch visits. Our digital process makes borrowing quick and easy, even for first-time borrowers. We trust our customers and offer fair interest rates based on your profile.

assurance (if approved)

Online

Safe

Transparent

Applying for a 30000 loan immediately requires minimal paperwork because we value your time and understand the urgency.

Your Aadhar card serves as the primary identity document for loan applications. We also accept valid passports, driving licenses, or voter ID cards as alternatives. These documents confirm your identity and address details for verification.

Salaried individuals need to submit the last three months' salary slips and six months' bank statements. Self-employed applicants should provide income tax returns for the previous year and business proof documents.

Recent utility bills like electricity or water bills can verify your current address. Rental agreements, passports, or bank statements also work as proof of residence to complete your loan application.

Getting money from lendingplate takes just minutes with our simple digital application process.

We stand apart from traditional lenders with our quick, paperless process and customer-first approach.

Loans are approved within minutes.

Just basic papers are needed.

Affordable rates for everyone.

Help is available at any time.

No branch visits are needed.

Complete transparency in fees.

You can get a 30000 personal loan online by visiting lendingplate website or downloading our app. Fill out the application form with your basic details, upload the required documents, and verify your income. Once approved, money gets transferred to your bank account within 30 minutes through IMPS.

Yes, you can apply for multiple loans in a year after repaying your first loan completely. Your repayment history affects future approvals. Make timely payments to build trust. We review each application based on your current credit score and repayment capacity, regardless of previous loans.

No, lendingplate maintains full transparency with all charges disclosed upfront before loan disbursal. You will see processing fees (1-5%), interest rates (12-36%), and potential penalties for late payments. Our loan agreement clearly mentions all applicable fees without any surprise costs later on.

Early prepayment incurs a foreclosure charge of 5% on the outstanding amount. However, this fee is waived if you prepay on or after your first due date. You save on future interest payments by closing early. Contact customer support before making a full payment to know the exact settlement amount.

Yes, our digital platform operates round the clock for applications. You can apply anytime through our website or mobile app. While application submission works 24/7, loan approval and disbursement happen during banking hours. Emergency funds typically reach your account within 30 minutes during these hours.

For urgent loan approval, you need identity proof (Aadhar/PAN), address proof (utility bill/rental agreement), and income documents (salary slips/bank statements). Salaried individuals should provide three months' salary slips and six months' bank statements. Self-employed applicants need income tax returns and business proof documents for quick verification.

Missing a payment results in a late payment fee and affects your credit score negatively. We charge a mandate return fee of ₹500 (inclusive of GST) for failed auto-debits. Multiple missed payments may lead to higher penalties and collection calls. Contact customer support immediately if you anticipate payment difficulties to discuss alternate arrangements.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.