Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

A balloon payment refers to a sizable final amount that becomes due at the end of certain loan agreements, typically after a series of smaller instalments. It is often offered for a limited term and is intended to ease repayment pressure early on. The monthly payments are lower at first, but the last payment is considerably higher and settles the outstanding balance.

A balloon payment may influence borrowers and lenders in areas like:

1. Overall cost of borrowing

2. Long-term repayment planning

3. Risk of missed final payment

Let’s explore the potential advantages, as you are now familiar with the balloon payment meaning.

A balloon payment is a large one-time amount that becomes due after a series of smaller monthly payments under a loan agreement. This structure is often applied in business, real estate, or asset-based lending in India. It leaves a sizable portion of the principal to be paid at the end unlike typical loans.

The aim is to reduce short-term repayment pressure by keeping early instalments relatively low. Borrowers who expect future earnings or asset returns sometimes prefer this model. But this option also introduces risk if the final amount is not planned for properly from the start. To avoid financial stress, it’s important to plan well in advance on how to repay loan obligations when the balloon amount becomes due.

If you're trying to fully understand what is a balloon payment, it means recognising both the benefit of early affordability and the responsibility of a major payment later.

A balloon payment is a large lump-sum due at the end of a loan’s end after a series of smaller instalments. During the term, borrowers pay mostly interest with minimal principal reduction. The structure helps in lowering monthly outgoings (because you’re servicing interest, not chipping away at the core). The chosen interest rate also plays a crucial role in determining the affordability of this structure over time.

Over the loan tenure, the instalments remain steady and interest-heavy while the principal balance remains substantial. At maturity, the final payment covers the outstanding principal in full, creating a significant cash-flow event. Borrowers using this structure typically plan ahead for that one-time payout (for instance, via refinancing or asset sale), given the financial impact.

This method smooths out monthly obligations but requires confidence that the final lump-sum can be managed when it becomes due.

Borrowers planning to take a balloon payment loan must meet a few non-negotiable financial conditions. These act as safeguards since the final payment is usually substantial and can't be pushed off easily.

1. A balloon payment is better suited for those with a predictable high-income flow or future returns (not something to gamble with if your cash flow is uncertain).

2. A strong credit profile is a must since refinancing or restructuring later depends on how trustworthy you look on paper.

3. The borrower should ideally have assets that can be leveraged in case the balloon payment becomes a pinch.

4. Regular financial planning is critical.

| Aspect | Pros | Cons |

|---|---|---|

| Monthly Instalments | Keeps EMIs lower through most of the loan term, freeing up working capital. | A large sum becomes due at the end, which can put pressure on liquidity. |

| Loan Sanctioning | May help secure higher loan amounts since repayments appear more affordable. | You might incur greater interest expenses over time due to deferred principal. |

| Exit Options | Borrowers can choose to refinance or sell the asset before the final payment. | Restructuring depends on credit standing and external lending conditions. |

| Asset Purchase | Makes it easier to acquire costly equipment or property for business growth. | Depreciation can make the asset worth less than what you owe. |

| Interest Savings | Reduces short-term interest burden, useful when cash flow is tight. | Long-term cost may rise as interest builds up on unpaid principal. |

If you want to stay ahead of the final payment, a balloon payment calculator is the place to start. It tells you what will be left unpaid once all your smaller monthly payments are done. This helps you plan for the big number that shows up at the end of the term.

The formula to calculate balloon payment is as follows.

A = PV × (1 + r) ^n – P × ((1 + r) ^n – 1 ÷ r)

Here is what each part implies:

PV is the original loan amount

P is what you pay each month

r is the interest rate per payment cycle

n is how many total payments you’ll make

Calculate your Personal Loan EMI!

