Did You Know?

We serve loans, the best way you can borrow

We understand that freelance income varies from month to month. That's why our loans for freelancers work differently from standard personal loans. We look at your overall earning pattern rather than your monthly fixed income. Your project contracts and client payments serve as proof of regular income.

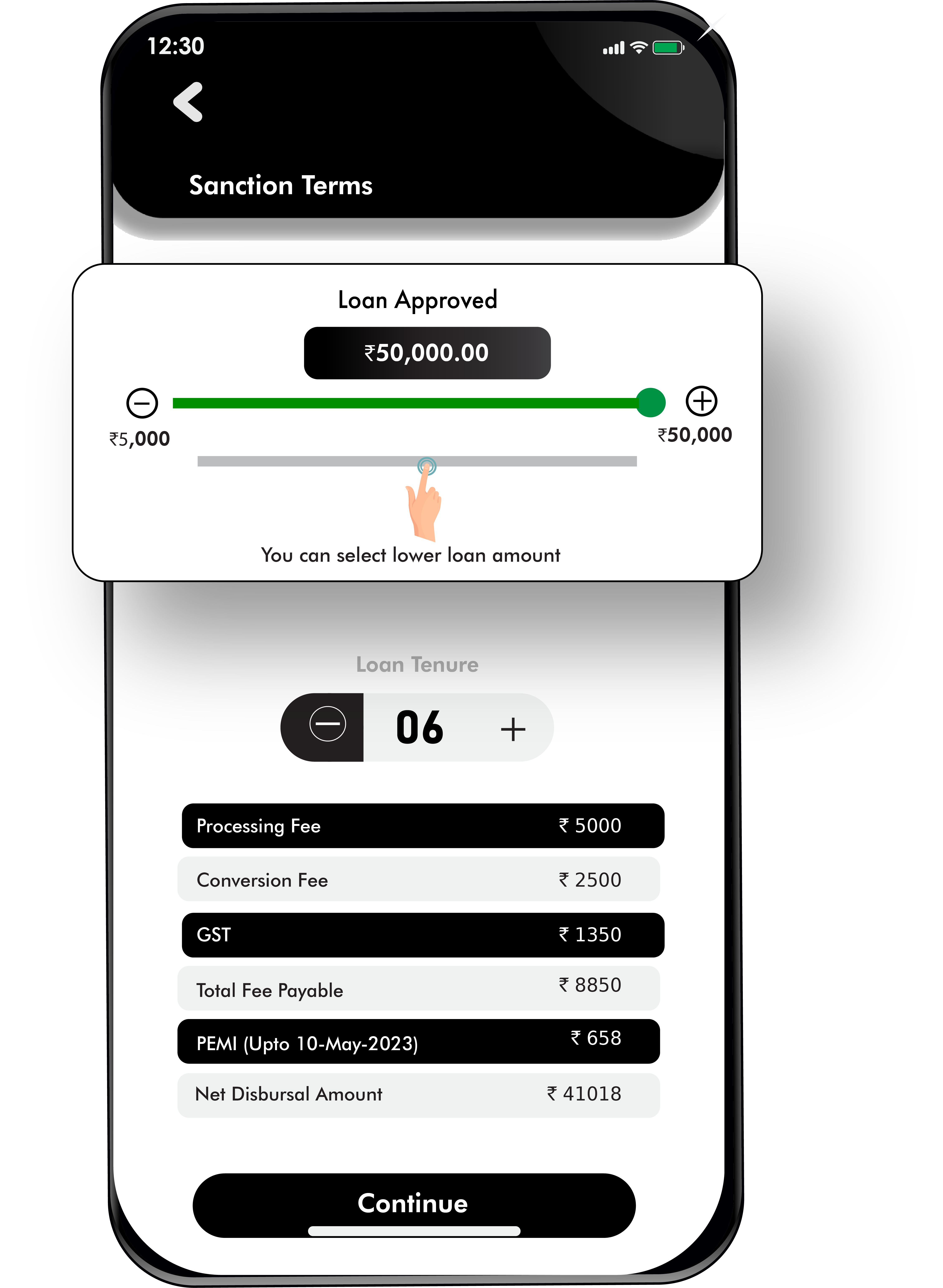

A personal loan for freelancers gives you quick access to funds without regular salary slips. You can receive money ranging from ₹5,000 to ₹2.5 lakhs directly in your account. Your income proof as a freelancer helps us evaluate your loan application within minutes.

With a freelancer personal loan, you can fund business expansion, manage cash flow gaps or invest in equipment. Our digital process makes borrowing simple. You need minimal documents and get instant approval decisions. We offer competitive interest rates starting at 12% per annum.

More freelancers now pick personal loans to support their growing businesses and manage seasonal income fluctuations. A loan for freelancers gives you complete control over fund usage. Loans from lendingplate help you stay financially prepared.

Quick Online Process

Your time matters as a freelancer. Our completely online application takes just minutes to complete from anywhere.

Flexible Documentation

We accept various income proofs like client contracts, bank statements and GST returns instead of salary slips.

No Collateral Required

Get funds without pledging any assets. Your freelance work history and income potential secure your loan.

Simple Repayment Options

Choose repayment terms between 3 to 15 months. Set up auto-pay to never miss a deadline.

Instant Disbursement

Get money in your account within 30 minutes of approval. Perfect for urgent business expenses.

Apply now for a personal loan for freelancers and receive funds in 30 minutes.

