Did You Know?

We serve loans, the best way you can borrow

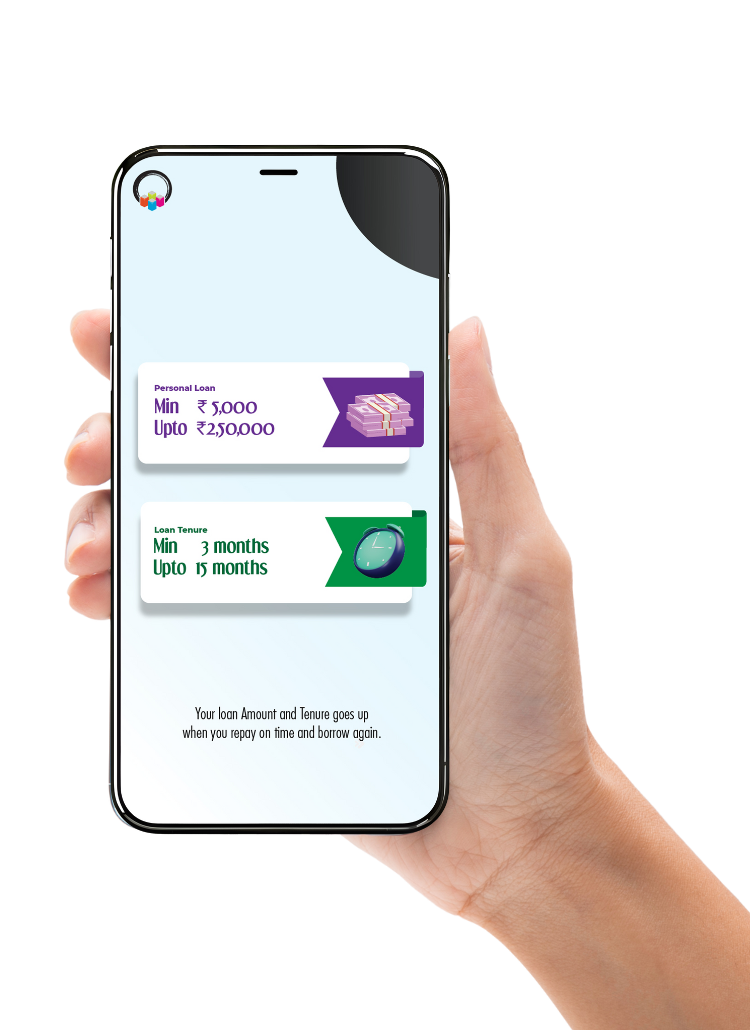

You need fast money without complicated processes, and 70000 personal loan options from lendingplate solve this problem.

Quick approval process

Need fewer papers

Zero property or assets as security

Various terms that fit your budget

Instant fund transfer within 30 minutes

100% Online Process

Low interest rates

Get covered with our fast processing system

We understand your urgent money needs and provide solutions tailored to your life situations.

We believe in complete transparency about our rates and want you to understand what you pay.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

We make loans accessible to working professionals who meet basic requirements without complicated processes.

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Everyone deserves financial help and we look beyond traditional credit scores for approvals.

Check Your Eligibility

Upload Your Documents

Get Quick Approval

Receive Money Fast

Your EMI depends on three main factors: loan amount, interest rate and loan tenure. For a 70K personal loan, EMI calculation follows a standard formula.

This gives you a fixed monthly payment amount.

For example, at 24% annual interest (2% monthly) for 12 months, your EMI would be around ₹6,540.

Your monthly payment decreases with longer tenures, but the total interest increases.

EMI drops to about ₹4,650 at 18 months. But you pay more interest overall.

Our online calculator helps you find the perfect balance between affordable EMIs and lower total costs.

Most borrowers choose 6-18 month tenures for a personal loan for 70000 based on their repayment capacity.

Getting a personal loan involves considering several factors beyond just the interest rate. You need proper planning for timely repayments without financial stress.

assurance (if approved)

Online

Safe

Transparent

Providing the right documents speeds up your loan approval process significantly. We keep the paperwork minimal while meeting regulatory requirements. Our digital verification systems check your information quickly without unnecessary delays.

You need a government-issued ID like Aadhaar, PAN card, voter ID, or driving license. These documents confirm your identity as required by financial regulations. Electronic verification happens instantly through our secure systems.

Your current residence proof includes utility bills, rent agreements, or bank statements. We need this to verify where you live for communication purposes. Recent documents dated within three months work best.

Recent salary slips, bank statements showing income credits, or tax returns prove your repayment capacity. These documents help us assess your ability to repay the loan comfortably. Six months of financial records give us good insight.

Our application process takes minutes instead of days with minimal documentation and quick verification steps. You make decisions fast without lengthy waiting periods.

We focus on solving your urgent money needs with simple solutions that respect your time.

Get decisions in minutes.

Pay fair charges only.

Apply from your phone.

You apply through lendingplate website by filling out a simple form. Share your basic information, including name, age, income, and employment details. Upload required KYC documents like ID proof, address proof and income statements. Our system verifies your details instantly using automated processes. Once approved, money transfers to your bank account within 30 minutes. The entire process happens digitally without visiting any branch.

Yes, you can apply multiple times after repaying your existing loan completely. We evaluate each new application based on your current financial situation and repayment history. Successful repayments improve your chances for future approvals. There's no specific cooling period between loans if you maintain good repayment records. However, applying too frequently might affect your credit score due to multiple inquiries. We recommend borrowing only when necessary.

No, we don't have hidden charges at lendingplate. All fees, including processing fees (1-5%), interest rates (12-36% annually), and other charges appear clearly in your loan agreement. You see the exact EMI amount before accepting the loan offer. Our mandate return fee costs ₹500 when applicable. Prepayment charges apply at 5% unless paid after the first due date. We believe in complete transparency about costs.

You can prepay your loan anytime with minimal charges. We charge 5% of the outstanding amount as a foreclosure fee. However, this fee doesn't apply if you prepay after your first EMI due date. Prepayment reduces your interest cost significantly. You need to inform us through the app or customer care before making the payment. The process takes 1-2 working days for complete closure. Your credit report updates within 30 days, showing zero balance.

Yes, our digital platform processes applications around the clock. You can apply anytime through a website or mobile app. Verification happens automatically for most applications through our digital systems. Fund transfers happen instantly during banking hours. During non-banking hours, funds disburse the next morning when banks open. Our customer support team helps during working hours with application questions. Weekend applications might experience slight delays.

You need these documents –

The documents must be clear and current for faster processing. Digital copies work fine through our app or website. We verify most documents electronically without physical submission. Sometimes, we might request additional documents based on your profile. Having these documents ready speeds up approval significantly.

Missing payments result in late payment fees and affect your credit score negatively. We charge penalties, as mentioned in your loan agreement, on overdue amounts. Our system sends reminders before and after due dates through SMS and email. After repeated missed payments, the legal recovery process might begin as per RBI guidelines. We recommend contacting customer support immediately if you face payment difficulties. Sometimes, we offer restructuring options for genuine financial hardships.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.