The personal loan app from lendingplate puts money directly in your pocket without the wait. You apply from your phone and we send funds straight to your bank account the same day. Our loan app works differently from banks that make you visit branches and fill out many forms.

We built our app to give you loans between ₹5,000 and ₹2,50,000 with fewer documents and faster approval. Our app helps you meet urgent cash needs for medical bills, weddings or emergency scenarios.

You pick the loan amount you need and we show you clear payment terms right away. The loan app keeps your data safe with strong security and sends you updates about your application status. Our team checks your details quickly so you get money fast when you need it most. The personal loan app makes borrowing simple and fast for everyone.

Fast loan decisions

Fewer papers needed

Choose what fits

No hidden costs

Data stays protected

Simple monthly payments

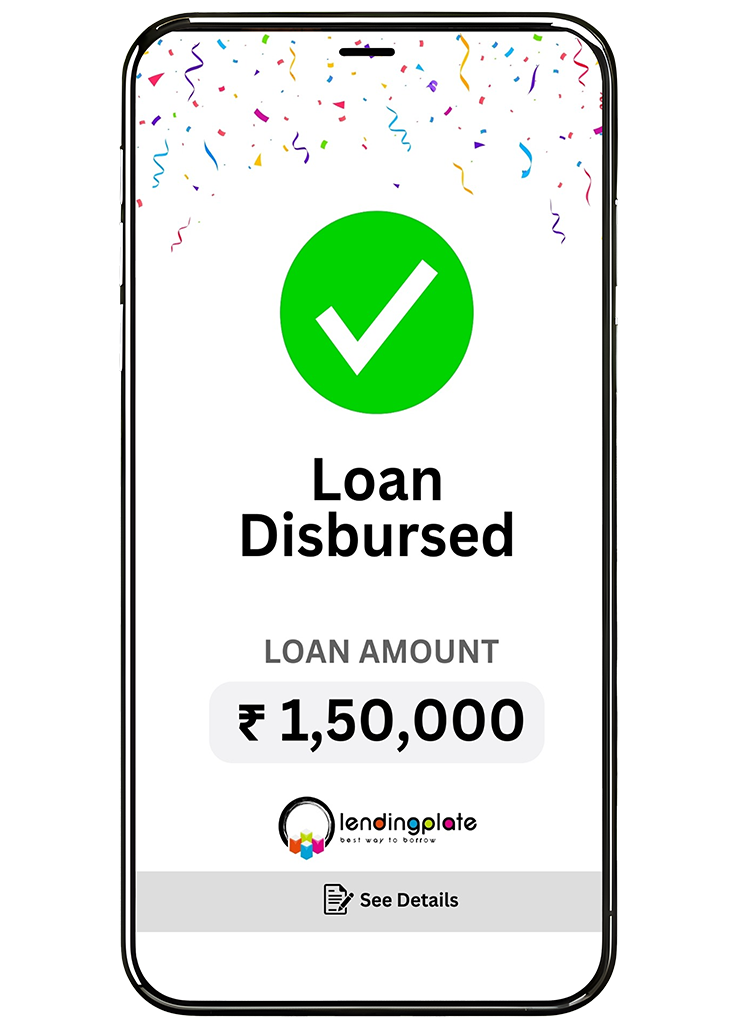

Get money in your account within 30 minutes after approval.

Apply with your phone from anywhere without printing a page.

Check loan status, track payments and contact support anytime anywhere.

Our money lending app helps with education costs, professional certification fees or career development programs that improve your income potential. We make getting money as easy as ordering food online.

