Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

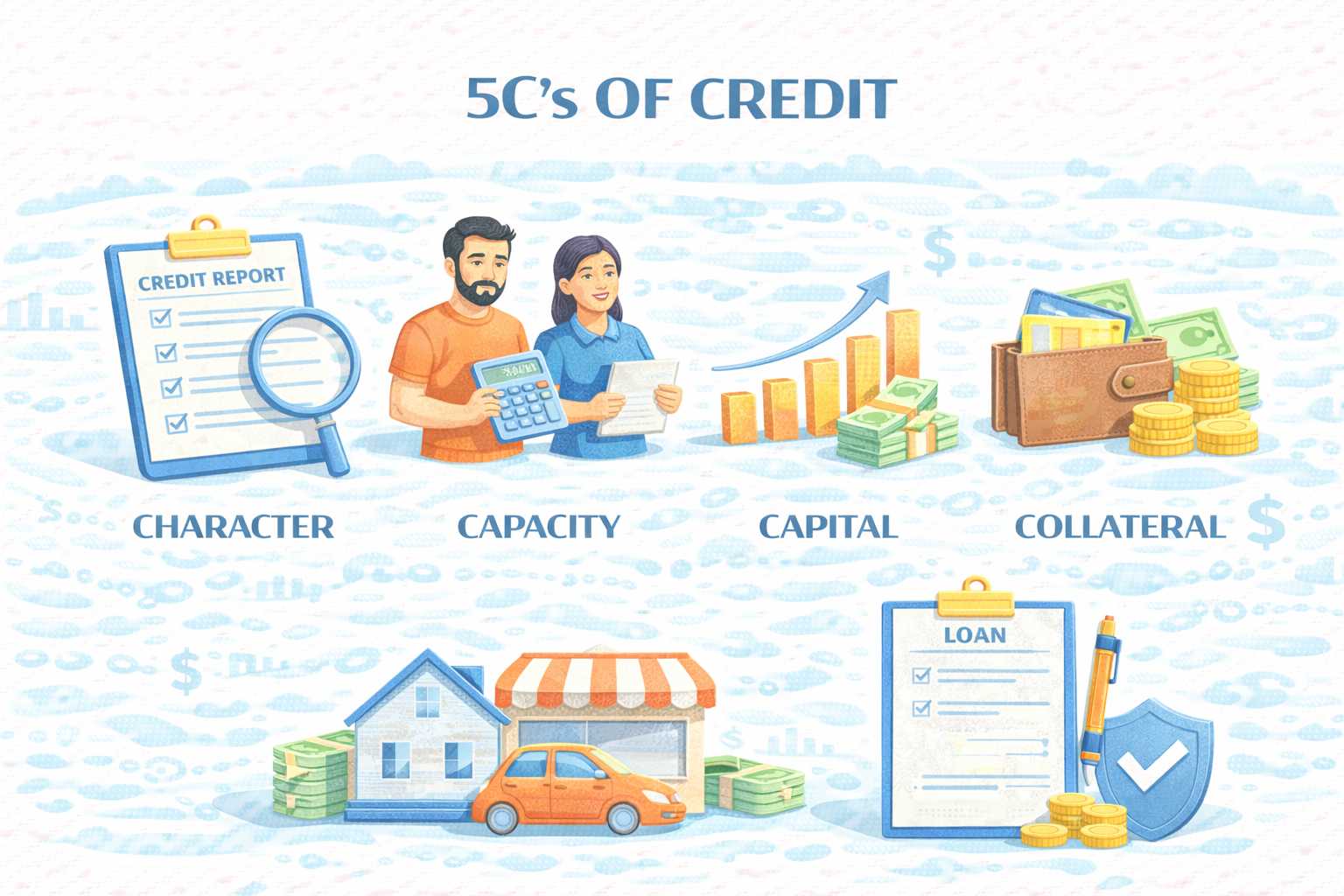

Anyone who wishes to apply for a loan must understand the five important components of credit. Also called the 5C of credit, they are character, capacity, capital, collateral, and conditions. Lenders use them to understand whether the candidate is eligible for the loan or not.

The borrower's capacity evaluates the ability to repay. On the other hand, the character is the credit history. Next comes the collateral, which is the security that the borrower offers. The next is capital, the one that you invest. Lastly, the conditions are the external parameters. If you're planning to apply for an instant personal loan, understanding these factors is crucial. Find out more in this post.

