Did You Know?

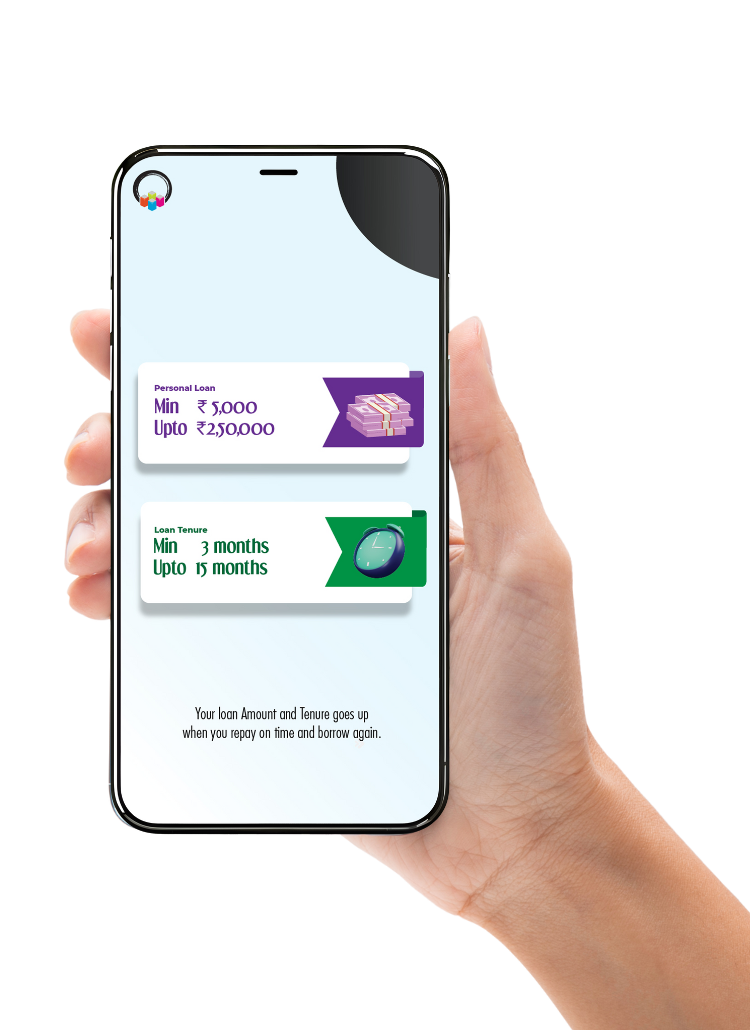

We serve loans, the best way you can borrow

Getting a 1 lakh personal loan often means you can quickly solve your money needs. The funds arrive straight in your bank within hours, so you get peace of mind. No waiting or paperwork headaches. You control the spending entirely (which is always helpful). With flexible repayment periods, your bank balance stays healthy. You keep your personal assets safe & no collateral is needed. Interest rates are clear, so you know your costs upfront. Approval is fast, and you only need basic info. In short, you get freedom to fund urgent and planned needs.

Upgrade Your Living Space- You can transform your home with a fast 1 lakh personal loan. Get fresh paint or start repairs and new décor. The money also covers new furniture instantly.

Tackle Medical Emergencies- If you need a 1 lakh rupees loan urgently, you can access funds for treatments, medicine or hospital bills. You avoid health delays and keep care moving.

Manage Wedding Costs- A 1 lakh instant loan can cover important wedding spends. Venue bookings, outfits, decorations – everything comes within the bill. You don’t put off big moments for lack of funds.

Handle Education Fees- Use your 1 lakh personal loan to pay tuition, buy books or pick courses. No need to halt studies because finance is short.

Fund Travel Or Holidays- Book tickets or settle trip costs easily. A small loan supports planned holidays, so you travel stress-free.

We transform your financial aspirations into immediate realities through our comprehensive loan solutions and customer-centric approach.

Our 1 lakh personal loan provides a great solution for your immediate monetary requirements and personal aspirations. We understand your unique financial journey.

Speedy Application Process

Fund Transfer within 30 Minutes

Digital Convenience Guaranteed

Excellent Repayment Solution

Minimal Documents Required

100% Transparent

Competitive Interest Rates

Zero Collateral Needed

Financial transparency remains our fundamental commitment to providing clear and simple borrowing experiences for customers.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Discover your loan potential through our transparent and inclusive 1 lakh instant loan qualification parameters.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Financial opportunities exist for every individual regardless of previous credit experiences and backgrounds. Find out more about our procedures –

Check Eligibility Online

Upload Required Documents

Receive Instant Approval

Complete Fund Transfer

Understanding EMI calculation might feel challenging. Let's break down this mathematical journey into simple, digestible pieces that anyone can comprehend.