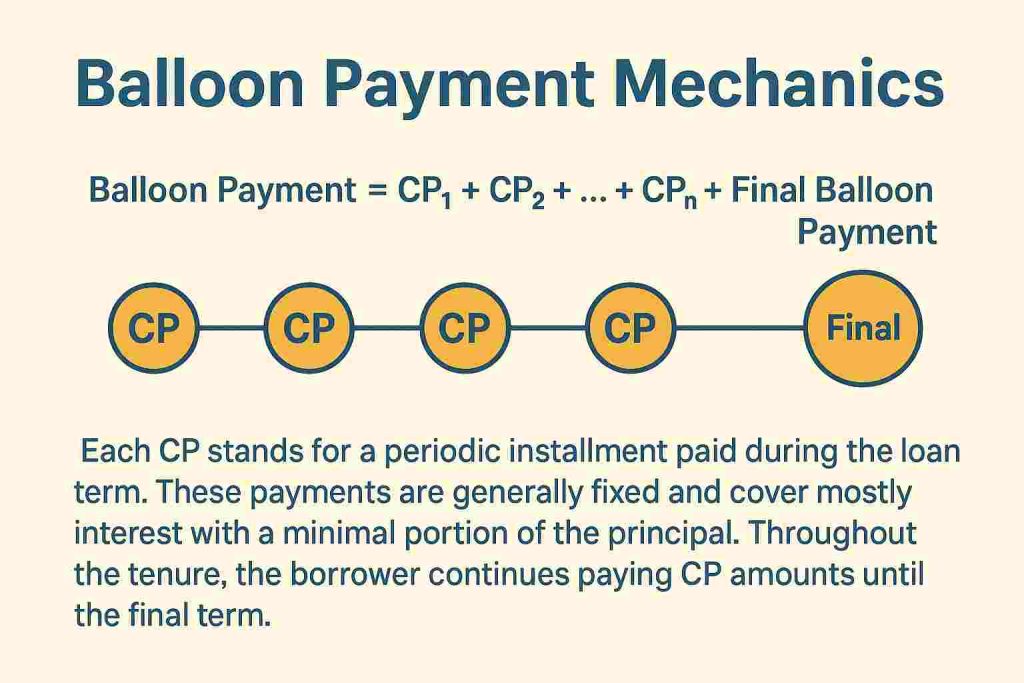

Balloon Payment = CP₁ + CP₂ + ... + CPₙ + Final Balloon Payment

Each CP stands for a periodic instalment paid during the loan term. These payments are generally fixed and cover mostly interest with a minimal portion of the principal. Throughout the tenure, the borrower continues paying CP amounts until the final term.

The remaining loan balance is paid as a final balloon payment at the end. Note that the amount is usually much larger than the earlier CPs. This structure is common in certain financing models where lower monthly payments are preferred upfront.

To see how a balloon payment operates in real life, here are seven Indian loan scenarios described in straightforward terms:

Home Loan Scenario

Mr. Sangal borrows ₹1.5 crore for a home across a 10-year term. He pays ₹1 lakh per month for the first eight years, with most of it covering interest. In the final year, he must settle the remaining ₹50 lakh as a single payment.

Car Loan Scenario

Ms. Raima takes a ₹10 lakh auto loan over five years. For the first four years, she pays ₹15,000 monthly, mostly interest. After the four-year stretch, the remaining ₹4 lakh comes due as one balloon payment.

Business Loan Scenario

A startup founder secures ₹50 lakh for equipment and operations to be paid over six years. He pays ₹3 lakh each month, primarily servicing interest. When the term ends, the unpaid ₹20 lakh must be cleared in one lump sum.

Personal Loan Scenario

Mrs. Mehta borrows ₹5 lakh for personal needs over a three-year period. She makes ₹10,000 monthly payments. At the end of that period, she has to pay ₹3 lakh in one go to complete repayment.

Commercial Property Loan Scenario

An investor borrows ₹3 crore to acquire a commercial property. She repays it over twelve years with ₹20 lakh instalments each month. She has to pay ₹1.5 crore as a balloon payment to settle the remaining debt.

Agricultural Loan Scenario

A Punjab farmer obtains ₹20 lakh to buy farming machinery. He repays it annually over five years by paying ₹2 lakh a year. The remaining ₹10 lakh must be repaid as a balloon payment after five years.

Travel Loan Scenario

Ms. Gupta borrows ₹2 lakh to fund a trip to Europe, with ₹7,000 monthly repayments over two years. She is left with ₹1.2 lakh that she must pay off all at once.

1. Uncertainty About Final Amount: Numerous borrowers worry about their ability to manage a large final payment after years of smaller EMIs. The situation can be stressful if their income does not grow as expected.

2. Preference for Predictability: Fixed EMIs offer peace of mind by distributing the burden evenly. Borrowers prefer consistent payments that help with lasting budgeting as well as financial planning.

3. Risk of Market Shifts: Changes in the economy or job loss can affect the borrower’s ability to refinance or repay. This makes balloon payments feel risky and less attractive.

4. Avoiding Interest-Only Structures: Most balloon payments cover interest. Several people opt for EMI-based loans to reduce the principal consistently and avoid debt shock at closure.

5. Desire for Better Planning Tools: Using a balloon payment calculator India helps visualise future costs, leading many to favour standard structures that avoid large end-term surprises entirely.

A balloon payment can lower monthly demands and free up cash flow (something borrowers often find helpful). Still, planning matters because a large lump sum due later may strain finances if not anticipated properly.

To avoid surprises, borrowers can use tools like a balloon payment breakdown and explore refinancing or alternative loan structures in the Indian context. Whether it’s a home loan or a personal loan, a clear repayment roadmap helps you stay confident and in control until the loan’s end.

Lenders can add balloon payment clauses if borrowers agree and the terms are fully explained. As long as everything’s laid out clearly in writing and not hidden in fine print, regulators allow it. The key is proper disclosure from the start.

They reduce early EMIs, helping with immediate affordability. Then you face a larger lump sum later. If you expect better income or can sell assets, then it might work. Otherwise, taking one could create stress if you cannot source that final amount.

It means you pay normal monthly instalments over five years, then a large final amount clears the debt. That final chunk must be planned for in advance through savings, refinancing, or asset sale. It helps in keeping the monthly burden low early.

That big final balloon payment can catch you off guard if life doesn’t go as planned. You are stuck if cash flow dries up or refinancing fails. Sudden expenses or job loss make it harder. Planning ahead and staying creditworthy really matters.

They ease pressure by offering smaller monthly payments at first, giving borrowers breathing space. Lenders gain by receiving a lump sum later. It suits those expecting stronger cash flow down the line, though it needs discipline to handle that final payment.

Note that typical loans are fully amortising, meaning equal instalments throughout. Balloon structures appear in select vehicle, property, or equipment loans. You won’t see them in standard personal loans. It’s worth using a balloon payment calculator to check if one fits your situation.

Both involve a large final repayment, but bullet loans usually mean you pay only interest during the term. Balloon loans include partial principal repayment along with interest, then finish with a big final payment. That difference affects both cash flow and cost distribution.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019