The 5C of credit helps lenders check if someone is eligible for the loan. They study how the person uses money, earns monthly, saves, offers backup, and reacts to outside changes. These parts give a full picture of how safe it is to give that person a loan.

Character shows your credit history. Lenders check your past repayment behaviour, loan defaults, and how well you handled earlier borrowings. A strong credit record builds trust. It tells if you follow the terms and pay on time. Good character means fewer risks for lenders and better chances for you to get approval with fair and honest loan terms.

Capacity checks if you can repay the loan. It looks at your job type, income, and existing monthly duties. If your income is steady and not already burdened by other loans, lenders feel safe to lend. It shows your current financial strength and whether you can manage the new loan along with your other fixed monthly costs.

Capital is what you bring in from your side. Lenders check how much you have invested in assets or savings. It shows that you are serious and ready to take part in the risk. A strong capital base reduces the risk for lenders. It also helps build confidence that you can support repayments if needed.

Collateral is the asset or security you offer for a loan. It can be property, gold, or any item that holds value. Lenders may use the collateral to recover the amount if the borrower fails to repay, as it reduces the lender's risk. Collateral is more important in secured loans, but it still adds weight to your application.

Conditions are external factors that affect your loan. These include the interest rate, job market, industry type, or even the reason for your loan. Lenders also look at the economy and how it may affect your ability to repay. Good conditions make it easier for the lender to approve your loan request with more trust.

Check your CIBIL Score!

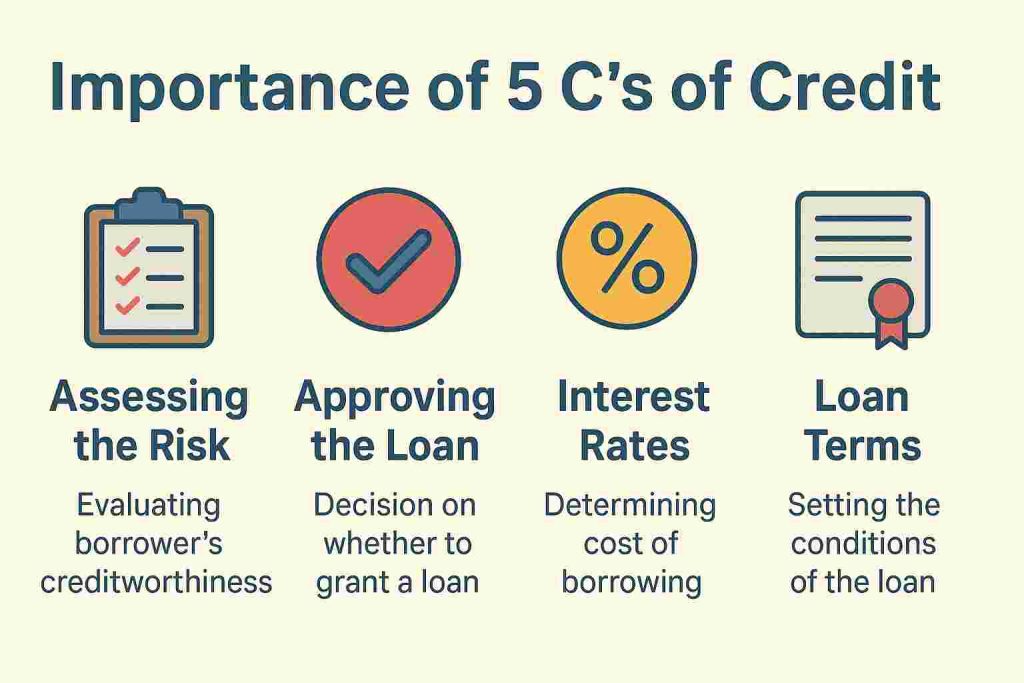

1. Assessing the Risk: The 5C of credit helps lenders check if giving a loan is risky. They look at your money habits, job, and savings. This helps them know if you will repay on time. If everything looks safe, the risk is low. It helps lenders avoid losses and take smart steps when giving money.

2. Approving the Loan: Lenders use the 5 C's of credit to decide if they should approve your loan. They check if you earn enough, pay bills on time, and have some savings. If your details look good, you are more likely to get the loan. If not, the lender may say no to your request.

3. Interest Rates: The 5 C's of credit also affect the interest rate you get. A strong credit score and income may give you a lower rate. If lenders see more risk, they may ask for a higher rate. They decide the rate by checking how safe your credit record is.

