Did You Know?

We serve loans, the best way you can borrow

Finding money for education expenses can feel overwhelming. At lendingplate we make getting an instant loan for students simple. You can receive funds directly in your account within 30 minutes of approval. We offer loans for students ranging from ₹10000 to ₹250000 with flexible repayment options.

Our personal loans for students help you manage various education expenses without delays. We understand students need quick access to funds for tuition fees, books and other academic requirements.

With minimal documentation and fast processing, lendingplate provides instant personal loan for students through our mobile app or website. Get quick financial support for your education needs today.

Money challenges should not interrupt your studies. Our instant loan for students supports various education needs that require immediate funding.

Tuition Payment:

Your college fees are due but your education fund is running short. We process loan applications quickly so you can pay your tuition fees and focus on studies without stress.

Emergency Expenses:

Unexpected costs like laptop repairs or study materials can arise anytime. Our instant approval process ensures you get funds when you need them most.

Living Expenses:

Managing accommodation, food and daily expenses while studying can strain your budget. Our loans help you cover basic living costs so you can concentrate on academics.

Study Materials:

Quality textbooks, reference materials and learning equipment are essential for success. We fund your educational resource needs so you can access the best study materials.

Project Requirements:

Academic projects often need special equipment or resources. Our loans support your project expenses – ensuring you can complete assignments without financial worries.

Getting financial support should be simple. Our streamlined process makes applying for personal loans for students quick and straightforward.

Basic Details

Fill out our simple application form on the mobile app or website. Enter your personal information and submit basic details about your education programme.

Document Upload

Share your identity proof education certificates and income documents through our secure platform. Our system verifies your information instantly.

Quick Verification

Our advanced system analyses your application and documents immediately. We process eligible applications within minutes for faster loan disbursement.

Instant Approval

Receive loan approval and get money in your account within 30 minutes. Start using the funds for your education needs right away.

We keep our requirements simple to help more students access financial support.

Getting your loan approved starts with proper documentation.