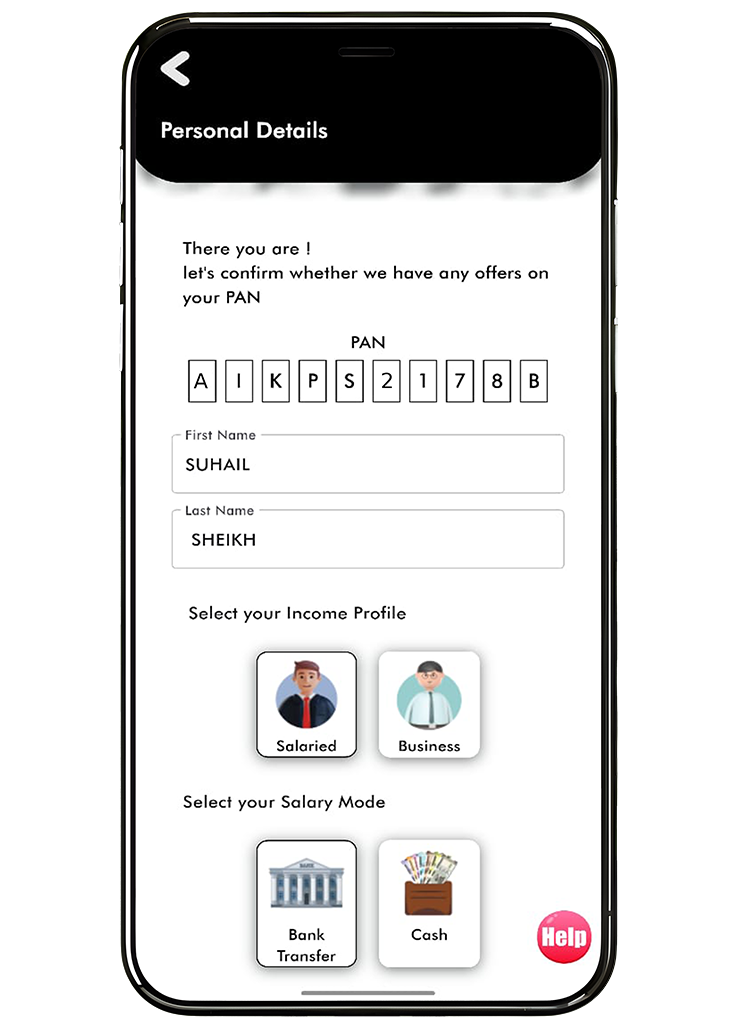

Fill out the form and share bank details for quick processing.

Upload your identity proof, address proof, and income details through the app.

After approval, we transfer money directly to your bank account.

Our app makes borrowing money as simple as sending a message to friends.

Getting money takes four simple steps on our app.

Check if you qualify for our loan before you apply with us.

| Document Type | Details Required |

| Identity Proof |

|

| Signature Proof |

|

| Address Proof |

|

| Business Proof |

|

| Income Proof |

|

| Financial Documents |

|

We maintain transparency about our interest rates & other charges:

| Charges | Details about the Charges |

| Processing Fee | 1% - 5% of loan amount |

| Conversion Fee | 1 - 5% of the amount |

| Interest Rate | 12% - 36% per annum |

| Foreclosure | 5% of the amount [Nil when prepaid on or after your] |

| Mandate Return Fee | 500/- [inclusive of GST] |

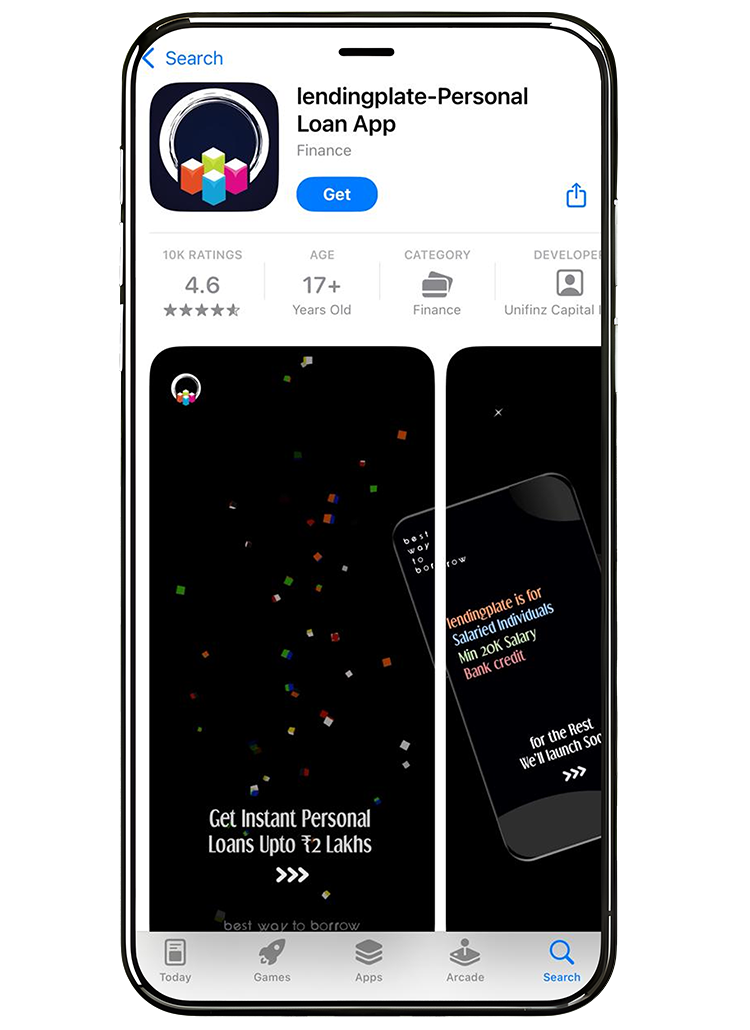

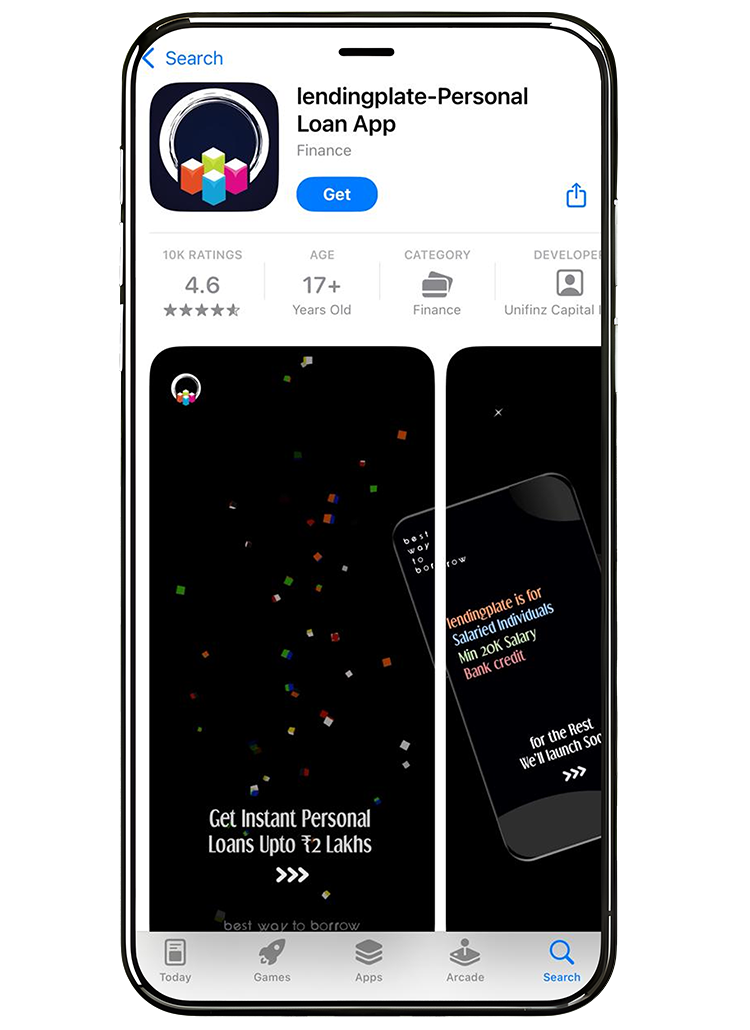

Get our personal loan app in minutes and start your loan application today.

The iOS version works the same way as Android (giving you all the features on your iPhone).