4. Loan Terms: Lenders also use the 5C of credit to set your loan terms. These terms include how much you can borrow, how long it will take you to pay, or whether you need to give any guarantee. You may get better loan terms alongside faster approval if your credit profile is strong.

The 5C of credit helps lenders study how much risk they take by giving a loan. These checks show if the person can repay & how much to lend (or what terms are safe).

Lenders may use them to set loan limits & determine the right interest rates. A full check of character, capacity, capital, collateral, and conditions helps avoid wrong decisions.

Borrowers can also use the 5 C's of credit to prepare better for loan approval. If someone has a steady income, clean records, and good savings, approval becomes faster. It gives them a strong profile in the lender's eyes and lowers the chance of rejection or delays.

Knowing the 5C of credit helps you get ready for a loan. Each part can be made stronger with simple steps. If you work on them, your loan chances go up. This helps you build a solid credit profile and gain trust from lenders without delay or stress. Understanding these steps also improves your personal loan eligibility.

1. Character - Pay all bills on time & keep the credit record clean. You also need to check your credit score often and fix any mistakes. Use fewer credit cards and avoid delays. It shows you are serious and careful with money.

2. Capacity - Try to lower your debts and show a stable income. Keep your job steady and avoid switching often. You can also add income from part-time work or other sources. This helps show that you can repay on time.

3. Capital - Save money and invest smartly. Keep some savings ready to support your loan. If you show good capital, lenders feel safe lending you more. This shows that you are prepared and know how to handle money.

4. Collateral - If your loan needs security, choose an asset that has value. Keep the papers ready and make sure all EMIs are paid on time. This helps keep the asset safe and shows you can be trusted.

5. Conditions - Think about your current need and the loan terms. Apply when the job market is stable and your income is regular. Do not apply when money flow is tight or the loan reason is weak. This helps avoid rejection. Also, ensure you gather all required personal loan documents before applying to avoid unnecessary delays.

The conventional ways of checking credit risk have limits. They depend too much on past data and slow steps. This may have an impact on how safe & fast loans get approved. Below are the main issues:

1. The data does not show your current financial status. It can miss changes after your last credit check.

2. Manual steps take time and effort. This delays loan checks and slows the full process.

3. No real-time updates. Lenders may not see income loss or other big changes quickly.

4. These methods cost more. They need more time, more staff, and more effort to check all details.

5. They cannot handle large or complex data. This results in missed facts and wrong loan choices.

Knowing the 5C of credit helps build a strong loan profile. These checks let lenders see how safe it is to give money. Improving character, capacity, capital, collateral, and conditions helps boost your chances of getting approved fast. Traditional credit checks may not be enough in today's fast-moving times. Using new tools with clear data helps make better choices.

Banks use the 5C of credit to check loan safety. These parts show if a borrower can repay without risk. Each "C" gives a clear look at financial behaviour, helping lenders decide on loan terms, interest, and approval without missing key money facts.

While all five Cs matter, character often stands out. It shows how you've handled credit before. A clean history builds trust. If your past loans and payments are strong, lenders feel safer. Without trust, even with income or assets, the risk feels high, making approval harder or terms stricter.

Character shows your credit habits. It includes payment records, loan history, and defaults. Lenders check if you're trustworthy with money. A solid track record builds confidence. If you repay on time and avoid missed payments, lenders trust you more and feel safer offering better loan terms or higher amounts.

Collateral is something of value you offer to back a loan. It gives lenders safety. If repayment stops, they can use this asset to recover money. This lowers their risk and increases your approval chance. Collateral shows you are serious. It often comes with better loan terms.

Lenders watch economic changes like inflation, job rates, and interest rates. If the market seems risky, they may focus more on income or job safety. Strong outside risks make lenders study all Cs more deeply. They may tighten rules even for borrowers with good credit profiles or history.

Keep credit clean for character, show steady income for capacity, grow savings for capital, offer assets for collateral, and apply during stable times for conditions. Avoid late payments. Hold a regular job. Save monthly. Use property or gold as backup. Watch market trends before applying to lower risk.

The weight of each C depends on the loan type and lender. Some focus more on capacity and character, especially in unsecured loans. Others may prefer collateral for large sums. Lenders change focus based on loan size, risk level, and market state. No single C works the same way always.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019