Did You Know?

We serve loans, the best way you can borrow

We serve loans, the best way you can borrow

Dealing with multiple debts can feel exhausting when you are unsure where to start. The debt snowball method helps by focusing on the smallest balances. It gives you early wins and a sense of progress. Each cleared debt boosts confidence. This makes it easier to keep going. This approach turns financial stress into something you can manage.

The debt snowball method speaks to anyone who feels like they’re drowning in bills. It doesn’t ask you to fix everything overnight. It helps you start with what you can actually control.

You list your debts from smallest to biggest. Then, you pay the minimum on each, except the smallest one—you throw every extra rupee at that until it’s gone. Once it’s off your chest, you move to the next. That first win matters more than you'd think. It’s proof you’re not stuck forever. You get to breathe again. The method is about momentum, and sometimes that is the only thing that keeps you going when you are tired of trying.

The snowball method to pay off debt doesn’t need perfect planning. It just needs you to keep showing up, even in challenging months. And it reminds you—you're not failing. You're already getting back up.

The steps involved in the debt snowball method are:

1. List Your Debts: Begin by writing down every loan you owe, arranging them from the smallest balance to the largest. At this stage, ignore personal loan interest rates—the goal is to feel progress, not perfection.

2. Pay the Minimum Amount: You should make sure the minimum required amount is paid on each debt every month. This prevents penalties and keeps your repayment track steady and stress-free.

3. Clear the Smallest Debt First: Put any extra money—however little—towards the smallest debt. Seeing it cleared gives a genuine emotional lift and proves that progress is possible.

4. Move to the Next Debt: When one loan is paid off, redirect that full payment amount to the next smallest debt. This adds strength to your effort, like pushing a snowball downhill.

5. Clear Debts: Your loan repayment power grows by clearing each debt. The snowball method helps you stay motivated.

1. Keeps You Going: Clearing debt can feel endless. The debt snowball method gives you a quick win by starting with the smallest loan. That first success isn’t just about money; it’s about finally feeling in control.

2. Takes the Pressure Off: You don’t have to overthink where to start. Just focus on one loan at a time. That simplicity helps when your head’s already full of numbers, calls from lenders, and unpaid bills.

3. You Feel It Working: Every time a loan disappears, it lifts a weight off your chest. It's that little mental relief that keeps you coming back the next month, and the next.

1. Interest May Add Up: It ignores which loan costs you more. You might feel better clearing the small ones first, but you still end up paying more overall.

2. Life Doesn’t Always Cooperate: Emergencies happen. Holding on to this plan month after month isn’t easy when life keeps throwing things at you.

3. Big Loans Remain Unpaid: A big loan with a scary interest rate stays until the end. It can delay and drag on longer than expected.

Know what is the Difference between Debt Consolidation and Debt Settlement

You must list all your loans from the smallest to the largest balance to start using the debt snowball method. It is important to continue making minimum payments on each one to avoid penalties. However, put any extra money into the smallest debt. This keeps things focused and manageable during uncertainties.

You should take the same amount and apply it to the next smallest debt once that first debt is cleared. Repeat the process. You’ll feel lighter with every loan cleared. If you're still wondering what is debt snowball method, it’s this: clear one, then move to the next. The method is simple, steady, and real.

The debt snowball method works because it makes you progress, even when your bank balance says otherwise. When you’re tired, frustrated, and unsure what to tackle first, clearing the smallest loan gives you one clear win. That small win hits hard. It’s proof that the mountain of debt isn’t unmovable. You did something to earn the trust of lenders.

It’s not about finding the most efficient method; it’s about choosing the one you’ll actually stick with. One cleared loan gives you the strength to tackle the next. Over time, your repayments grow bigger without the overwhelm. This method speaks to real people who are trying their best in a messy situation. The method gives you the belief that you can keep going, even on the challenging days.

The debt snowball method works because it feels doable. It doesn’t ask you to fix everything at once. You start with what’s smallest. As each loan gets cleared, you stop feeling stuck. That shift matters. You’re not just reducing debt; you’re building belief. Over time, your monthly payments grow stronger, and you don’t need to keep guessing what comes next.

