Did You Know?

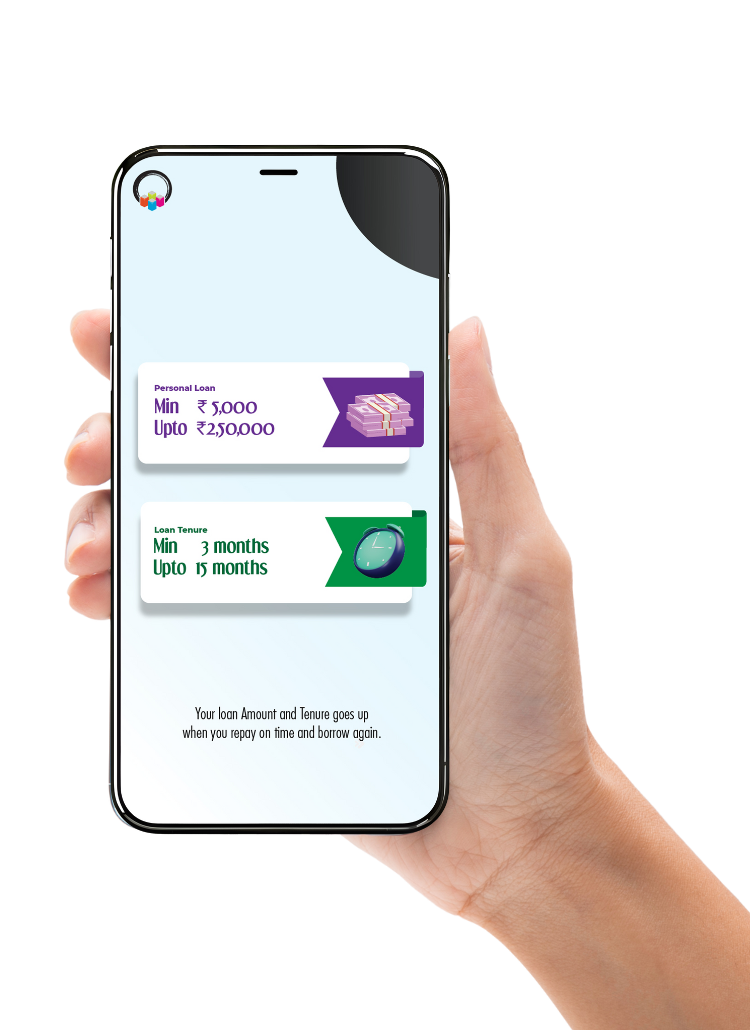

We serve loans, the best way you can borrow

If you need immediate funds, a 2 lakh personal loan or an amount as specific as ₹2,00,000 offers a solution you can count on. You can use it for many situations. Manage expenses or grab a unique opportunity.

Quick Access To Funds- You get funds quickly. You do not have to wait for weeks. Application processes take minimal time. Documentation is kept light. So, your urgent needs stay covered.

Flexible Usage- You can use your 2 lakh personal loan the way you need. Travel, home fixes, or emergency care. There are no restrictions. The money is in your control.

Improve Your Credit Score- Paying on time will definitely improve your credit score. Your financial profile looks stronger when you borrow & pay back on time.

Minimal Paperwork- With basic documentation, you skip long procedures. This keeps things stress-free if you are in a hurry.

We understand your financial journey requires reliable and swift support. Our platform ensures smooth and transparent lending experiences.

Financial challenges can strike unexpectedly. Our 2 lakh instant loan provides the perfect solution to manage your urgent monetary requirements.

Hassle-Free Funding Process

Flexible Repayment Options

No Collateral Required

Instant Online Application

Competitive Interest Rates

Wide Range of Usage

Minimal Documentation

Excellent Customer Support

Understanding the financial commitment is crucial. We believe in complete transparency for our customers.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

We make borrowing accessible while maintaining responsible lending practices.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Financial opportunities exist for everyone regardless of credit background. Complete your loan application from home using our user-friendly mobile app or website. Check out more from here –

Check Eligibility Online

Upload Required Documents

Receive Instant Approval

Complete Fund Transfer

EMI calculation involves standard financial formulas considering principal amount, interest rate and loan tenure. A 2 lakh personal loan EMI depends on multiple factors, including – repayment period and interest rate).

The standard EMI formula provides a systematic approach to determining your monthly repayment amount. Let’s break this down into a formula –

EMI Formula: [P x R x (1+R)^N] / [(1+R)^N - 1]

Where –

P is Principal Amount (₹2,00,000)

R is Monthly Interest Rate (Annual Rate ÷ 12)

N is the Total Number of Months

Let’s say the annual interest rate for the loan amount of ₹2,00,000 is 18%. Your monthly interest rate is 1.5%, and your loan tenure is 12 months.