Submit your application digitally from anywhere. Get an instant decision on your loan request without visiting any branch.

We accept various documents proving your freelance income. Show us client payments, contracts or invoices instead of fixed salary slips.

Get rates starting at 12% per annum based on your profile. No hidden charges or prepayment penalties.

Pick a repayment schedule that matches your income pattern. Choose between a 3 and 15-month tenure with affordable EMIs.

Use the funds freely for any purpose. Invest in equipment, manage cash flow or expand your freelance business.

Regular EMI payments help improve your credit score. Better scores mean higher loan amounts and lower rates later.

Need quick funds? Get a personal loan in just three simple steps.

You need to understand the charges once you borrow the amount from us. Once you know the charges, it becomes easier to apply for the loan –

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

Managing repayment is simple with our flexible EMI options designed specifically for variable freelance incomes.

Flexible Tenure Options: Pick repayment terms between 3 to 15 months based on your income pattern and loan amount.

Multiple Payment Methods: Pay EMIs through auto-debit, UPI, net banking or our mobile app. Set reminders to never miss a payment.

Part Payment Benefits: Make extra payments when you have surplus funds. Reduce your interest burden without any penalties.

Auto Debit Facility: Set up automatic EMI payments from your bank account. Stay stress-free about monthly dues.

Payment Date Choice: Select your preferred EMI date that suits your client's payment schedules.

Take time to review these key points before applying for a personal loan. Your thorough preparation helps secure better loan terms.

Monthly Budget Check

Review three months of your income to spot earning patterns. Calculate fixed costs like rent and internet bills first. Match potential EMIs against your monthly cash inflow.

Clear Loan Terms

Read every part of your loan offer carefully. Ask questions about processing fees and foreclosure charges upfront. Know exactly how much you will pay each month. Different lenders have varying terms that affect your total loan cost.

Income Flow Analysis

Map out your confirmed projects for the next six months. Look at your client payment schedules and identify any seasonal patterns. Good income planning prevents payment stress. Keep track of which clients pay quickly and which take longer.

Emergency Savings Plan

Set aside funds equal to three loan payments before taking the loan. Keep this money separate from your business account. Protect yourself against delayed client payments. Your emergency fund acts as a safety net during income gaps.

Compare Loan Features

List out offers from different lenders side by side. Compare more than just interest rates - look at processing speed and flexibility. Consider which payment cycles match your income pattern. Pick a lender who understands freelance income variations.

Managing your finances takes smart planning. Many freelancers find different ways to get funds beyond personal loans. These options might work better for your specific needs.

Business Cards

Credit cards give you buying power for daily business costs. Track all expenses through monthly statements and earn rewards on purchases. Many cards offer interest-free periods on new purchases. Build business credit while managing short-term expenses through proper card usage.

Invoice-Based Lending

Turn your upcoming payments into instant cash. This option works great when clients take time to pay invoices. Keep your work moving without waiting for client payments. Invoice financing helps maintain a steady cash flow.

Flexible Credit Line

Access money whenever needed without fresh applications. Pay interest only on the amount you use, not the full credit limit. Return funds as they come in to reduce interest costs. Credit lines give you more control over business expenses.

Equipment Loans

Finance your essential work tools and tech through dedicated loans. Lower rates make expensive equipment purchases manageable. Split costs into easy monthly payments.

We evaluate your income through multiple documents showing regular earnings from freelance work. This includes bank statements showing client payments, GST returns, income tax returns and active contracts. Your project history and professional experience also factor into the assessment. Higher-value long-term contracts alongside regular client relationships strengthen your application.

Yes, you can apply without a traditional steady income. We consider your average monthly earnings from all freelance sources. Show us completed projects, ongoing contracts and projected income through proper documentation. A good credit score & an established freelancing history can improve approval chances. Multiple income streams from different clients make your application stronger.

Our personal loan for freelancers offers amounts up to ₹2.5 lakhs based on your income and credit profile. The minimum loan amount starts at ₹5,000. Your approved amount depends on factors like average monthly income, existing loans and credit score. We look at your bank statements to understand your income stability and business growth. Regular client payments and growing income trends help qualify for higher amounts.

Interest rates start from 12% per annum and vary based on your credit score and income profile. The final rate considers factors like freelancing experience and client quality. Better documentation and higher credit scores help secure lower rates. We offer transparent pricing with no hidden charges. The processing fee ranges from 1% to 5% of the loan amount.

You can choose repayment terms between 3 to 15 months based on your loan amount and repayment capacity. We structure EMIs according to your income pattern. Longer tenures mean lower EMIs but higher total interest costs. You can make part payments when you have surplus funds. Early repayment carries no penalties after your first EMI.

No, our personal loans are unsecured and need no collateral. Your income proof and credit history secure the loan. We trust your earning potential and professional track record. Strong client relationships and regular income flow strengthen your application.

Your credit score significantly influences loan approval and interest rates. Higher scores above 750 qualify for better rates. Regular credit card and EMI payments help maintain good scores. We report your loan EMI payments to credit bureaus monthly.

Yes, we consider all your verifiable income sources. Combine freelance earnings with rental income or fixed deposits. More income streams strengthen your application. Show us proper documentation for each income source. Multiple revenue channels indicate financial stability and better repayment capacity.

Yes, we offer special benefits for freelancers – including instant approval and minimal documentation. Get competitive rates starting at 12% annually. Access our mobile app for easy loan management. Set flexible EMI dates matching your income cycle.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.