Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

Managing debt can feel stressful. It is true especially when there are so many payments to consider. It becomes easy to lose your money if you do not have a clear plan. That's why choosing the right repayment tactic matters the most. The debt avalanche method is one such approach that you can consider.

You will learn how it works, when to use it & how it compares to other methods in this guide. So you can make a decision accordingly.

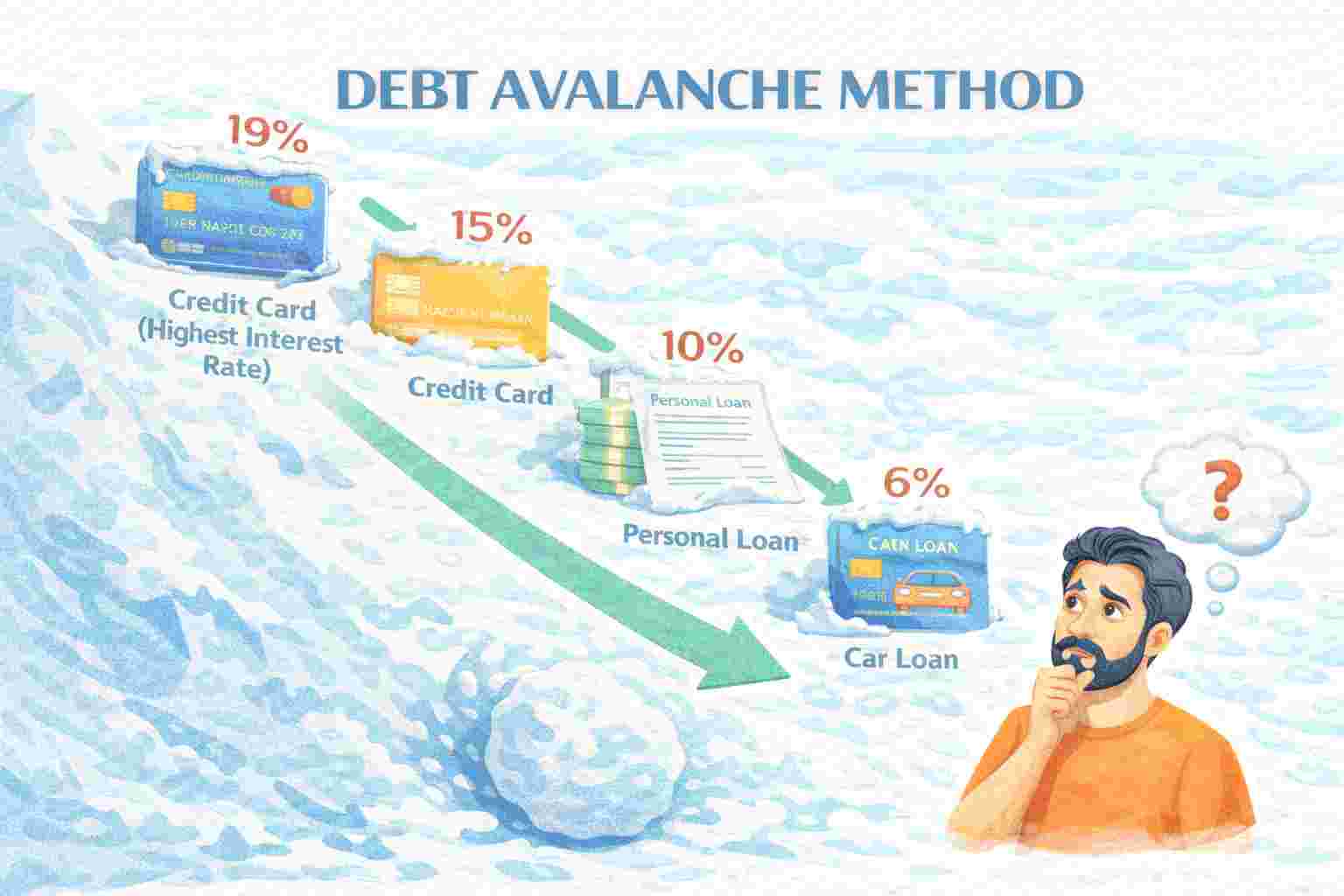

The debt avalanche method helps you repay debt by focusing on loans with the highest interest rates at first. You list all your debts. Then, check their interest rates to pay the most expensive one while still making minimum payments on the rest.

Using the debt avalanche calculator helps you save more money over time. It works for things like credit cards, personal loans, education loans, etc. The goal is to reduce total interest paid & become debt-free faster. This method can help if you are looking for a smart repayment plan.