EMI, or Equated Monthly Instalment, represents your fixed monthly payment combining principal and interest components. Imagine it as a carefully sliced financial pie divided equally across your loan tenure. The calculation involves three magical ingredients: loan amount, interest rate, and loan duration.

The classic EMI formula looks like this: EMI = [P × R × (1+R)^N] / [(1+R)^N-1]

P = Principal Amount (₹1,00,000)

R = Monthly Interest Rate

N = Total Number of Months

Let's walk through a practical scenario. For a ₹1,00,000 loan at 18% annual interest over 12 months:

This means you'll pay ₹9,200 consistently every month, gradually reducing your outstanding loan balance. The initial months include more interest, while later instalments contribute more towards principal repayment.

Enjoy affordable 1 lakh loan interest rates that match your financial capabilities and provide a transparent borrowing experience. Access our loan services anytime and anywhere using a smartphone or computer with complete ease and comfort. =Submit basic personal and professional documents through our user-friendly digital interface for hassle-free processing.

assurance (if approved)

Online

Safe

Transparent

Your journey to financial freedom starts with a few simple steps through our user-friendly digital platform. Get maximum convenience and enjoy a hassle-free loan application procedure by following these simple steps.

We focus on helping you meet your financial needs with exceptional customer support. Here’s why customers think we are second to none –

Get your 1 lakh personal loan approved and disbursed within 30 minutes.

Apply for loan from anywhere using smartphone or computer without visiting physical branches.

Experience complete clarity with no hidden charges or unexpected financial complications.

When you need options, these practical ideas help you use your loan well. Each purpose solves a real problem. Pick one that fits your needs.

Make Urgent Home Repairs- Fix plumbing, wiring, or paint with instant money. Keep your house safe without any delays.

Cover Medical Bills- Pay for treatments swiftly using your loan funds. Avoid health risks due to cash shortage.

Finance Education Moves- Get fees covered, buy study material, and secure extras for classes. You keep progress on track.

Buy Business Tools- Order new equipment or essential goods for business. Grow or streamline your work.

Plan a Wedding- Book venues, vendors, and essentials with your loan. All events go forward as planned.

Book Travel Instantly- Reserve flights, hotels, or transport. The money is disbursed & transacted to your account on time.

Taking a 1 lakh personal loan opens choices, but smart repayment helps you stay stress-free. Handling your loan well makes things easier. Here’s what you can do to keep overhead low and peace of mind high.

Set up a Simple Budget- Mark out your monthly earnings and loan dues. Track home bills, groceries, and extra spends. Categorise wisely to see where the cash goes. This habit keeps loan management smooth and cuts confusion every month.

Use the EMI Calculator before Signing- Check your likely payment using the 1 lakh personal loan EMI calculator. When you know your outflow, adjusting other spends becomes straightforward. Choose EMI dates that fit your business cycle or pay days for easy handling.

Always Pay on Time- Late payments cost you more (and impact your future loans). Set reminders & make timely payments. This will improve your credit score while keeping lenders happy.

Only Borrow the Amount You Require- Select the amount that suits your plans. Small loans solve issues quickly. Borrowing above your limits may hurt your budget later on. Staying realistic ensures you repay easily & avoid the debt trap.

Keep Extra Savings for EMIs- Always hold some emergency cash for months with high costs. Stability helps you pay EMIs even when work is slow. You avoid missed payments and keep money stress away.

Getting an online loan with lendingplate feels like magic, but it's actually a streamlined, secure process. Start by visiting our website or downloading our mobile app. Create your account with genuine personal details. Upload necessary documents like income proof and identity verification. Our advanced algorithm processes your application within minutes, checking your creditworthiness and income stability. Once approved, funds transfer directly into your bank account, often within the same day.

Loan reapplication depends on your financial history. Successful repayment of previous loans increases your chances of future approvals. We recommend maintaining a good credit history and ensuring timely repayments to enhance your borrowing potential.

Our potential charge is communicated upfront during the loan application process. Our detailed loan agreement outlines processing fees, interest rates, and potential foreclosure costs. We believe in building trust through clear communication. No surprises, no hidden fees. Every financial aspect is explained before you commit to the loan.

Early loan closure is welcome at lendingplate. We offer flexible prepayment with minimal foreclosure charges. If you prepay after the first due date, no additional penalties apply. This approach encourages financial discipline and rewards proactive borrowers. Our goal is to support your financial journey, not create unnecessary financial barriers.

Our digital platform ensures continuous loan accessibility. While actual approvals happen during business hours, you can submit applications anytime. Our system captures your details before initiating the verification process. Instant digital verification ensures speedy processing so that you receive funds when you need them most.

Essential documents include –

Our digital upload system makes document submission convenient, secure, and paperless, simplifying the entire loan application experience.

Missing a loan instalment attracts penalty charges and potentially impacts your credit score. We recommend setting up automatic payments or timely manual transfers.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.