Did You Know?

We serve loans, the best way you can borrow

Quick Approval Process

No Collateral Required

Easy Online Application

Zero Hidden Charges

Flexible Repayment Terms

Low Credit Score Accepted

Minimal Documentation Needed

Same Day Disbursals

We create a borrowing experience that puts your needs first with our focus on speed, convenience and fair processing fees for personal loans.

We offer competitive interest rates and a transparent fee structure for our personal loans. You know what you pay before you apply for your instant personal loan 20000.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

You can apply for our personal loans with basic requirements that most working adults already meet.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Everyone needs money sometimes – but not everyone has a perfect credit history. At lendingplate we understand your situation and offer loans even if your credit score is not perfect. We believe in providing financial support when you need it most.

Simple online application

Minimal credit checks

Fast approval process

Flexible repayment options

EMI stands for Equated Monthly Instalment – which you pay every month until your loan is fully repaid. Your EMI amount depends on three main factors: loan amount, interest rate and loan tenure.

EMI = [P × R × (1+R)^N]/[(1+R)^N-1]

In this formula, P stands for your principal amount (₹20,000), R represents your monthly interest rate (annual rate divided by 12 months and then by 100), and N equals your total loan tenure in months.

For example, if you take an instant personal loan 20000 at 18% annual interest for 6 months, your monthly EMI would be approximately ₹3,513. For the same loan amount at the same interest rate but for 12 months, your EMI reduces to ₹1,834.

You can use our EMI calculator on the website to find the perfect balance between EMI amount and tenure according to your financial situation.

Taking a loan is a big financial decision that needs careful thinking. When unexpected expenses come up, getting a quick instant personal loan 20000 can help you manage without stress. Our fast approval process means you get money when you need it most. We understand your time is valuable so we keep our process simple and transparent throughout.

assurance (if approved)

Online

Safe

Transparent

Getting an instant loan of 20000 has never been easier. We have simplified our documentation process to save you time and effort. Here are the essential documents you need to submit with your loan application.

Your Aadhaar card, PAN card, passport, voter ID or driving license works as valid identity proof for loan verification.

Latest salary slips, bank statements showing salary credits or income tax returns help us verify your repayment capacity.

Recent utility bills, rental agreements, passports or Aadhaar cards can be submitted as proof of your current residential address.

Our loan application process is designed to be quick and hassle-free. You can complete the entire process online without stepping out of your home. Follow these simple steps to 20000 loan apply now.

We pride ourselves on offering exceptional loan services that meet your urgent financial needs.

Money in minutes

Basic documents needed

Always ready help

No hidden charges

Customise your EMI

Easy application steps

Getting an instant loan of 20000 online is easy with lendingplate. Visit our website or download our mobile app. Fill in your personal details along with employment information. Upload the required documents like ID proof, address proof and income proof. Our system processes your application within minutes. Once approved, the money is transferred directly to your bank account on the same day.

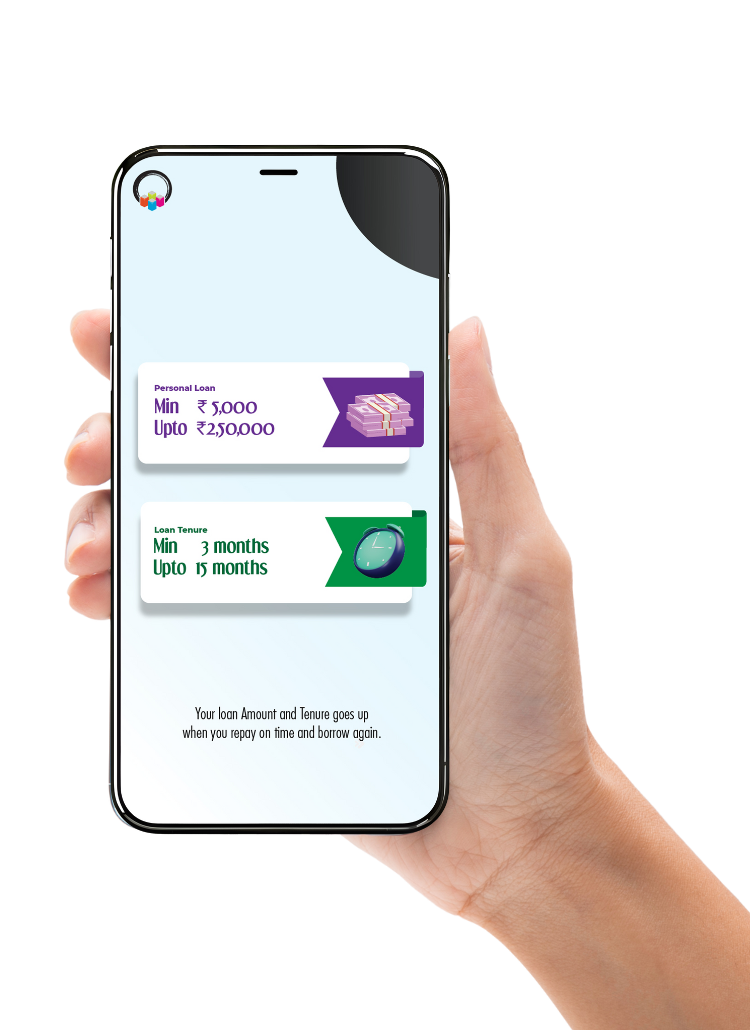

Yes, you can apply for a ₹20,000 personal loan multiple times in a year with lendingplate. After repaying your existing loan, you become eligible to apply for another loan. Regular repayments build your credit history with us. This makes future loan approvals faster. Your loan limit might increase based on your repayment behaviour. We review each application independently based on your current financial situation.

No, there are no hidden charges for our ₹20,000 personal loans. We believe in complete transparency. All applicable fees are clearly mentioned in the loan agreement. These include processing fees, interest charges and foreclosure charges (if any). You get a detailed breakup of costs before signing the loan agreement. Our customer support team can explain any charges you have questions about.

If you prepay your ₹20,000 personal loan early, a foreclosure charge of 5% on the outstanding amount applies. However, this charge is waived if you prepay on or after your first due date. Prepayment helps reduce your overall interest cost. You can prepay through our website or mobile app. We process your prepayment request within 24 hours. Your loan account closes automatically after successful prepayment.

Yes, our ₹20,000 emergency loans are available 24/7 through our online platform. You can apply anytime using our website or mobile app. Our automated verification system works around the clock. While application processing is available 24/7, disbursements follow banking hours. Weekend applications get processed immediately – but disbursal happens on the next working day. Our customer support is available during business hours for any assistance.

For urgent ₹20,000 loan approval, you need identity proof like your Aadhaar or PAN card. Address proof, such as utility bills or rental agreements, is required. Income proof (including recent salary slips or bank statements showing salary credits) must be provided. A passport-sized photograph for identity verification is needed. All documents can be uploaded digitally through our website or mobile app.

If you miss a payment, a late payment fee applies to your account. This affects your credit score with credit bureaus. Multiple missed payments could lead to collection calls and emails. We understand financial difficulties happen, so contact us immediately if you face payment issues. Our team can help restructure your payment schedule. Early communication helps avoid negative impacts on your credit history.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.