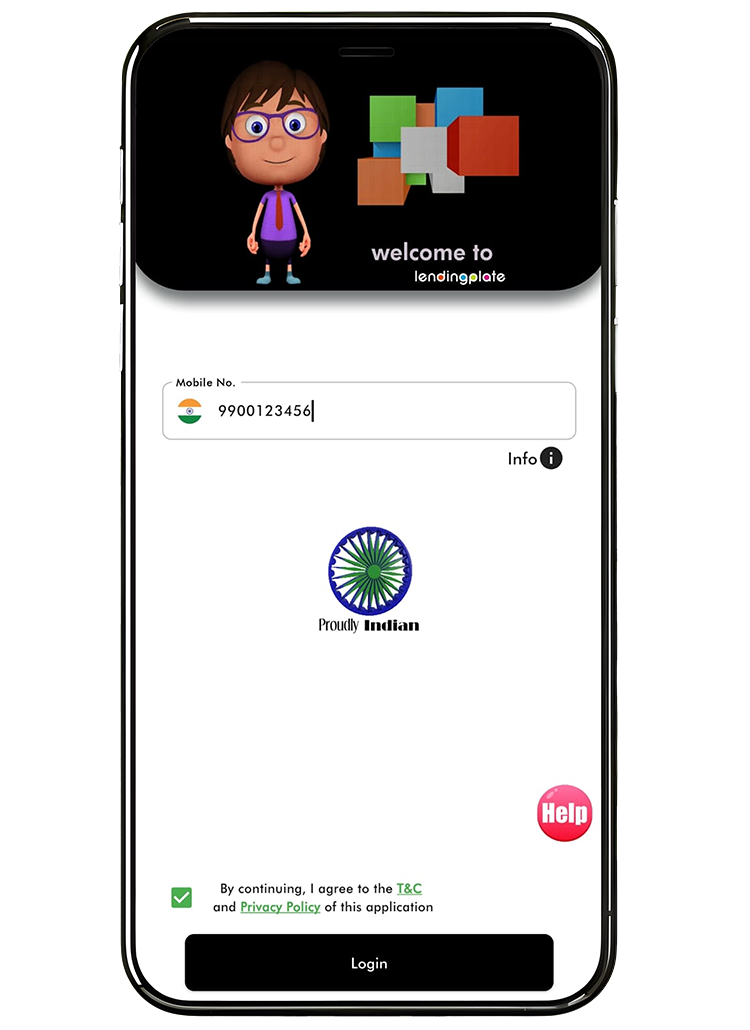

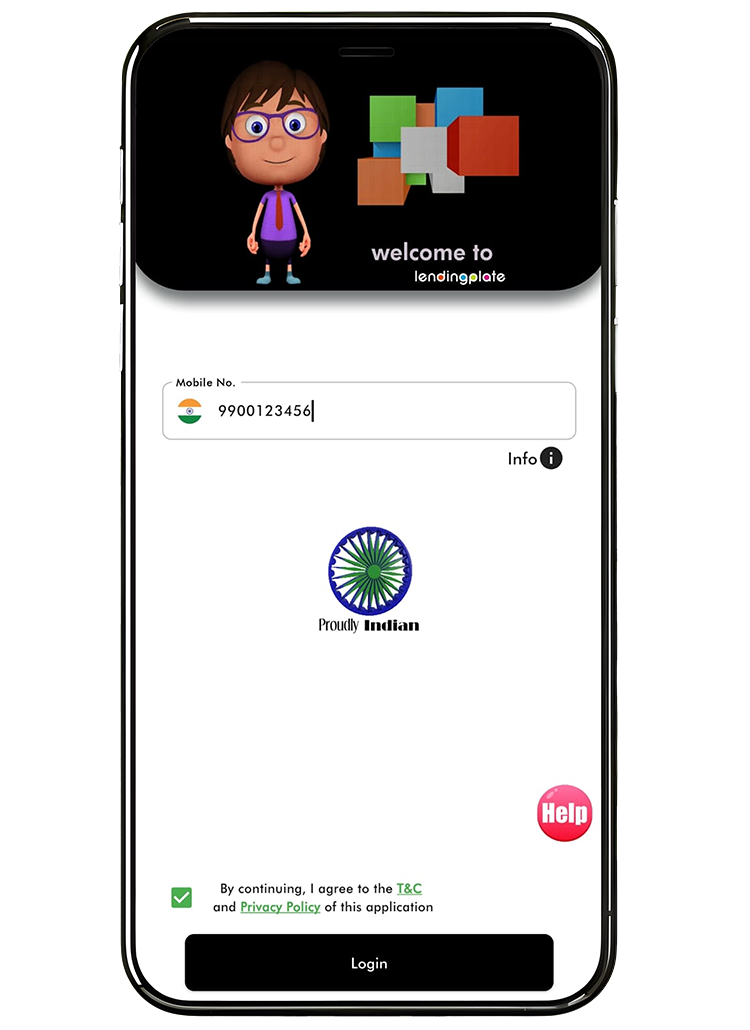

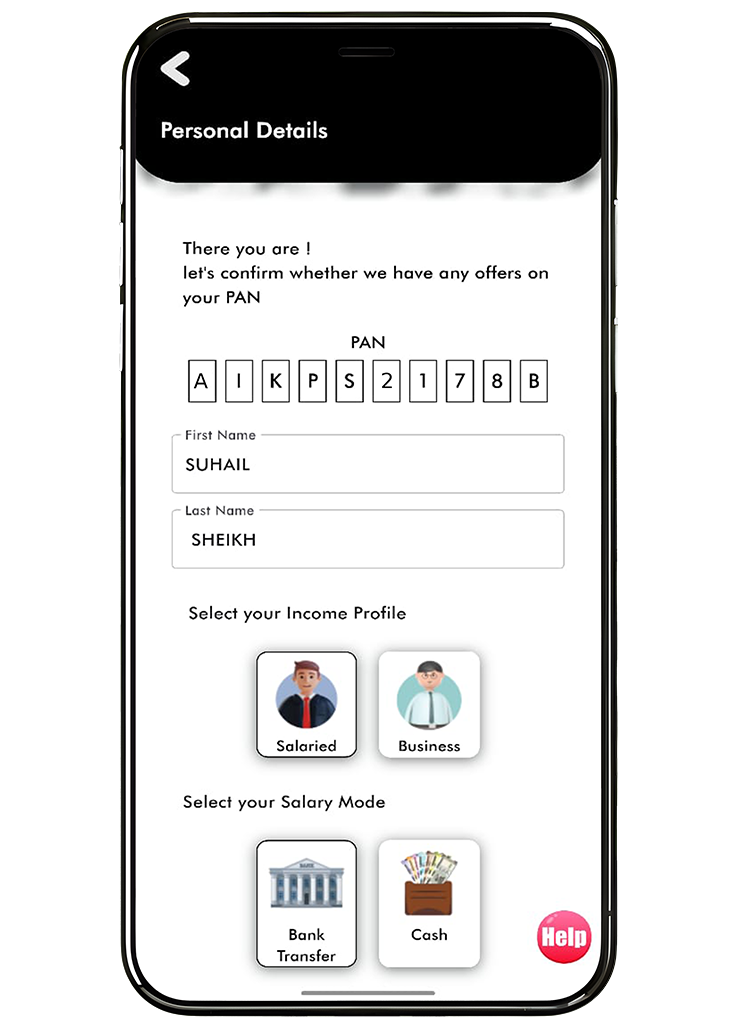

Getting started with the personal loan app from lendingplate is straightforward. What you require is following the steps-

These steps let you access your instant loan app in minutes. You can start your application without hassles. The process is simple & secure. This way, you can get funds for emergencies or planned expenses. lendingplate makes it easy to get approved & disbursed speedily.

Your data's safety is the top priority for lendingplate’s personal loan app. The bank graded encryption keeps your information secure during the process. Advanced encryption algorithms safeguard every detail from unauthorized access whenever you upload documents or fill out forms.

Secure Login and Authentication

The money lending app offers secure login measures to ensure only you can access your account. This way, it protects you & your private details against unauthorised access (especially on shared or public devices).

Privacy and Data Handling

lendingplate follows strict privacy policies. Your personal as well as financial details stay confidential. You may trust that no third parties access your information.

lendingplate minimises data collection to only what’s necessary for your personal loan app process. We respect your privacy & make your application secure.

Using a personal loan app simplifies borrowing. lendingplate offers unmatched convenience as well as speed. The paperless process saves you time & effort.

Speed

You get approval within 30 minutes. We will evaluate your eligibility instantly once you upload documents and submit your requests. Funds are then transferred directly into your bank account. This may be within the same day or within business hours. This eliminates long waits typical of offline procedures.