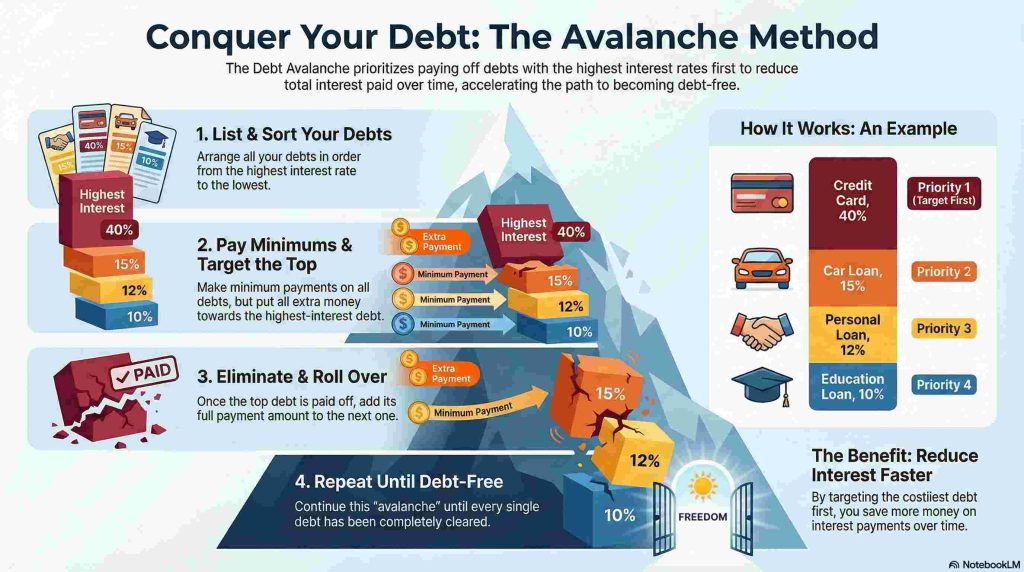

Start by listing all your debts along with their interest rates to use the debt avalanche method. Then, sort them from highest to lowest interest. Each month, make minimum payments on all your debts. Use any extra money to pay off the one with the highest interest first.

If you owe on a credit card (40%), a car loan (15%), a personal loan (12%), & an education loan (10%), you'll focus on the credit card first. Suppose your budget allows for ₹40,000 a month. After covering the minimum payments on the other loans, put the rest towards the credit card.

Once that's paid off, roll over that full amount to the next debt in line. This avalanche debt reduction method helps reduce interest faster and speeds up repayment without needing more money each month. You repeat this until all debts are cleared, always targeting the costliest one first.

1. Extremely Inexpensive - You reduce how much you pay in interest over time by considering the highest debt first. It helps you save more money compared to other methods that do not consider interest rates while prioritising repayment.

2. Logically Sound - The debt avalanche method follows a logical approach. Note that it targets the most expensive debt. So, it results in the lowest overall loan repayment amount. It's best if you are focused on long-term savings.

3. Efficient Choice - This method clears debt faster with consistent payments and no change to your budget. Once one loan is done, that full amount rolls over to the next. It improves progress without additional effort or new spending limits.

1. Consistency is Needed - This method works best if you wish to stay on track without missing any payments. Skipping months or losing momentum can slow your progress.

2. Progress Feels Slow at First - You're targeting high-interest debts (not small ones). So, you may not clear your first loan right away. That can feel discouraging if you expect early results.

3. Doesn't Suit Every Situation - It is not for someone whose income changes or emergencies come up every now and then. It's not always easy to adjust (especially when your highest debt also has a big balance & a long timeline). Flexibility is limited.

Know the Difference between Debt Consolidation and Debt Settlement

Here are the steps to consider:

1. List all Your Debts - Write down the loan or outstanding balance you have. Do not miss out the interest rate & amount owed for each one. Be accurate since it sets the foundation for everything else.

2. Rank them by Interest Rate - Reorder your list from highest to lowest based on interest rates. Don't focus on balances, only the rate. This list helps you decide where to direct extra money.

3. Set a Fixed Monthly Budget - Decide how much you can commit each month to debt payments. It should cover all minimum payments and leave room to target your top-priority debt.

4. Pay Minimums on all But One - Continue paying the minimum on every loan except the one with the highest interest. The rest of your budget goes toward that top-priority debt.

Redirect the payment amount to the next on the list once the top-interest debt is paid off. Keep this cycle going until all your debts are cleared.

Do you want to pay less interest overall & don't mind waiting a bit to see progress? The debt avalanche method could work excellently. If you're consistent, this method can help you clear debt more efficiently.