So, here is the calculation:

Calculate Monthly Interest Rate –

Annual Rate: 18%

Monthly Rate: 18% ÷ 12 = 1.5% (0.015 in decimal)

Determine Total Months –

Loan Tenure: 12 months

Apply the EMI Formula – [2,00,000 × 0.015 × (1+0.015)^12] / [(1+0.015)^12 - 1]

Your result is approximate₹18,500 (monthly EMI).

Financial choices impact your future. Making informed decisions requires careful consideration and understanding of personal loan options.

assurance (if approved)

Online

Safe

Transparent

Access funds without risking your valuable assets or property with our unsecured personal loan. Get money directly in your account without complicated paperwork or long waiting periods at lendingplate.

Submit basic documents and get instant verification without complex paperwork at lendingplate to enjoy these benefits –

Get loans approved quickly.

Lowest interest rates available.

Seamless online application process.

Getting a 2 lakh personal loan is practical. You can address many spending needs without waiting years to save up. You avoid draining your emergency reserves. Use the money for situations that need action right away.

Travel or Holiday- You may want to see new places with your family. Your 2 lakh personal loan can cover flights, hotels, and shopping. No need to put off those plans until later.

Wedding Costs- Indian weddings mean celebrations and expenses. Venue, food, outfits, photos. Cover them all without putting stress on your savings.

Study Support- High tuition and equipment? Your loan can help you pay for fees, books, or devices. It gives you a head start on your goals.

Home Refurbishment- Redecorate or repair. Paint your home or upgrade the kitchen. Finish medium-level jobs comfortably.

Medical Expenses- Hospital bills can arrive anytime. With fast funds, you get prompt treatment, medicines, and aftercare.

Debt Merging- If you juggle several loans or credit cards, you can roll them into one. Your 2 lakh instant loan can help manage repayments easily.

Women’s Initiatives- Starting a venture or learning a skill? A 2 lakh personal loan EMI plan empowers more financial goals for women.

Shopping for Big Items- Buy any big appliance or gadget. Spread the cost so it's easier each month.

Business Funding- Need equipment, advertise, or manage daily needs? Apply for a 2 lakh loan EMI calculator and keep your business or self-employed objectives on track.

Take a smart approach to managing your 2 lakhs personal loan EMI calculator. This helps you stay secure and stress-free.

Plan Your Monthly Budget- Work out your monthly income and fixed spending. Only borrow what fits your affordable range.

Check The Fine Print- Go over loan terms before you sign. Know about charges, tenures, and interest so there are no surprises.

Repay On Time- Never miss an EMI. Not only does this protect your credit score, it avoids penalties and extra charges.

Use Funds Wisely- Stick to spending on high-priority items- such as health, education, or necessary home upgrades.

Track Your Loan- Review your statements each month. Raise it at once if you notice any error.

Avoid Additional Borrowing- Do not take extra loans while you have a running loan. This keeps your debt load manageable.

Explore Prepayment Only If Feasible- Sometimes prepaying can save interest. You should check your lender's specific terms.

Update Your Information- Keep banks or lenders updated about address or contact changes.

Know The Interest Rate- Understand the 2 lakh personal loan interest rate. Compare & choose what feels right for your budget.

Understand The Application Process- Learn how to get 2 lakh personal loan quickly by knowing the exact documents needed. Apply with all details in hand for a smoother start.

Choose The Right Loan Tenure- Select a term that suits your repayment capacity. A shorter tenure cuts down interest outgo.

Securing a speedy personal loan is simple with lendingplate. Visit our website to complete the digital application by providing accurate personal and financial details. Upload the necessary documents and verify your income instantly. Once approved, funds transfer directly to your bank account within minutes.

Multiple loan applications are possible based on your repayment history. Each application undergoes individual assessment considering your current credit score and financial capacity. Timely repayments of previous loans enhance your chances of future approvals. We evaluate your financial credibility holistically.

Transparency defines our lending approach. All charges are clearly communicated upfront before loan disbursal. Our detailed loan agreement includes processing fees, interest rates, and potential penalties. No surprise costs will emerge later. You receive complete financial clarity from the beginning. Check out our rates to get a better understanding.

Early loan closure involves a small foreclosure charge calculated as a percentage of the outstanding amount. We offer flexibility by waiving prepayment penalties after your first due date. This approach encourages financial discipline while providing borrowers with cost-saving opportunities.

Our digital platform enables round-the-clock loan applications. Emergency fund transfers typically complete within 30 minutes, ensuring rapid financial support when you need it most.

Quick loan approval requires minimal documentation. Submit government-issued identity proof, address verification documents, and income statements. Salaried individuals need recent salary slips and bank statements. Self-employed applicants must provide income tax returns and business documentation for smooth verification.

Missing loan payments may trigger specific consequences. A mandatory return fee applies, and your credit score may be impacted. We recommend proactive communication if you anticipate payment challenges. Our customer support can help design alternative repayment strategies.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.