Convenience

Applying through a personal loan app lets you do everything from your phone. You can proceed with the steps anytime & anywhere. You no longer need to visit a bank or branch physically. The only thing you need is to fill out the form digitally. Do not forget to upload your documents.

Paperless Benefits

You need to give digital copies of the necessary documents. This eliminates the need for physical paperwork. Processing is faster- starting from upload to approval. Everything happens within a few clicks. This saves hours often spent on visits alongside paperwork.

You must ensure your application is prepared. This ensures you get speedy approval. Keeping documents ready & maintaining a healthy credit score improves your chances. Besides, you also need to apply within your eligibility.

Keep Documents Ready

Have clear copies of your documents (like ID proof & address proof) helps you get the loan faster. You need to upload your documents during the application. This avoids delays. Organising the documents before starting will also help get speedy approval.

Maintain a Good Score

A decent credit score increases your chances of loan approval. You need to pay your bills on time. This reduces your existing debts. At the same time, it avoids multiple loan applications at once.

Apply for Eligible Amounts

Request what you need & are eligible for. You may check the loan limit depending on your income as well as your credit history. Applying for larger sums or multiple loans may result in slow processing or rejection.

It ensures your personal loan app application is fast. Keep these tips in mind & you’ll experience the benefits of the instant quick loan app & make borrowing easy.