It fits into planning because it frees up money. That same amount can move into savings or SIPs without you needing to rethink your budget. It’s not a magic trick. But it works because it’s real. When you feel progress, you stay on track. That helps more than any spreadsheet can. Instead of jumping between bills, you move with purpose. The process adds structure to your repayments.

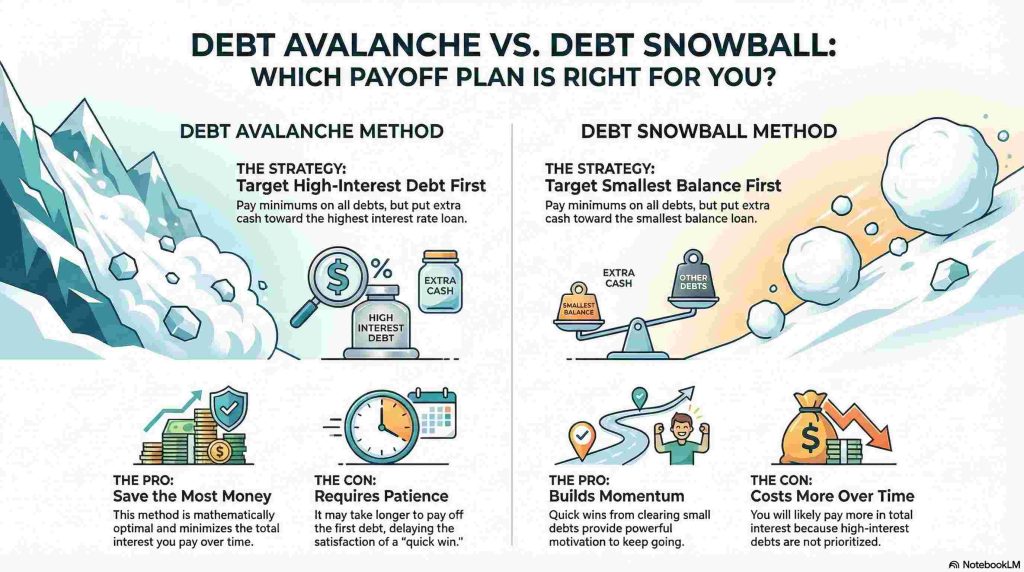

Note that there are several ways to repay debt. The two most common are compared below. If you're using a debt snowball method worksheet, this breakdown can help you see where it fits best.

| Debt Snowball Method | Debt Avalanche Method |

|---|---|

| Focuses on paying off the smallest loan first. Helps build confidence early in the process. | Prioritises loans with the highest interest, regardless of the balance amount. |

| Ignores interest rates. Only the size of each debt matters when choosing the order. | Works purely by interest cost. Higher interest loans are paid off first to cut total expenses. |

| Keeps people motivated. Seeing quick results gives emotional relief and pushes consistency. | Helps reduce total interest paid, but may feel slower, especially in the beginning. |

| It is suitable for people needing and to stay on track. | It is better for those focused on long-term savings. |

The debt snowball method can feel tiring after the initial excitement fades. You might find yourself doubting whether small payments are worth it. But the moment one loan gets crossed off, that doubt starts to fade. You feel like something is finally under control.

Break things into smaller tasks to stay motivated. You should write down your debts, from smallest to largest. Cross them off as you go. Place the list somewhere you will see every day. These small wins become visible proof that the plan is working. Ask them to check in once in a while if someone close to you knows your goal. Having that quiet support helps more than you expect.

Once a loan is cleared, add that amount to the next payment. It grows without much extra effort. That kind of progress builds confidence without needing perfect discipline.

This process is not about flawless budgeting or big sacrifices. It is about showing up, even when you are tired. Note that every cleared loan means fewer reminders and more control. That change in your daily life is what keeps you going even before the debt is fully gone.

The debt snowball method can help if staying motivated has always felt like the hardest part. It is easy to feel stuck when you are staring at several debts. But clearing even one balance can remind you that change is possible. That early progress can feel like breathing room when everything else feels tight.

This strategy is less about interest rates and more about building emotional momentum. It works for people who need to feel like they’re winning early on. If you’ve ever abandoned a plan halfway through because it felt like nothing was changing, this method gives you something real to hold onto. These are the results you can actually see.