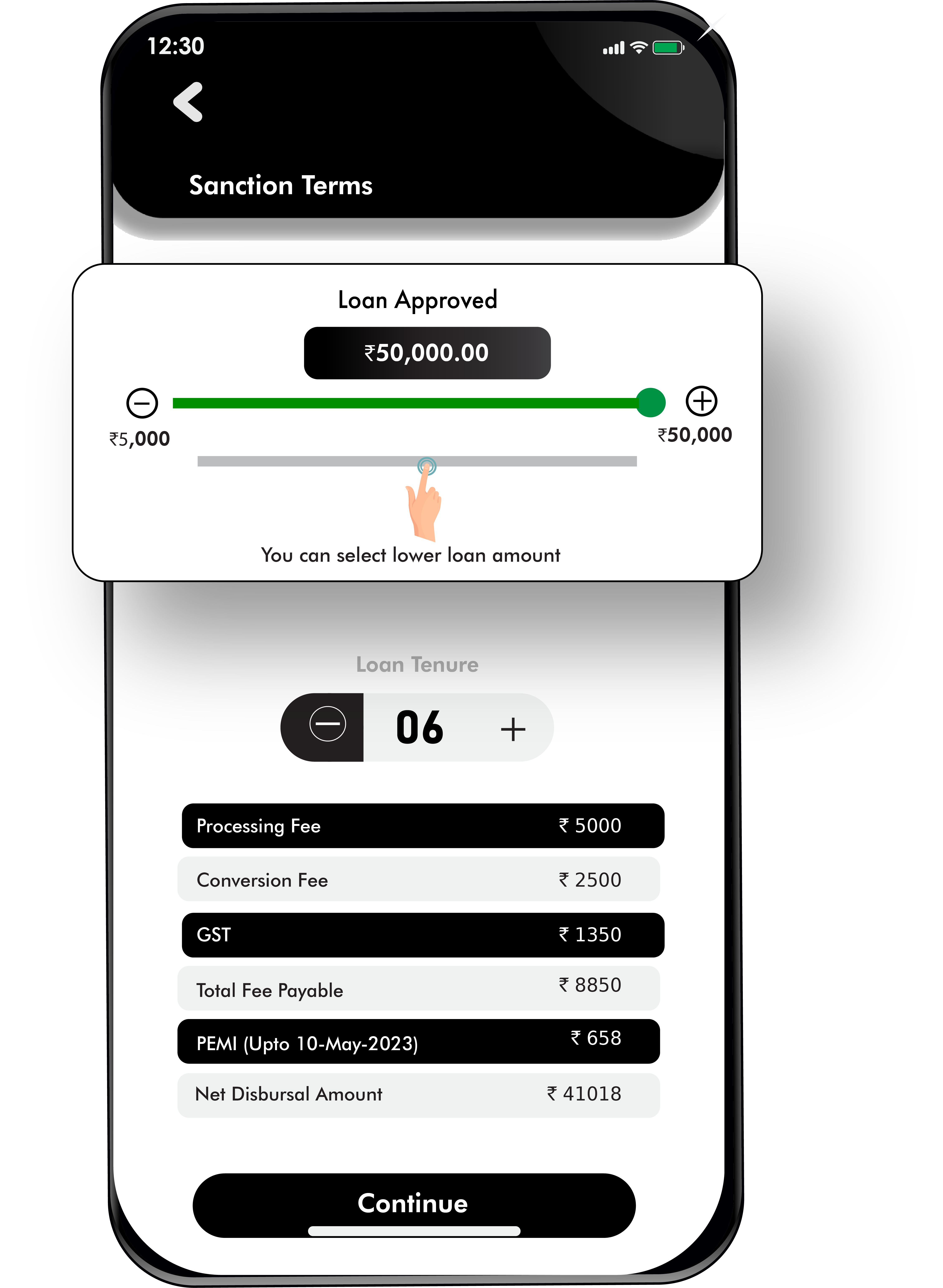

At lendingplate, we maintain complete transparency about our interest rates and other charges:

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Submit your application and receive money in your account within 30 minutes. No lengthy waiting periods or complex procedures.

Choose repayment terms that suit your budget. Select EMI duration between 3 to 36 months based on your convenience.

Apply with basic documents like student ID and address proof. Our simplified process needs fewer papers than traditional loans.

Complete your entire loan application online through our website or mobile app. No branch visits or physical paperwork is needed.

Taking an education loan needs proper planning. Review these key points to make the right borrowing choice. Consider these important factors before applying.

Repayment Capacity Assessment:

Calculate your monthly expenses and ensure EMIs fit your budget. Consider your current and future income sources before committing. Create a monthly budget showing how you'll manage loan payments with other expenses.

Interest Rate Impact:

Understand how interest rates affect your total repayment amount. Compare different loan options and choose what works best for you. Ask about special student interest rates that might be lower than regular personal loan rates.

Loan Term Selection:

Pick a loan tenure that balances affordable EMIs with total interest cost. Shorter terms mean higher EMIs but lower total interest. Think about your job prospects and starting salary when deciding EMI amounts.

Documentation Preparation:

Keep all required documents ready before applying. Proper documentation helps avoid delays in loan processing. Update your bank statements and make sure your account is active.

Co-applicant Requirements:

Ask working family members who can be your co-applicants with steady income proof. Check if your co-applicants age and income meet the minimum requirements. Make sure your co-applicant understands their responsibilities in case you miss payments.

Alternatives to Instant Loans for Students:

Money management during studies takes careful planning. Consider these options alongside instant loans for students for complete financial planning.

Educational Scholarships Available:

Research and apply for scholarships from government institutions and private organisations. Many offer merit-based and need-based funding.

Government Grant Programs:

Explore various government schemes supporting student education. These often provide financial aid without repayment obligations.

Part-time Work Options:

Consider combining studies with part-time work opportunities. This can help reduce loan dependency while gaining experience.

Education Savings Schemes:

Look into dedicated education savings programmes. These can provide tax benefits while building your education fund.

Our student loan interest rates start at 14% yearly and change based on several factors. Your college reputation course type and family income affect the final rate. Co-applicant credit score and employment status might help you get better rates. We offer special interest rates for students in premier institutions. The exact rate appears on your loan offer after the initial assessment.

Our instant loans serve Indian students studying at recognised institutions within India only. NRI students need a local co-applicant with proper income proof to apply. We accept applications from Indian students in government-approved distance learning programs too. Students planning overseas education should check with specialised education loan providers. Visit our website's eligibility checker to know if you qualify.

Most student applications get approved within 15 minutes if all documents are correct. Our smart verification system checks your details against multiple databases instantly. You receive updates about your application status through SMS and email. The money reaches your account 30 minutes after you accept our loan offer. Keep your bank account active and KYC updated for quick fund transfer.

Missing EMI payments affects your credit score – making future borrowing difficult. Late payment charges add extra costs to your monthly repayment amount. A poor repayment record might create problems during job background checks. Budget carefully and keep some savings for emergency expenses while studying. Start repayment planning before taking the loan to avoid future stress.

Contact our support team before your EMI due date if you expect payment issues. We might offer temporary payment plans based on your situation. Extra charges apply on payments delayed beyond five days from the due date. Multiple missed payments lead to negative credit bureau reporting. Send a written explanation with supporting documents to request payment restructuring.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.