Many borrowers make these errors when getting loans on apps – but you can avoid them.

Skipping Document Checks: Before applying make sure you have all required documents ready for upload. Many applications get delayed when people submit wrong documents or poor-quality scans. Check that your ID address and income proofs are valid and match the details you provide in your application form. This small step saves you from rejection and speeds up approval.

Ignoring Interest Rates: Look at the total cost of your loan, not just the monthly payment amount. Some borrowers focus only on getting quick money without checking interest rates and fees. Calculate the total amount you will pay back – including all charges – before accepting any loan offer.

Multiple Applications Together: Applying to many lenders at once hurts your credit score badly. Every time you apply for a loan, the lender checks your credit history – which counts as an inquiry. Too many inquiries make you look desperate for money and risky to lenders. Choose one or two trusted apps like lendingplate and wait for results before trying others.

Borrowing Maximum Amounts: Take what you need and not what apps offer as your maximum limit. Many people borrow the highest amount shown in their app without considering their repayment ability. It results in payment struggles and stress later on. Calculate how much you actually need and borrow just that amount to keep your finances healthy.

Missing Payment Dates: Set reminders for your loan payment dates to avoid late fees and credit score damage. Many borrowers forget due dates or ignore payment notifications from their loan apps. That may cost extra money in penalties and affect your ability to get loans in future. Use automatic payments or calendar alerts to pay on time every month.

You can borrow between ₹5,000 and ₹2,50,000 through our app based on your income and credit score. We look at your monthly salary, job stability and past loan history when deciding your loan limit. Most first-time borrowers start with smaller amounts – which increase after good repayment records. The app shows your eligible amount after you complete the basic application form.

You need to upload your PAN card, Aadhaar card, latest salary slips, bank statements for 3 months and address proof. The app lets you take pictures of these documents directly or upload files from your phone. All uploads must be clearly readable and match the information you provide in your application. We might ask for additional documents in some cases based on our verification process.

Most loans get approved within minutes after document verification and money reaches your account within 30 minutes. The speed depends on how quickly you upload clear documents and complete all verification steps. If you apply during banking hours on weekdays the process works fastest. Weekend applications might take slightly longer but still get processed the same day in most cases.

You can pay off your loan early through the app with minimal charges applied. We charge 5% of the remaining amount as a foreclosure fee if you pay before your first due date. After your first EMI payment there are no foreclosure charges when you want to close the loan early. The app shows the exact payoff amount – including any fees (before you confirm the transaction).

We protect your data with bank-level encryption and strict access controls. Your information stays in secure servers with multiple safety layers against unauthorised access. We share your data only with credit bureaus and regulators as required by law. The app uses a secure connection for all transactions and stores no sensitive payment information on your device.

Late payments result in penalty charges and might affect your credit score if they continue. We send reminders before due dates through app notifications, SMS and email to help you remember. If you face temporary financial problems, contact our support team through the app to discuss payment options. We might offer revised payment plans in genuine hardship cases to help you manage your loan better.

Select the loan details you want to know

Select the loan details you want to know

Planning your perfect wedding shouldn't be limited by money worries. Book the perfect venue, hire top photographers and order those gorgeous outfits today. A marriage loan covers everything from venue bookings to catering services. Our marriage loans bring you flexible repayment options and fast approvals. Start planning your special celebrations with the support of instant financing.

Want to explore new places, but your savings are falling short? A travel loan brings your dream holiday closer, letting you book flights and hotels right away. Pay in simple monthly instalments that match your salary. No need to touch your savings or miss those limited-time travel deals. Create wonderful memories now with our fast-track travel loans.

Multiple debts causing stress? Say goodbye to financial stress as you work steadily to become debt-free with simplified money handling. Stop juggling multiple payments and high interest rates. Get one loan to clear all your debts with lower monthly payments. Track your progress easily as you move steadily toward becoming debt-free with simplified money management.

Make your living space better without emptying your savings account. Fix that leaky roof or build the kitchen you've always wanted. Get competitive interest rates and flexible repayment options. Quick approvals mean you can start work fast. Smart interest rates and easy EMIs help you create better living spaces with peace of mind.

Getting urgent medical care shouldn't depend on your bank balance. Medical emergency loans give you quick access to funds when health issues strike. We care about your health with instant medical loans. Get started with minimal paperwork and receive money in your account within hours. Easy repayment terms let you concentrate on recovery while managing your finances sensibly.