Did You Know?

We serve loans, the best way you can borrow

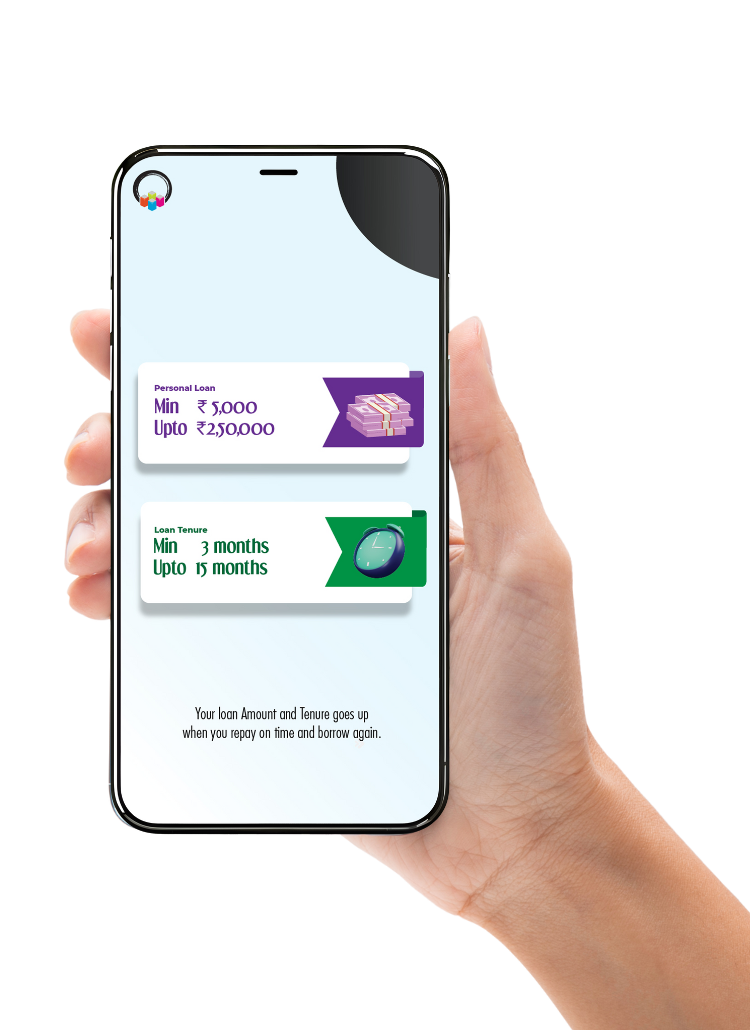

Your financial dreams need smart support. Our 250k personal loan brings possibilities closer than you imagine. We understand your unique financial requirements.

Fast Money Transfer

Excellent Customer Support

Digital Fast Procedure

Minimal Eligibility Criteria

No Collateral Required

Flexible Repayment Options

Zero Hidden Costs

Simple Documentation

We transform lending into a seamless experience tailored to modern financial needs.

Understanding your financial commitment helps you make informed decisions. We at lendingplate believe in complete transparency.

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

We make borrowing accessible with straightforward requirements most working adults can meet. You can apply if you are:

Your loan application needs to meet these basic criteria:

Age: 21-60 years

Monthly Income: Minimum ₹20,000

Stable employment history

Acceptable credit score

Residential stability

Keep these ready for a smooth application:

Identity Proof: PAN Card

Address Proof: Aadhaar Card

Latest salary slips

Bank statements

Photograph

Everyone deserves a financial opportunity. We look beyond traditional credit scores. Discover your loan potential without impacting your credit score. Share identity and income details quickly through our digital platform. Receive money in your account within 30 minutes of approval.

Check Eligibility Online

Upload Required Documents

Receive Instant Approval

Complete Fund Transfer

Your monthly payment depends on multiple financial factors, including principal amount, current interest rates, and selected repayment duration. Our online calculator offers insights into your precise repayment structure with remarkable accuracy.

Basic EMI Calculation Formula: EMI = Principal × Rate × (1+Rate)ⁿ ÷ [(1+Rate)ⁿ - 1]

Suppose you apply for a 250k personal loan for 12 months. Your monthly instalment is around ₹21,544.

The total interest accumulation progressively increases with longer repayment periods. We guarantee complete financial transparency before formal loan acceptance. This way, we ensure no unexpected surprises emerge during your borrowing journey.

lendingplate delivers exceptional lending experiences through transparent processes and reliability without hidden complications. Select your loan tenure and get the loan approved within minutes.

assurance (if approved)

Online

Safe

Transparent

We need minimum documents from your end to get your loan approved within minutes. You only have to submit the following details to get the loan from us –

Government-issued photographic identification documents are vital. We may require your Aadhar card, PAN card, voter card, or driving license.

Detailed financial records of earning potential will help validate your repayment capabilities. Lenders get critical insights into your economic stability.

Bank statements are required (preferably for 3 months). They reveal your income stability as well as spending patterns. We can also track your financial health for the loan evaluation with the statement.

Visit our digital platform, complete a straightforward application form, upload necessary documents provide basic personal financial information.

Minimal paperwork means faster loan processing for your convenience. Access funds without risking your valuable assets or property with us –

Visit our digital platform, complete a straightforward application form, upload necessary documents provide basic personal financial information. Our advanced algorithmic system processes your request swiftly, ensuring quick verification and comprehensive evaluation, providing instant loan approval decisions.

Customers can submit repeated loan applications after completing full repayment of previous loans. Your consistent repayment history significantly influences future loan approval prospects. We assess current income credit status comprehensive financial profile, determining subsequent loan eligibility transparently.

Absolute transparency defines our lending approach. No concealed fees exist in our loan agreements. All charges, processing fees, interest rates prepayment options appear clearly documented before formal loan acceptance. Our customer support team remains available to explain any financial queries comprehensively.

Borrowers enjoy flexible prepayment alternatives without substantial penalties. You may settle the outstanding loan amount at any time after the initial EMI payment. Early repayment potentially reduces total interest expenditure. Contact our customer care for precise settlement amount calculation guidance.

Personal loan applications are accepted continuously through digital platforms. Automated verification mechanisms operate during standard business hours. Digital infrastructure enables instant processing and comprehensive evaluation, ensuring rapid fund disbursement.

Essential documentation includes government-issued photo identification, recent salary slips comprehensive bank statements. Self-employed applicants must provide additional business income tax returns. Clear digital document uploads expedite the verification process substantially.

Late payment results in specified penalty charges and potential credit score impact. We proactively send multiple reminders through communication channels. Customers experiencing potential payment difficulties should contact the support team immediately to discuss alternative arrangements to prevent further financial complications.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.