It’s often best for those carrying multiple small loans who feel overwhelmed by the whole picture. Seeing a loan disappear from your list creates a shift. It makes the rest of the journey feel less impossible and more within reach.

Let us say Neha is trying to repay these debts.

Credit Card – ₹13,000 balance with a minimum monthly payment of ₹1,000

Personal Loan – ₹34,000 balance with a minimum monthly payment of ₹2,200

Education Loan – ₹70,000 balance with a minimum monthly payment of ₹4,300

Neha can spare ₹9,500 each month to deal with her debt. Her first step is to cover the minimum payments for her personal and education loans. It comes to ₹6,500 total and leaves her with ₹3,000.

She clears the debt after a few months of paying ₹3,000 toward the credit card. That moment gives her a real sense of relief and momentum. With one less burden, she now turns her attention to the personal loan.

She continues paying ₹4,300 toward her education loan and starts putting ₹5,200 toward her personal loan. It takes time, but she watches the balance shrink every month. That visible progress is hard to ignore.

When the personal loan is gone, she’s left with the education loan. Now her entire ₹9,500 goes toward clearing that one. Every payment lifts a little weight off her shoulders. She doesn’t need perfection to keep going. She needs proof that she’s moving forward, and this method gives her that. Watching the number of active loans fall from three to two, then one, helps her stay emotionally invested in finishing what she started.

The debt snowball method helps you tackle multiple debts without needing complex calculations. By paying off the smallest balance first, it offers quick wins that matter when you are feeling stretched. Each cleared account feels like a small victory, which builds the belief that you can keep going. When your finances feel heavy and scattered, having a plan that shows progress from the beginning can make a real difference to your mental and emotional state.

On the other hand, some prefer focusing on interest rates rather than loan size. The avalanche method does that, helping reduce the overall interest paid in the long run. But it may take time before you clear your first loan. That waiting period can test your patience. If you are someone who needs early confirmation that your effort is working, this method may not feel encouraging at the start. Choosing a strategy should depend on how you stay motivated, not only on numbers.

If emotional momentum matters to you, the snowball method can feel like the right push. It rewards consistency and keeps things clear. You do not need to figure everything out at once. You will likely benefit from small wins if your goal is peace of mind along with financial progress.

The debt snowball method starts by listing all your loans from smallest to largest balance. You make minimum payments on all, then put extra money toward the smallest one. Once that clears, move to the next. Progress builds confidence and keeps you focused.

A debt snowball analysis helps you track balances and your monthly repayment capacity. It lets you plan your repayment schedule. You can also estimate how long each debt repayment will take. Using a debt snowball method worksheet often helps visualise early wins and boosts morale effectively.

The idea behind the debt snowball method is based on behaviour, not maths. Clearing small debts early gives you emotional wins. That progress becomes your fuel. It creates the belief that things are moving, which keeps you steady through the longer, tougher parts of repayment.

When debt starts to feel like too much, small wins matter. The snowball method helps build momentum by clearing the smallest dues first. The avalanche eases long-term stress by cutting high-interest costs. And consolidation is suitable when everything just feels scattered and exhausting.

If there is only one loan, the debt snowball method does not apply fully. Instead, focus on clearing it faster through higher payments. You can also use tracking tools or share your goal with someone close. External motivation helps when the internal drive to repay loans dips.

Download our personal loan app to apply for a personal loan. Get up to 2Lakhs* as a personal loan. Download Now!

Sign into avail a personal loan up to ₹ 2,50,000

Register to avail an instant loan in just a few minutes. Fulfil your financial needs with our loan and repay in easy EMIs.

Apply NowUnifinz Capital India Limited is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). lendingplate is the brand name under which the company conducts its lending operations and specialises in meeting customer’s instant financial needs.

Corporate Identity No. (CIN)

L 1 7 1 1 1 D L 1 9 8 2 P L C 0 1 3 7 9 0

RBI Certificate of Registration No (CoR):

1 4 . 0 0 2 3 3

Registered Office :

Rajlok Building (Floor-5), 24 Nehru Place, New Delhi-110 019