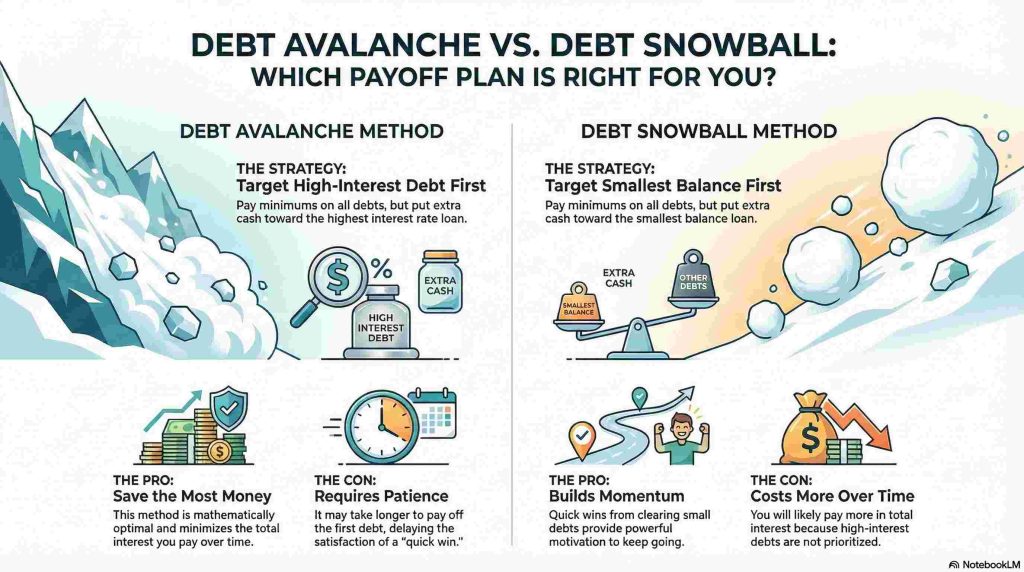

Here are the differences between debt avalanche vs snowball:

| Parameter | Debt Avalanche Method | Debt Snowball Method |

|---|---|---|

| Approach | Focuses on paying off the highest interest rate debts first. | Focuses on paying off the smallest balance debts first. |

| Motivation | Suit those motivated by long-term savings and reduced interest rates. | Works well for people needing quick wins to stay motivated. |

| Financial Efficiency | More efficient financially, saves more money over time. | Less efficient, may cost more in interest, but feels more rewarding. |

Let's understand how the debt avalanche method works with a simple real-life example.

Personal Loan of ₹1,50,000 at 18% interest

Home Renovation Loan of ₹2,50,000 at 13% interest

Education Loan of ₹3,00,000 at 9% interest

You can start by paying off your credit card first using the debt avalanche method. It charges the highest interest. At the same time, you keep paying the minimum amount on your personal loan, home renovation loan, and education loan. Any extra money should go straight towards clearing the credit card.

Once that's done, consider the personal loan. Move to the home renovation loan. After this, finish with the education loan. This way, you reduce interest costs and become debt-free faster without increasing your monthly budget.

Read Also: Debt to Income Ratio

The debt avalanche method reduces overall interest while helping you become debt-free faster (especially if you are focused on long-term savings). It requires patience & discipline. If you're someone who can stick to a plan without needing quick wins, this method can really pay off. Choose the method you know you'll actually follow through with.

You may use the debt avalanche method for most kinds of debt. It works when your debts have different interest rates. It targets the highest interest first. So, it reduces how much you pay overall (especially on high-interest debts like credit cards).

Start with the one that feels more urgent if your debts have nearly identical interest rates. Some people choose the smaller balance. Others prefer to focus on debts with higher monthly payments. The key is consistency.

You don't have to stick with just one method forever. It is perfectly good to switch to something like the snowball method if the debt avalanche method feels too slow. What matters most is making progress. Choose the tactics that keep you going.

How soon you see results depends on your loan amounts, interest rates, as well as how much you can repay each month. It might feel slow at first. But you should not lose focus. Track your payments & watch your overall balance go down. Remind yourself that even small steps count.

You can choose the snowball method if you start with the debt avalanche and feel discouraged. You can also do the reverse if you're ready to save more on interest. It is all about what works best for you during different stages of your avalanche debt repayment journey.

Indirectly, you may improve your credit utilisation ratio & payment history by making regular payments and reducing your debt. The debt avalanche method helps you stay current on all loans while aggressively paying off high-interest ones. It gradually results in a better credit score over time.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019